18 October 2022

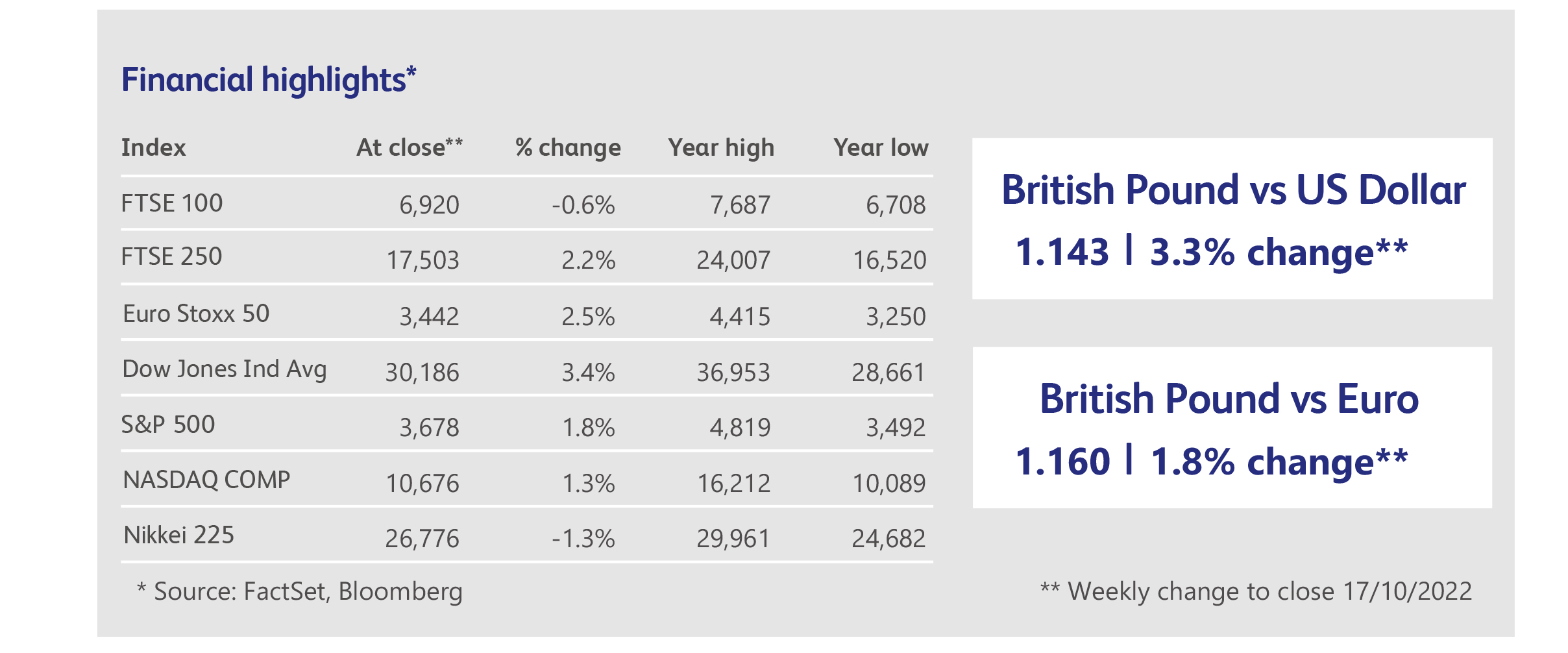

It was a turbulent week for markets and British politics. On 14th October Kwasi Kwarteng was sacked as the Chancellor meaning he was the second shortest serving Chancellor in British history at 38 days. He was replaced by Jeremy Hunt who swiftly announced a reversal of the majority of the tax cuts previously outlined, helping to bring nominal yields down on government bonds and restore some calm to financial markets. Following the mini-budget on 23rd September, where the prospect of a large surge in government borrowing on the back of the announced spending increases and tax cuts, the UK markets had been extremely volatile. Nominal yields on government bonds surged with the 30 year gilt yield crossing 5%, the pound fell and equity markets had seen high volatility. After being down just over 2% during the past week markets rebounded on first the rumour and then confirmation of Kwarteng’s sacking to finish 17th October broadly flat.

Meanwhile in the US, September’s Consumer Price Index (CPI) data was released and showed inflation in the US had eased for a third straight month to 8.2% year-on-year, the lowest since February but above market expectations of 8.1%. With CPI still well above the Fed’s 2% target, markets are expecting it to maintain its hawkish rhetoric and keep raising interest rates at a quick pace. Initially US markets reacted badly to the news on 13th October, with the S&P 500 falling to a low of 3,492 before staging a dramatic recovery and finishing the day at 3,670. Strong services inflation offset declines in core goods and energy prices. Resilient demand and wage inflation have contributed to strong services inflation, whilst weaker commodity prices, lower shipping costs and recovering supply chains are likely to continue to reduce inflationary pressures over the coming months.

Another key development this week is that Western suppliers have started cutting ties to some Chinese chipmakers in response to the new US export controls. The export controls, announced on 7th October aim to slow China’s ability to manufacture high-end semiconductors that have dual uses in military and commercial technology. The Dutch semiconductor company ASML, told US employees to stop installing or servicing equipment at any Chinese chip factory while it processes the new rules. While it is not uncommon for Western companies to suspend exports in the wake of new US sanctions as they digest the new rules, national-security experts say the new restrictions are among the toughest the US has enacted. The controls essentially stop exports to China of American-made manufacturing equipment needed to produce advanced chips and also prohibit the export of any US components or tools to Chinese factories capable of making high-end semiconductors.

Chris Hill, Hargreaves Lansdown’s chief executive of six years, has announced he will step down by November next year. The move comes as the UK’s largest investment platform seeks to deliver on ambitious plans for tech-fuelled growth. In February, Hill outlined a five-year strategy which included plans to invest £175 million in upgrading the investment platform’s systems and building a technology-led financial advice service. A £100 million lawsuit was also filed this week against the company over its promotion of Neil Woodford’s fund prior to the collapse of the fund in 2019; claims the group has rejected.

Two companies that have reported strong results during this quarter's US earning season are Johnson & Johnson and Goldman Sachs. Johnson & Johnson posted better-than-expected third-quarter numbers today, supported by a strong performance in its pharmaceutical division. Analyst expectations for reported group sales were for around $23.3 billion, but the company reported $23.8 billion beating expectations. While Goldman Sachs reported revenues of $11.98 billion, beating expectations of $11.41 billion and earnings per share of $8.25 ahead of the estimated $7.69. The strong sets of results were supported by record quarterly net revenues of $2.38 billion in its consumer and wealth management unit.

Moneysupermarket, the price comparison website, announced today that its core earnings for the third-quarter would be at the upper end of expectations supported by customers switching financial products. Moneysupermarket said home services, broadband and mobile saw good growth and helped revenue for the three months to the end of September rise to £102 million, up 33% on the previous year.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.