24 January 2023

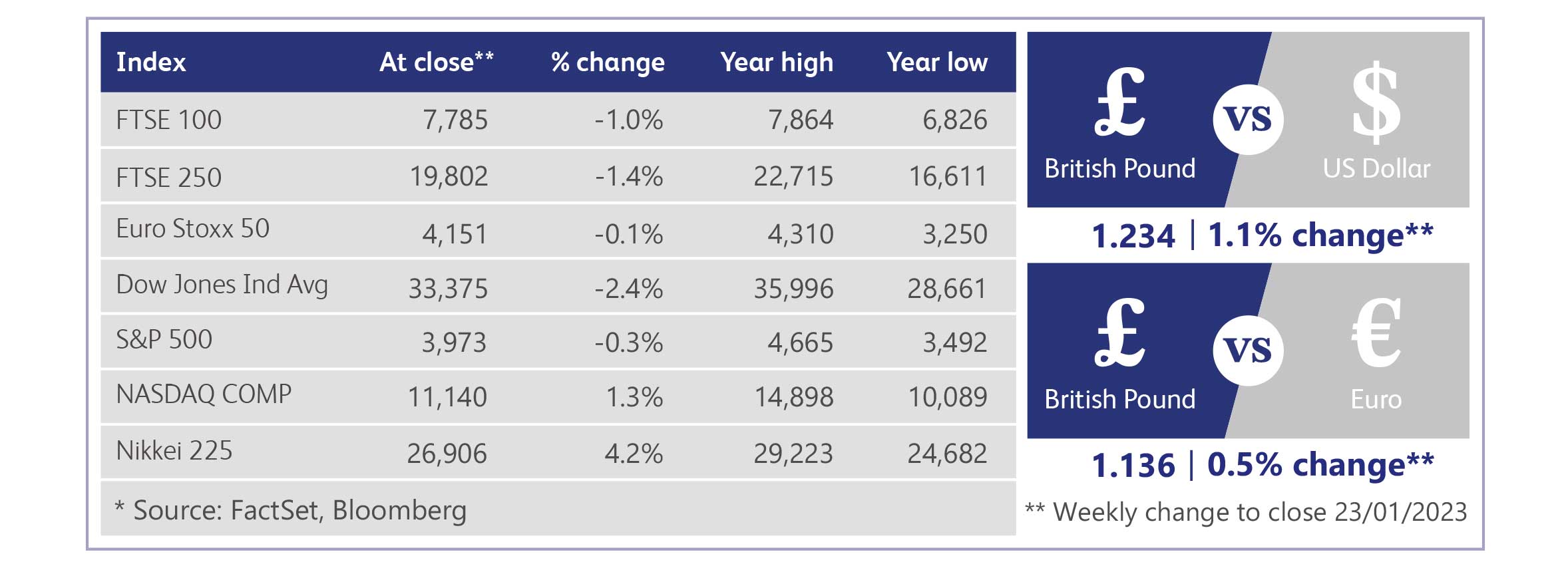

Equity markets delivered mild returns, despite an array of poor economic data announcements. Bond yields were also relatively flat leading to minor price changes with weakening conditions justifying potentially lower interest rate hikes across multiple developed economies.

Figures released from the Office for National Statistics revealed further falls in retail sales by 1% in December as struggling consumers cut back their spending. UK house prices also recorded a sharp decline over the same period according to the latest Royal Institution of Chartered Surveyors survey. This was a reflection of a challenging environment for new buyers following increasing mortgage costs and heightened economic uncertainty.

UK unemployment was unchanged at 3.7%, while wage growth surpassed expectations and continued its ascent starting in September. There was a noticeable drop in the number of job vacancies with economic uncertainty leading employers to hold back on recruitment. Despite continued strength in the UK labour market, CPI inflation declined for the third consecutive month. Prices fell to 10.5% in line with forecasts with the largest downward contribution coming from motor fuels as well as clothing and footwear and recreation and culture. Investors welcomed the news with this lowering the pressure on the Bank of England to hike interest rates at such an aggressive pace. Some trepidation remains over the upward pressures from the jobs market with this contributing to the overall rate of inflation.

While prices were falling in the UK, in Japan inflation rose to 4%, the highest level since January 1991 following rising commodity prices and weakness in the yen. The anticipated rise was not enough for the Bank of Japan to consider raising interest rates, to follow the trend of other principal developed market central banks. Rates were maintained at -0.1% by unanimous vote with policy-makers more mindful of further deteriorating economic growth, noting forecasts had already been cut for 2023.

The Chinese economy expanded 2.9% year-on-year in the fourth quarter of 2022, lower than 3.9% the previous quarter, but higher than 1.8% expected. The full year marked the second lowest growth since 1976 driven in part by the country’s stringent Zero Covid policy of widespread lockdowns and testing. Reports followed from China's Centre for Disease Control and Prevention stating that the current wave of infections had impacted around four-fifths of the country’s population.

Microsoft has announced a multi-billion-dollar investment in OpenAI, the firm behind the program ChatGPT. Exact details have not been disclosed, but the company said it was investing billions of dollars in a "multi-year" agreement. Microsoft first made a $1 billion investment in OpenAI in 2019 in an agreement that conferred the tech group first rights to commercialise the artificial intelligence technology. Despite a broader tech market downturn, where tens of thousands of tech workers have lost their jobs, AI start-ups are seeing a flood of investment.

Dignity, the UK's biggest funeral provider has agreed a takeover that values its equity at about £280 million. The buyer consortium of Phoenix Asset Management Partners, SPWOne V and Castelnau Group, which already owns 29% of Dignity, agreed to pay 550p per share for the remaining 71% it doesn't own. This represents a near 30% premium on the closing share price on 3 January 2023 - the day before the company revealed it was in talks with a buyer. Dignity was part way through a turnaround strategy, which has hit profits as it sought to cut prices to gain market share.

Alphabet, the parent company of Google, has announced it is to lay off 12,000 people worldwide. This represents around 6% of Alphabet's global workforce and is understood to include staff in teams across recruitment, engineering and products and some corporate functions. It comes as tech workers across the industry are losing their jobs following the reversal of the tech sector boom seen during the pandemic. Microsoft announced it is cutting around 5% of its staff - 10,000 jobs - and Amazon is set to cut 18,000 jobs.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.