15 June 2021

Last week’s data showed that inflation in the US is now running at 5% versus a year ago, a level it has reached only once before in the last 30 years. Last month the figure was “only” 4.2%, and the big jump surpassed most forecasts. Given the market’s panicky reaction to the inflation scare in February and March, you might have been forgiven for thinking that another unexpected rise in inflation would cause another wobble in markets. When it did happen, though, investors bought the dip so aggressively that both bond and equity markets were significantly up by the end of the day. Bizarrely, the assets that had been most exposed to inflation fears earlier in the year turned out to be the best performers.

Inflation doves argue that the goods whose prices are rising most are those most affected by the pandemic: for example, used cars (being bought to supply car rental fleets), car rental and air fares. As the pandemic is – ultimately – a temporary phenomenon, all these prices can be expected to go back to normal. Inflation hawks argue that “temporary” might still be long enough for inflation expectations to become ingrained and for workers to start pushing for bigger pay rises. The rapid rise in house prices, for example, is only just feeding through into inflation data through rental costs, and rental costs are a big component of the inflation calculation. With demand for accommodation rebounding, supply tight and house prices rising, rent inflation could be a factor for many months to come.

The US central bank is firmly in the dovish-camp - its latest forecast showed inflation returning to 2.2% by the fourth calendar quarter of this year. The consensus of expectations in the private sector is that it will be a full percentage point higher – quite a large gap for such a sensitive subject. While central banks regard inflation as temporary, they will continue to pump money into markets through extraordinary amounts of asset purchases. Only last week the balance sheet of the US Federal Reserve bank passed $8 trillion for the first time, double its size of a year ago and now about a third of the size of the entire US economy. With close to $300 billion being pumped into markets by central banks every month, the attitude among investors seems to be, “hold your nose and buy!”

The mystery of the missing jobs is about to be solved. Like in the UK, where 11% of the total workforce is still furloughed despite a strong recovery in most sectors of the economy, US employment seems to have been sucked into a black hole. About 5 million people have gone missing from the US labour force since the pandemic started, even though demand for workers is at a record high due to the ending of lockdowns. One of the most popular explanations is not that people want to avoid catching Covid, but that generous, Covid-era unemployment benefits are incentivising people to stay out of work. With 25 US states having chosen to withdraw those benefits, economists will soon be able to compare the jobs created in those states with others where the benefits have been maintained. It’s not a joke for the states withdrawing benefits because, if they are wrong, they will have lost billions of dollars in federal funding.

The electric pickup truck maker Lordstown Motors Corp. said on Monday that CEO Steve Burns and finance chief Julio Rodriguez have stepped down from the company after a new report from a board committee found inaccuracies in parts of the company's disclosures on truck preorders. Lordstown Motors' share price fell nearly 19% on Monday as a consequence of the announcement, and is the biggest drop since the company went public. It comes as the lure of the global shift towards electric vehicles is creating a new generation of industry competitors, drawing in both investors imaginations and funds, but, there have been several cases where these companies have tripped up as newly public companies.

The Dutch health technology company Royal Philips NV has recalled millions of sleep apnea and ventilator machines because of concerns over a type of foam used in the devices could degrade and release harmful, possibly carcinogenic particles. Patients using the sleep apnea devices, known as BiPap and CPAP. have been told by the company to stop treatment and seek alternatives if possible. The company also said those on the companies life-supporting ventilators should in general continue to use the device, as harm from withdrawal could outweigh the risks of the foam particles. Three to four million machines will be affected by the recall, more than half of which are in the U.S. The company has set aside €500 million for costs associated with the recall and replacing the affected machines.

Jaguar Land Rover (JLR) has announced it is working on the prototype of a hydrogen fuel cell electric vehicle, with testing of the concept expected to begin later this year. The vehicle will be based on the new version of the Land Rover Defender and comes as part of JLR's attempt to meet a target of zero tailpipe emissions by 2036.

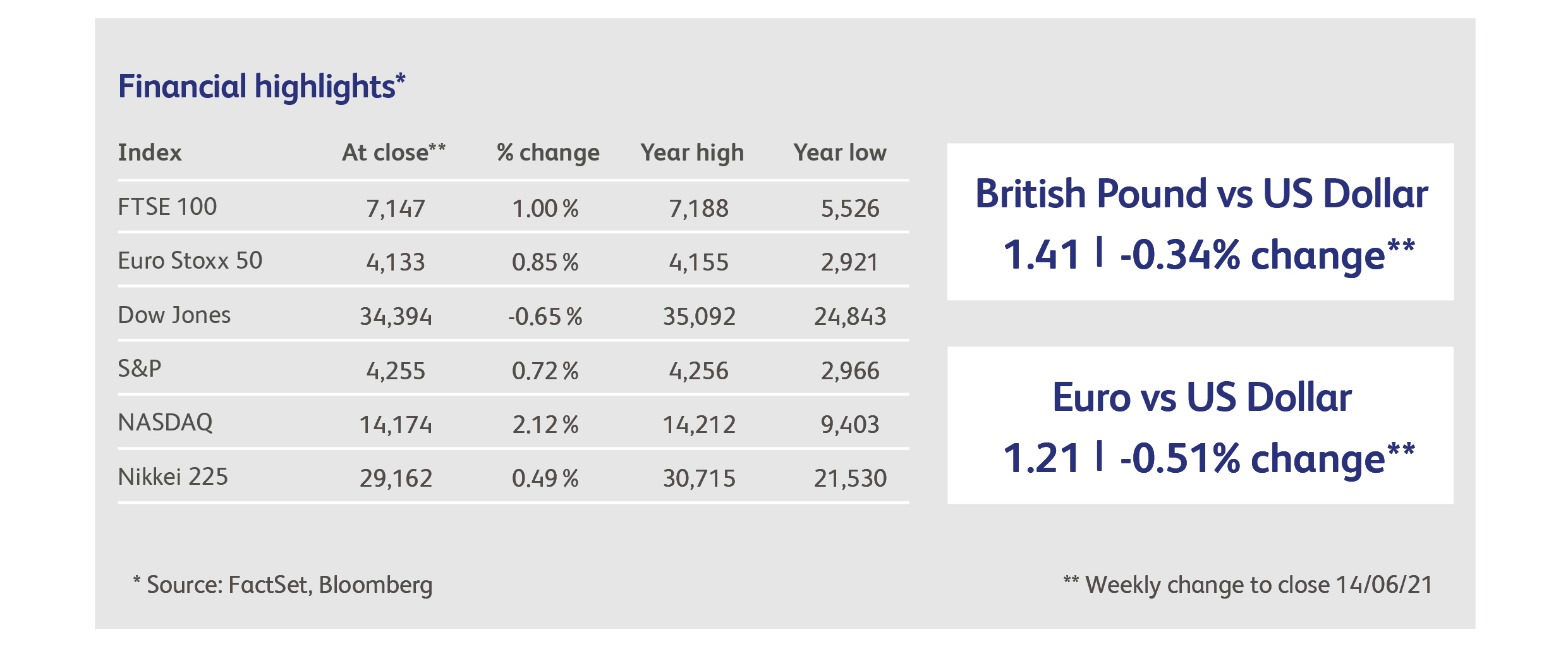

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.