19 July 2022

Stock markets managed to end the week roughly flat, despite the announcement of dreadful inflation data in the US that threatened to derail the current, month-long bounce. There was little to be positive about in the data: US inflation leapt to 9.1% in June from 8.6% in the previous month, far surpassing most expectations. Fuel and food did most of the damage but, excluding these more-volatile components, the so-called “core” rate of inflation also beat expectations as rent and second-hand car prices accelerated again. The only silver lining was that core inflation continued to fall from its peak in March.

Predictably, stock markets fell on the news, as fears grew that the US central bank would have to raise rates by a full percentage point at its next meeting. These fears were promptly quashed publicly by two Federal Reserve governors, however, and the markets could then recover. Even more helpfully, an influential survey of inflation expectations in America, one that has been referred to by the Federal Reserve in its decision-making, showed that longer-term inflation expectations were declining. The week ended on a sour note, however, as Apple, the world’s second-largest company by market value, was reported to be slowing down its expansion plans. This prompted a sudden, 2% slide in the technology-heavy Nasdaq Composite index.

It was harder-going in Europe, where the resignation of the Italian Prime Minister prompted a minor collapse in Italian assets to their lows of the year. Expectations were also rife that the Nord Stream pipeline, which transports Russian natural gas to Germany and was recently closed by the Russians for “repairs”, would probably not re-open next week as scheduled. Those expectations were cemented when the pipeline’s operator, Gazprom, invoked force majeure clauses in its contracts with European buyers in respect of delivery shortages. Continental Europeans were told to expect their energy usage to be rationed. Nevertheless, European markets managed to end the week up, suggesting that a never-say-die attitude may be forming among investors.

Markets continue to be buffeted by fears of inflation and recession on a daily basis, but at least this week they showed that they can shrug off some seriously bad news. The hope for investors is that sufficiently dismal expectations have now been priced in by markets, and that a base may be forming which could support asset prices despite the inevitable bad news stories that are yet to come. Crucial to this hope is the current round of earnings reports for the second calendar quarter and, specifically, whether they will force analysts to raise or lower their expectations for future profits. On present form, investors could probably stomach some bad news on profits, but it is difficult for a company’s stock price to rise when a profits warning is being issued.

Volkswagen is reported to have hired more than a dozen banks to market the forthcoming public offering of its Porsche division, in what will be one of Europe’s biggest ever launches. Despite concerns about the complicated governance structure being put in place, European fund managers will struggle to avoid an investment in Porsche, as it will automatically be catapulted into the major indices used to track the performance of professional investors.

Burberry Group shares fell nearly 4%, and were down as much as 7% during the day on Friday, despite the company managing to largely maintain its profit forecast for the current year. Burberry generates one third of its sales from China, more than many of its competitors, and is attempting to lessen this reliance. Chinese sales were impacted by lockdowns during the second calendar quarter, but management reported that the rebound in June had been “encouraging”.

American banks are among the first companies to report their results following the end of each calendar quarter, and mostly reported results that satisfied investors despite weakness in some divisions. Both JP Morgan Chase and Citigroup announced they would be suspending share buybacks to meet higher capital requirements but Citigroup was, nevertheless, the star performer, generating an 11% increase in revenues. Citigroup shares had one of their best days in years, surging by 13%.

At one point during the pandemic the amount of value being traded through options linked to equities was greater than the amount being traded directly on the stock market. Now, a new craze is emerging on Wall Street - for exchange-traded funds that leverage the performance of individual company stocks. The ETFs are likely to target tech-sector stocks that are already very volatile, making them even more risky, and have already prompted criticism from the US financial regulator.

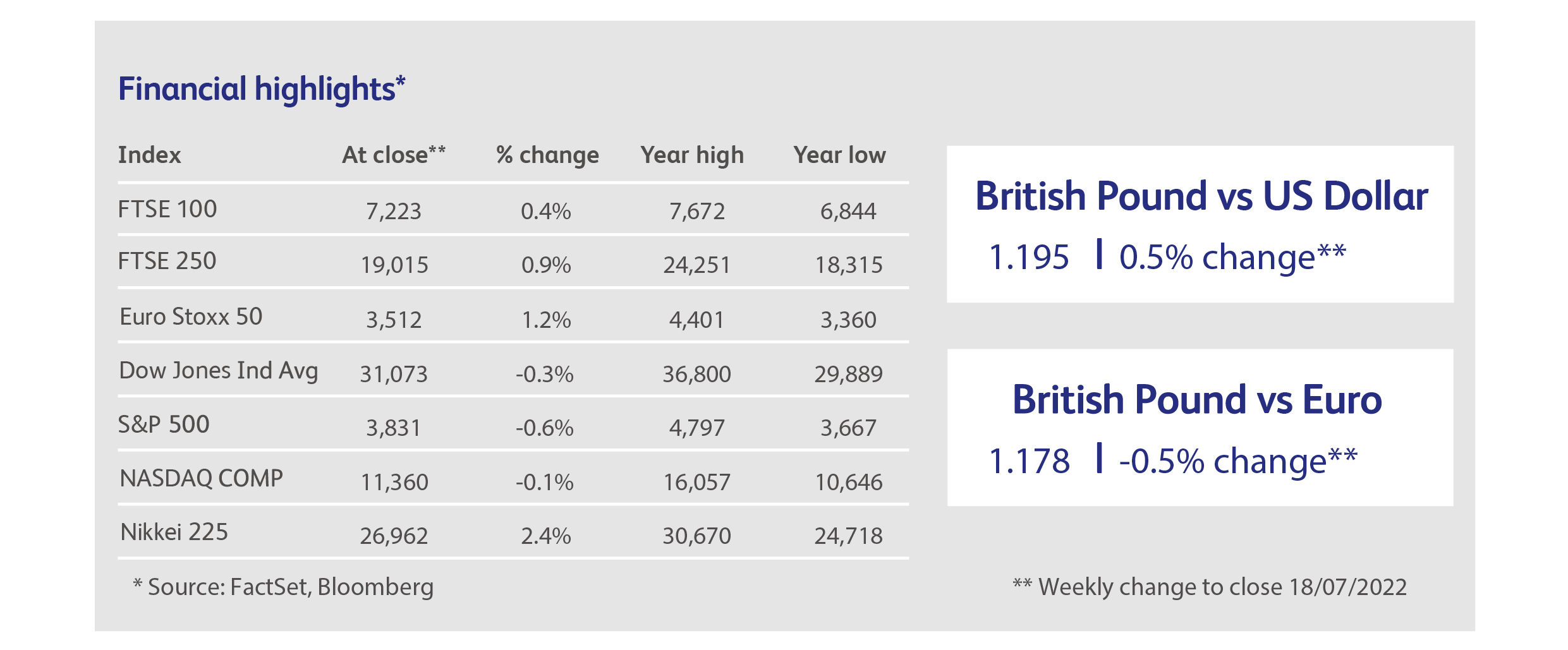

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.