8 November 2022

Monetary policy and economic data were in the driving seat last week, with both the US Federal Reserve and the Bank of England scheduled to announce monetary policy decisions. The Fed raised the possibility of a slowdown in the pace of interest rate rises, adding new language to its statement on monetary policy to the effect that it would consider the cumulative impact of rate rises on the economy when setting rates. This was hardly the “pivot” towards more dovish monetary policy that markets were hoping for, but it was enough to unleash a rally. Unfortunately, the rally lasted all of half an hour, by which time Fed Chairman Powell’s press conference had squelched any optimism, saying that rates were actually likely to go higher than expected, even if they went higher in smaller increments.

Investors were left wondering why the US central bank would signal simultaneously that it will soon pivot to smaller hikes but that it will pursue higher rates over time. Some analysts see this as evidence of a rift opening up between the hawkish Chairman and his more dovish lieutenants. Others point to an anomaly apparent in the bank’s thinking and behaviour: the Fed is concentrating all its efforts on the risk that inflation becomes embedded in the economy, even though there is plenty of evidence to suggest that downward pressure on inflation and economic activity is now building in the system. In other words, the Fed is setting policy to address a single negative outcome instead of taking into account all possible outcomes, and one that is not even close to being the most likely outcome. Such an approach risks provoking an unnecessarily sharp slowdown in the economy. More information will become available when the US inflation data for October is published on Thursday.

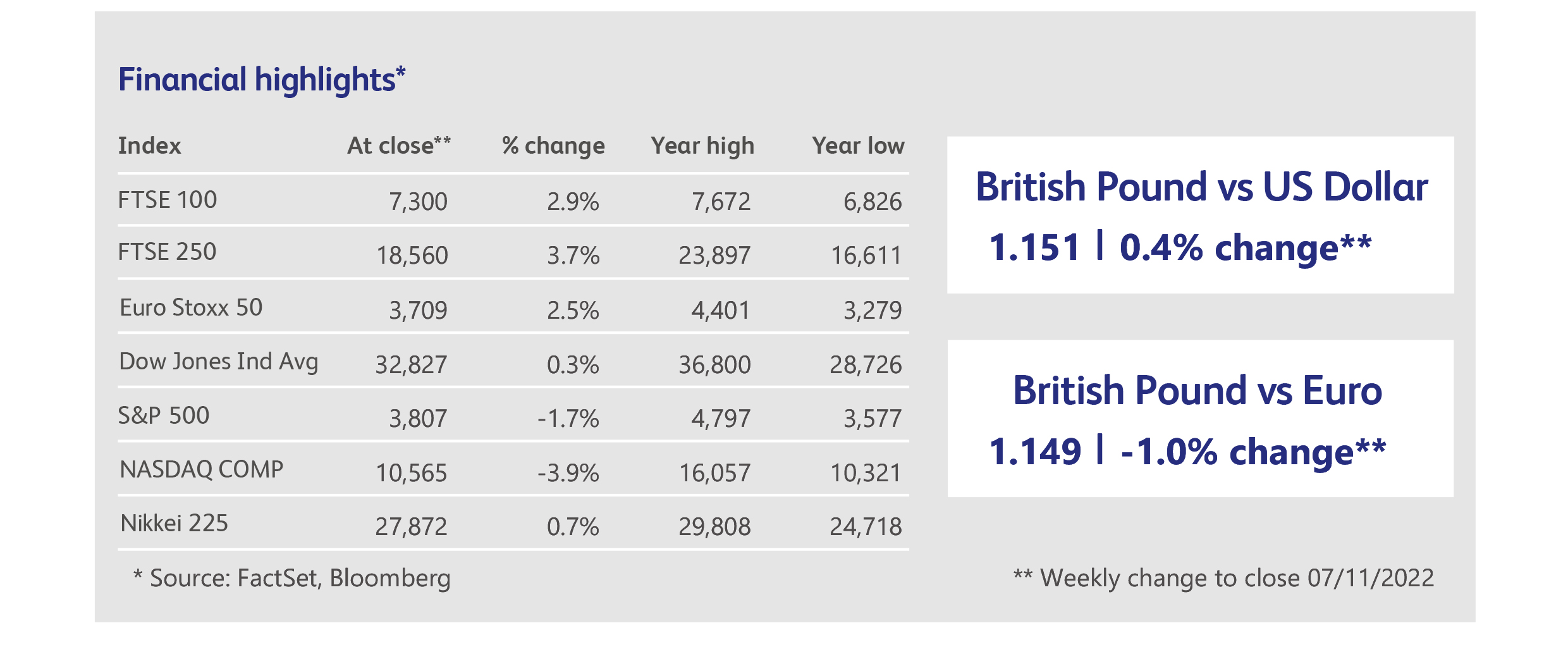

US stock markets struggled to see whether the glass was half-full or half-empty, with the technology sector selling off but old-world stocks holding onto their gains of the last month. US bond markets were in no doubt that Powell is not yet finished, with shorter-maturity bonds selling off to new lows for the year. European stock markets have less of a technology-sector bias and were able to put some distance between themselves and US equities. Sentiment in Europe has been helped by their central bankers being further along the road to a genuine pivot in interest rate policy, though this is mainly the case because so much economic momentum has already been lost.

The real excitement for market watchers, however, was in China where a rumour on social media, purporting to suggest that China might be softening its rigorous anti-Covid policy, set off a rally of epic proportions. Despite having all the hallmarks of a “pump-and-dump” strategy, markets in Hong Kong enjoyed their best weekly gain in a decade. The government was keen to dispel the rumour, and actually ordered further lockdowns as Covid cases in China spiked to a six-month high. This did nothing to dim the enthusiasm of traders, however. When the dust settled, Chinese stocks had risen in value by about half a trillion dollars, and even the Chinese currency got in on the act, enjoying a 1% bump against the US dollar.

Apple’s problems finally caught up with the stock price, as investors lost patience with an onslaught of bad news. The quarterly results announcement last week had proceeded smoothly enough, with management reporting revenues and profits that beat expectations. However, a subsequent spate of rumours suggest that all is not well. Apple is reported to have cut hiring for many departments, and departmental budget cuts have been escalated, according to the financial news service Bloomberg. Production of iPhone 14 handsets is rumoured to have been cut by 3% due to soft demand, contrary to the company’s own statement that demand remains strong. The company’s problems with Covid lockdowns in its main iPhone assembly site in China have already been well-publicised. The shares declined by 10% during the week, enough to cast a pall over the entire technology sector.

Investors in Tesla are nervously watching the saga of Elon Musk’s takeover of Twitter, which threatens to distract Musk from his more valuable electric car and battery business. Having reacted with horror to Musk’s failed attempt to extricate himself from the acquisition, Tesla shares reached a new low for the year following Musk’s initial managerial actions. These included firing half of Twitter’s workforce, setting off a round of lawsuits. Musk has admitted that Twitter, which was acquired for $44 billion, is losing $4 million a day after advertisers adopted a “wait-and-see” attitude to the diminished oversight of content.

A month-long rally in GSK shares was cut short following the company’s announcement that its anti-cancer drug Blenrep had failed to help patients live longer in a clinical trial. The announcement sent the shares down 5% and spoilt what would otherwise have been a good week for the company, after management upgraded its forecast for sales and profits this year.

Airbnb shares fell by 16% after the company forecast that growth in the fourth calendar quarter is likely to be moderately slower than the rapid growth of 25% attained in the third quarter. Average daily rental rates had risen by 5% in the third quarter, entirely driven by inflation, but management pointed to a shift in usage towards smaller, urban accommodations fetching lower rates. Airbnb shares are down over 40% year-to-date.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.