11 July 2023

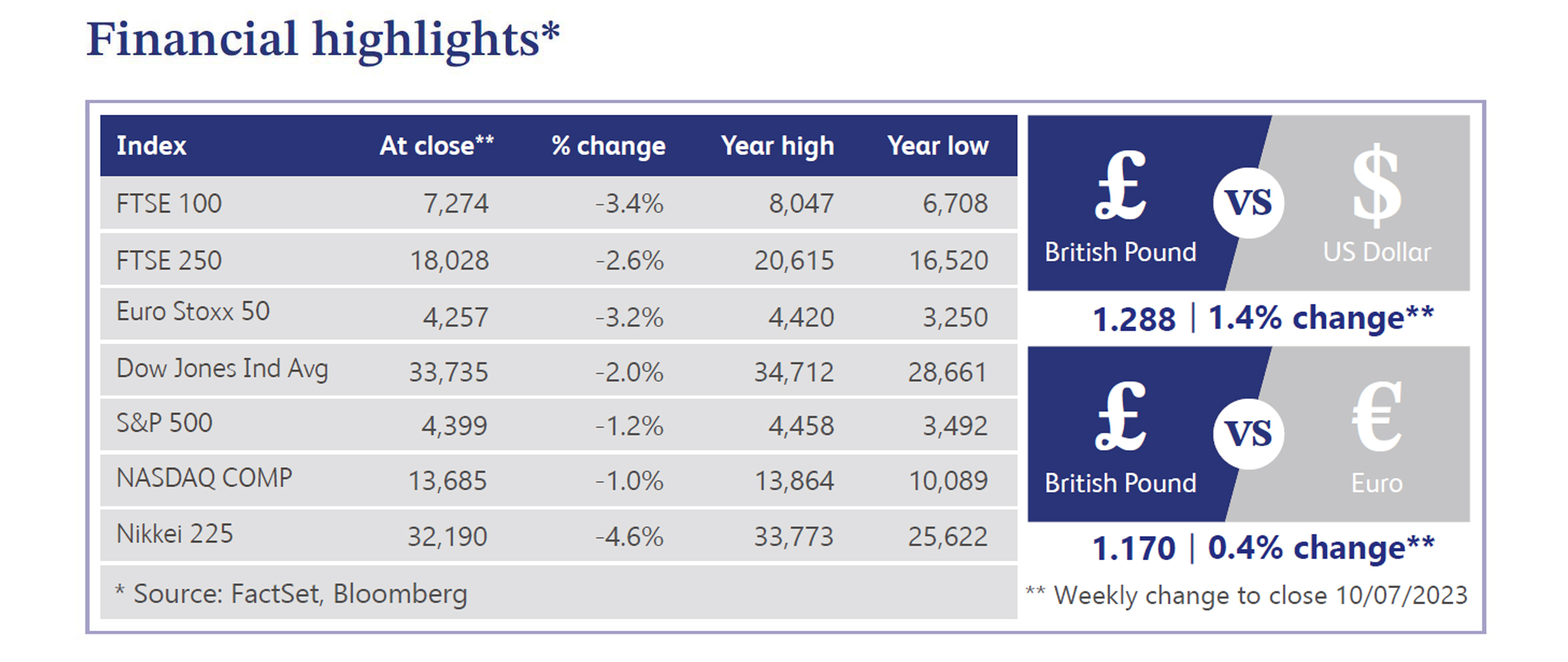

The UK’s FTSE 100 saw a decline of approximately 3.4% last week. The index closed Monday’s sessions at 7,274 as sticky inflation and rising interest rates continue to be an area for concern. Bank of England (“BoE”) Governor, Andrew Bailey, stated in an interview with the BBC his continued commitment to bringing inflation down. Bailey did not provide a timeframe for when rates might peak or begin to decrease as inflation continues to remain too high. This led to market expectations continuing to rise with markets now anticipating rates to reach 6.5% by March 2024. Last week also saw research published by JP Morgan highlighting that the BoE may need to hike rates to 7% in a worst-case scenario. However, their expectation is that rates will peak at 5.75% in November this year.

Rising rates also continue to put pressure on the UK housing market as homeowners face significant jumps in borrowing costs. This is having a wider impact on the market as property portal Zoopla showed in its latest research that more than one third of homes have dropped in value since December 2022. It should be noted that these price falls are still modest, with a third of homes estimated to have decreased in value by at least 1%. Zoopla’s research also stated that it does not expect negative equity as house prices are only expected to fall by approximately 5% over the course of 2023. Although, if the BoE does raise the base rate to 6.5% in line with market expectations, it is expected that many mortgage holders would likely struggle to service debt on a 7.5% mortgage rate. Therefore, some analysts are suggesting that research is underestimating the impact of higher rates on house prices. However, when considering the broader economy, around two thirds of houses are owner occupied, of which 28% or 6.8 million are with a mortgage or a loan. Taking this into account, the impact on the wider economy could be argued to be less than expected.

Last week also saw a shift in asset allocations as investors sold equities, mixed assets and property funds to switch into the fixed income and money markets. Data from Calastone, the global funds network, showed that investors withdrew approximately £662 million from equity funds in June. This was the largest outflow since September 2022 as a result of the UK mini-budget during the Liz Truss era. June was one of the top ten worst months in Calastone’s records for equity funds, which reportedly accounted for outflows totalling £1.12 billion - £384 million in mixed assets and £79 million in property. However, fixed income and money markets saw inflows of £880 million and £503 million respectively, totalling £1.38 billion. This demonstrates that investors currently favour safer investments providing higher yields as the economic uncertainty continues.

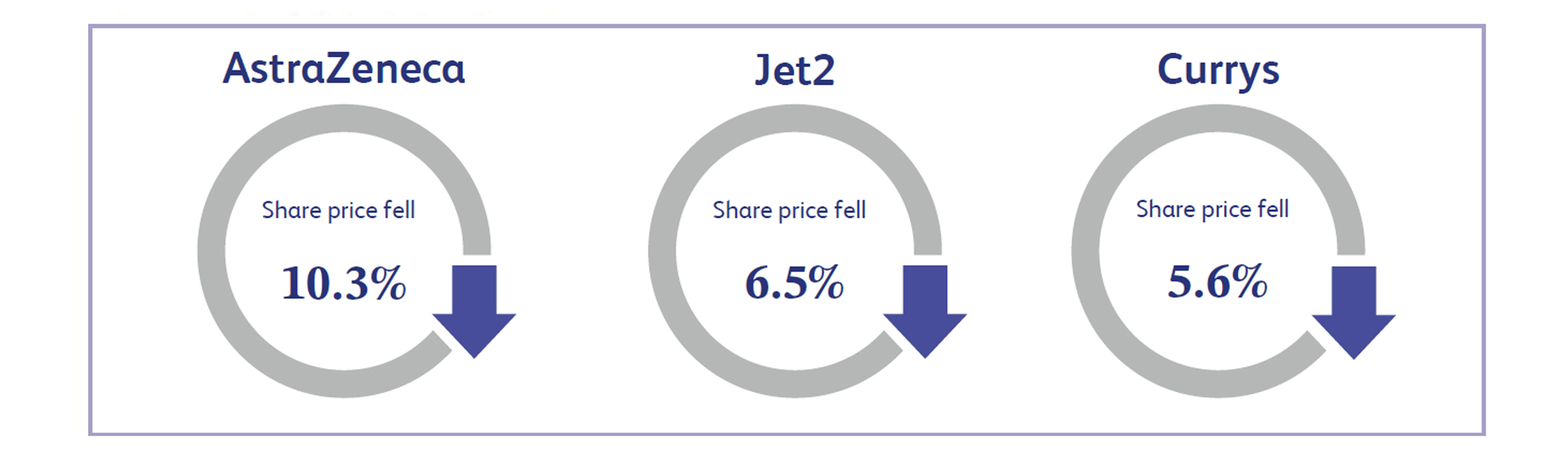

AstraZeneca saw its share price decline by approximately 10.3% last week. The company published the first results from the phase 3 trial of its new lung cancer drug which failed to meet investor expectations. The results provided some positive news, but AstraZeneca provided limited detail and did not declare its results “clinically meaningful.” Investors had high expectations based on previous drugs produced by the company, so the lack of detail provided by the company led to a lowering of investor expectations.

Jet2, the UK-based leisure and travel company, announced its year end results last week and flagged that economic uncertainty means that it is too early to provide profit guidance for the year ended March 2024. The company also announced that founder and Executive Chairman Philip Meeson will step down from the board after 40 years. Meeson has a shareholding of 18.3% in the business, and markets are anticipating Meeson selling some of his shareholding as he steps down. The shares were down approximately 6.5% last week after this news.

Currys, the UK based retailer of technology products and services, saw its share price decline by approximately 5.6% last week after announcing its year end results. The company announced a swing to a pre-tax loss in the full year 2023 due to difficulties in its Nordic business. These problems were presumed to be relatively short term, but the continuing difficult economic outlook has meant they have lasted longer and the company has now had to withdraw its dividend. The company has now positioned itself prudently and the decision not to pay a dividend is to protect its cash flow.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.