5 September 2023

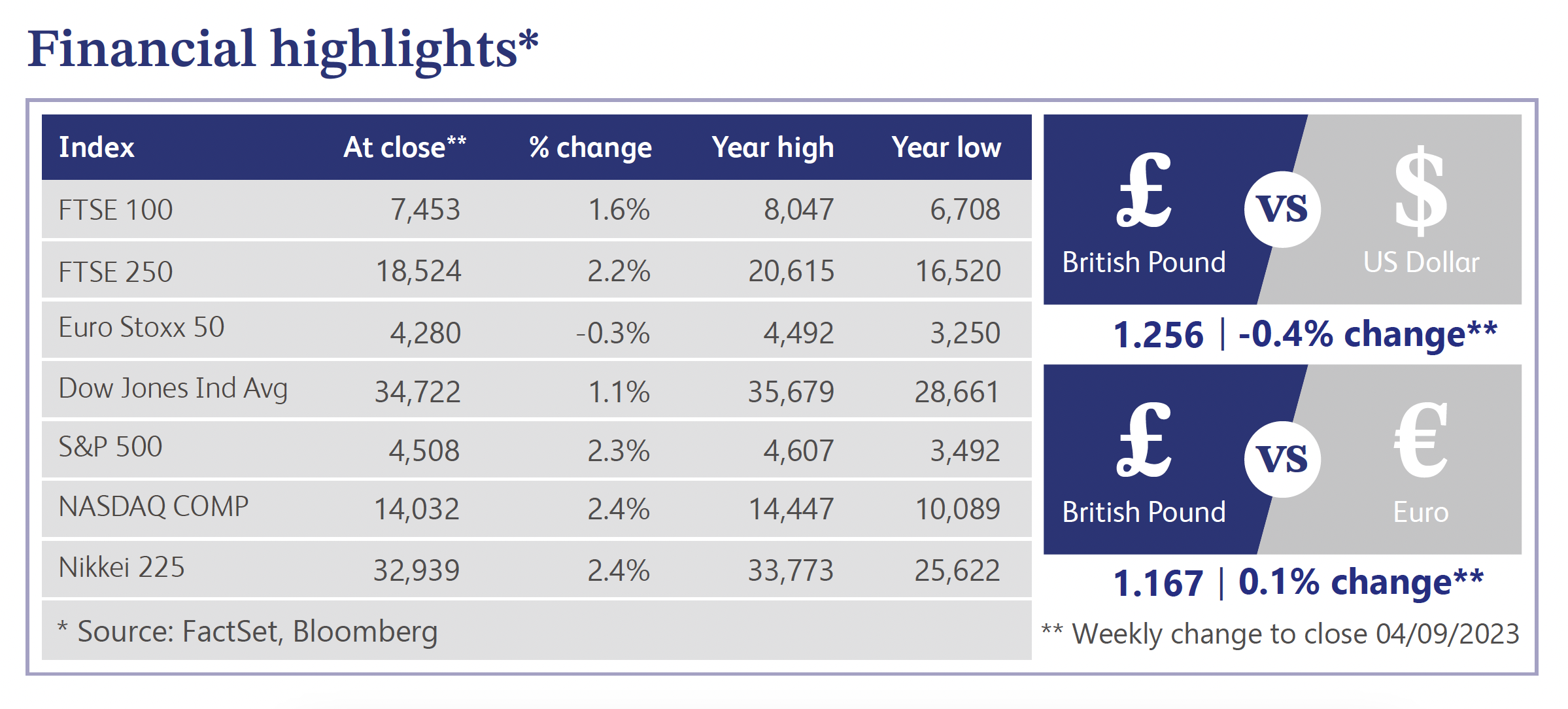

Last week saw the FTSE 100 rise 1.6% amid hopes that global economies are nearing the end of the monetary tightening cycle. Growth within the UK equity market has been relatively flat since the start of 2023, with the FTSE 100 increasing by approximately 0.5% over the year to date. Persistent high inflation and aggressive monetary tightening by the Bank of England (“BoE”) have been the main factors leading to minimal growth for UK equities. On a valuation basis, the FTSE 100 is trading on a price to earnings ratio of approximately 10.5x, which is at the lower end of statistics over the past two decades, indicating that current UK equity prices could be considered as cheap. This is of no real surprise given the consistent negative sentiment surrounding the outlook for global economies.

In terms of economic outlook, last week saw Bloomberg cite Karen Ward, Chief Market Strategist at JP Morgan and member of the Chancellor of the Exchequer’s economic advisory council, who stated that central banks will push western economies into a recession in order to be sure of winning the battle against inflation. Ward stated that it appears unlikely that western economies will be able to escape inflation without triggering a recession due to the resilience of the labour market. This will lead policymakers to keep borrowing costs higher for longer which will continue to add pressure on markets and ultimately require weakness in order to bring inflation back to target levels. Therefore, until it is clear that labour markets are loosening and wage pressures are easing, it appears likely that rates will need to be higher for longer.

It was also suggested that UK officials should consider lifting the BoE’s inflation target from 2% once inflation has been brought under control. The BoE has generally resisted suggestions that the inflation target should be changed at a time when inflation is higher as it could potentially undermine credibility. However, as markets have become increasingly accepting of rates being higher for longer, arguments have been made that a higher inflation target may reduce the risk of overtightening when there is risk of structurally higher prices due to changes in supply chain, green transition and labour market dynamics.

In the UK housing market, Nationwide data for August showed that house prices have now declined 5.3% from their August 2022 peak. On a monthly basis prices fell by 0.8%, which aligns with other industry data which indicates that price weakness accelerated once seasonal support faded earlier this year, due to higher interest rates. The outlook for UK house prices remains weak. However, Nationwide believes that a soft landing is still possible due to the healthy rates of nominal income growth and the potential for a moderation in mortgage rates, once we reach the end of the monetary tightening cycle.

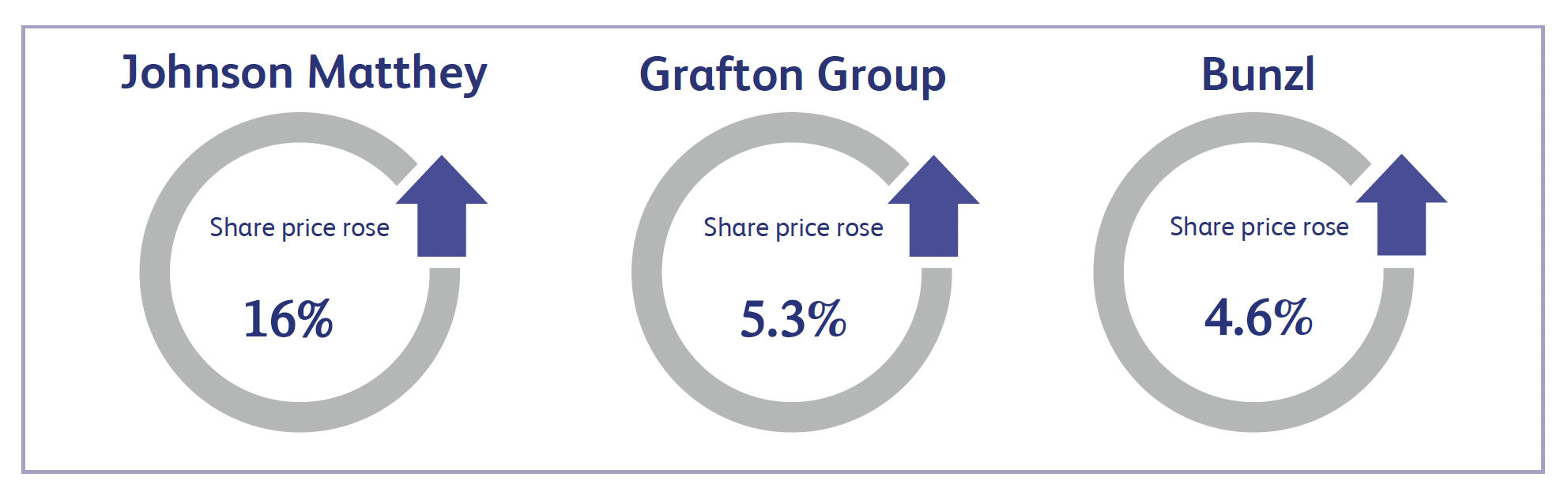

Johnson Matthey, the UK based sustainable technologies company, saw its shares surge approximately 16% last week after it was announced that Standard Industries doubled its stake in the company to approximately 10%. Standard Industries operates in over 80 countries through investments in public markets and early to growth stage technologies across performance materials, logistics, real estate and next-generation solar technology. After increasing its investment, Standard Industries is now Johnson Matthey’s largest shareholder after first investing back in April 2022. This has led to rumours of a potential takeover.

Grafton Group, an international distributor of building materials, saw its share price increase by approximately 5.3% last week after announcing interim results. The company announced revenue just shy of £1.2 billion in the first half of the year, which was 3.2% higher than the prior year. However, adjusted operating profit fell approximately 30% to £103.9 million. The company also announced that full year expectations remain unchanged and a further £50 million share buyback which should be completed by 31 January 2024.

Bunzl, the UK based specialist international distribution and services company, announced its interim results last week which saw its share price increase by approximately 4.6%. The company announced that margins were moving to a structurally higher level as mergers and acquisitions and penetration of own label products increased the scale and efficiency of the company. Investors were also pleased to see the group upgrade its full year 2023 guidance for adjusted operating profits, driven by the meaningful increase in operating margin expectations.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.