3 October 2023

Last week saw mixed signals for the UK economy as the job market displayed signs of cooling. According to an update from the Recruitment and Employment Confederation (“REC”), job postings rose by 13.5% in the week ending 17th September but remained below earlier-year averages, with 175,000 new job adverts posted, down from over 200,000 on average earlier in the year. The REC Chief Executive, Neil Carberry, noted that recruiters across the country have reported a market normalisation as job postings fell from pandemic highs. This cooling labour market was highlighted by the Bank of England (“BoE”) as one of the factors influencing its decision to keep interest rates on hold.

Despite these concerns, the UK's economic performance since the onset of the Covid-19 pandemic has been stronger than previously thought. Data from the Office for National Statistics revealed that the UK's recovery has outpaced that of Germany and France, signalling a faster post-pandemic rebound. This unexpected resilience in the economy has raised questions about the accuracy of official economic forecasts. The Institute for Fiscal Studies cautioned that excessive government borrowing, driven by costly policies introduced by recent chancellors, has undermined faith in these forecasts.

Bloomberg reported that National Grid is preparing for a January supply crunch due to planned nuclear outages during high winter demand. As a contingency plan, households may receive payments to cut heating usage and prevent gas shortages. Discussions about scrapping inheritance tax, concerns over rising HS2 costs and global banking reform delays add to economic challenges. The UK's real estate sector, both commercial and residential, faces pressure from higher rates and weak demand, notably in London's office market, with 30-year high vacancy rates causing property values to plummet. These developments underscore the need for close monitoring in the coming weeks due to the complex economic landscape.

Regarding interest rates, economists widely believe the BoE has likely finished raising rates, with over 75% of those surveyed by Reuters not expecting the central bank to raise rates again in its November monetary policy committee meeting. However, the BoE is not anticipated to cut rates until the third quarter of 2024. This is influenced by a softer labour market and a surprising slowdown in core and services inflation, with attention now shifting to how long rates will remain restrictive. The median prediction indicates rates will hold steady until at least July 2024, while a third of experts anticipate a rate cut in the second quarter of 2024. Additionally, UK money supply shrank in August, the first drop in over 13 years, though the BoE minimises its importance for inflation.

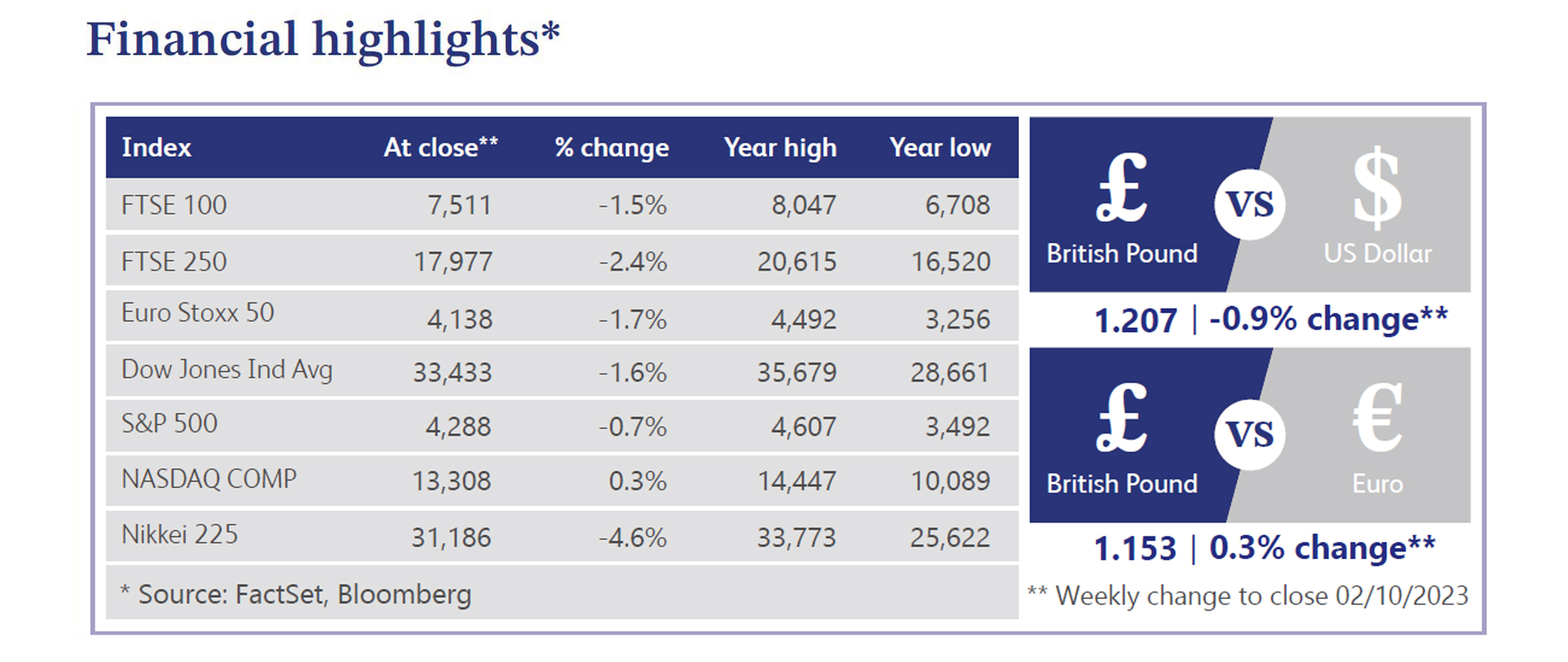

Looking at the broader market landscape, Goldman Sachs has expressed optimism about the UK's FTSE 100 benchmark equity index, citing a positive correlation with oil prices and the benefits of a weaker pound. However, challenges lie ahead, with KPMG forecasting a slowing economy in the second half of the year, with real gross domestic product for 2023 projected at 0.4% and growth of just 0.3% in 2024, due to high interest rates, ongoing uncertainty and low productivity.

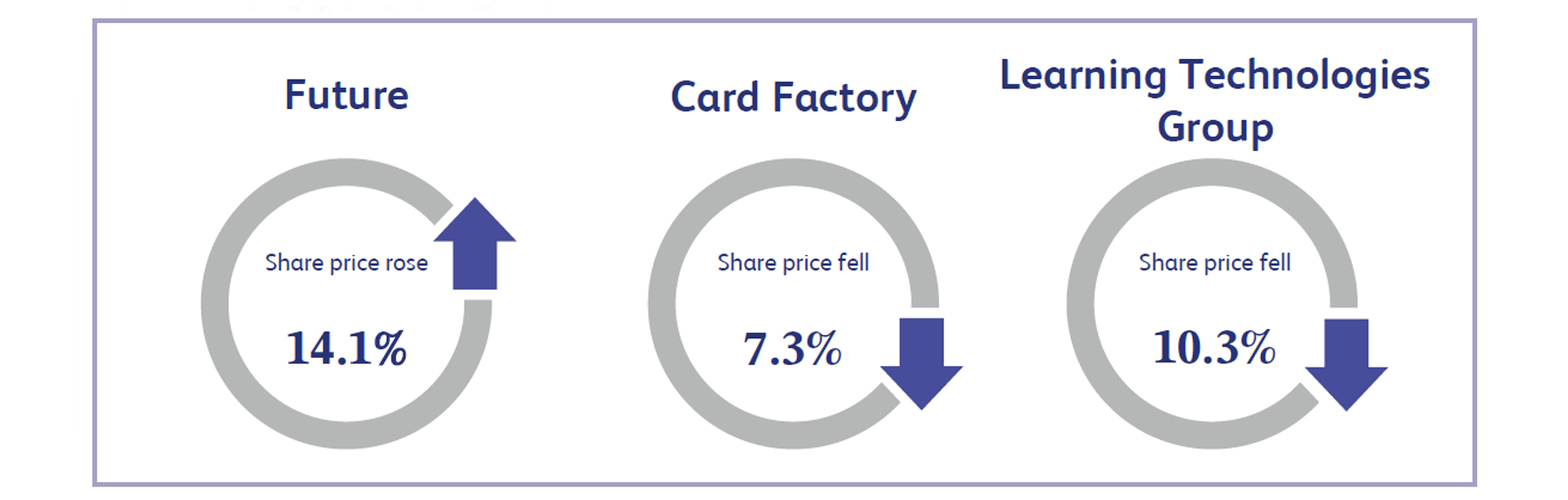

Future, the UK based global platform for specialist media, saw its shares surge 14.1% last week following a positive full year trading update. Despite ongoing economic volatility, the company expects its adjusted operating profit to meet board expectations of £254.1 million. Audience numbers stabilised in the second half of the year, and there was momentum in the final quarter. While consumer spending and digital advertising posed challenges, Go Compare revenue accelerated, due to strong market volumes, and magazine revenue held up well.

Card Factory, the specialist retailer of greeting cards, gifts and party supplies, saw a 7.3% decline in its shares last week despite announcing strong performance for the first half of the year, with a 12% revenue increase to £220.8 million and an impressive 105% rise in adjusted profit before tax to £22.1 million year-on-year. Despite expressing confidence in the second half of the year and reaffirming long-term goals, resulting in the company’s management team and its strategy being praised by analysts, concerns arose due to the challenging pre-Christmas economic climate. Investors were cautious about the traditional greeting card industry's future amid the ongoing shift to online platforms.

Learning Technologies Group, the UK based holding company which provides a range of learning and talent software and services to corporate customers, saw a 10.3% share price decline last week following its report for the first half of the year. While revenue increased by 2% to £284.6 million, profit dropped, with earnings per share down as well. Factors contributing to the decline include lower transactional volumes tied to the macroeconomic environment and reduced demand in GP Strategies, acquired by Learning Technology Group in 2021, particularly in China. Despite some positive aspects, these concerns weighed heavily on the market, resulting in the corresponding share price decline.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.