12 March 2024

Market News

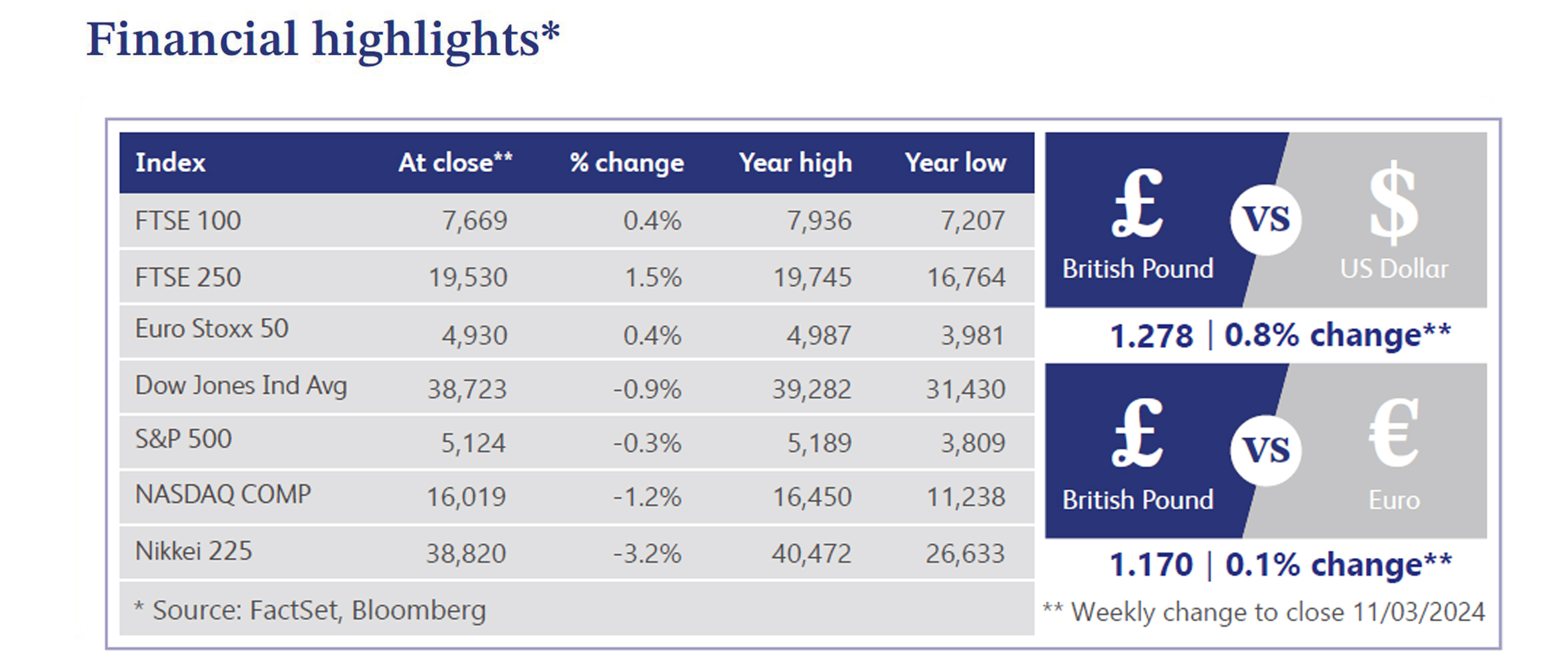

UK Chancellor Jeremy Hunt unveiled a 2% reduction in the main rate of National Insurance contributions in the Spring Budget, in line with expectations. These adjustments were supported by upgraded forecasts from the Office for Budget Responsibility, with revised gross domestic product projections of 0.8% in 2024 and 1.9% in 2025. However, an article from Bloomberg noted concerns as fiscal headroom dropped to £8.9 billion from £13 billion in the November forecast, the second lowest level on record.

Contrary to the optimistic outlook presented by Hunt, Citibank analysis suggested a potential £50-£60 billion gap in fiscal forecasts, indicating a more challenging position. The discrepancy was attributed to overestimated UK growth potential and unrealistic cuts to public spending, potentially setting the stage for economic challenges.

As a result of the Budget, battle lines were drawn on topics such as tax cuts and public services for the upcoming election. Despite the lower taxes pleasing businesses, some members of parliament expressed disappointment, setting the stage for political debate. Elsewhere, Bank of England chief economist, Huw Pill, discussed the potential for rate cuts while maintaining a restrictive policy stance, highlighting the need for conclusive evidence in inflation dynamics.

In the investment landscape, Bloomberg reported that optimism is returning to the UK as a global investment destination, with overseas corporations expressing positive sentiments ahead of the anticipated general election. Despite the economic challenges of 2023, a predicted recovery and favourable political backdrop positions the UK as a top investment destination, second only to the US. Data from Calastone demonstrated that UK investors increased their appetite for equities, with record inflows of £2.54 billion, primarily into US Environmental, Social and Governance (“ESG”) funds. However, UK-focused equity funds continued to experience outflows, reflecting persistent investor caution despite low valuations.

The UK's Debt Management Office (“DMO”) is expected to announce record bond sales for the upcoming fiscal year, with estimates reaching £258 billion. To address concerns about dwindling demand for long-dated debt, the DMO is considering adjustments such as skewing sales towards shorter maturities and opening gilt auctions to retail investors.

Retail data from consultancy firm BDO revealed a concerning trend, with UK retailers experiencing the longest drop in sales since the 2020 lockdown. A 1.3% contraction in sales across various sectors, especially during the crucial Christmas and New Year sales periods, underscored the ongoing challenges faced by brick-and-mortar stores.

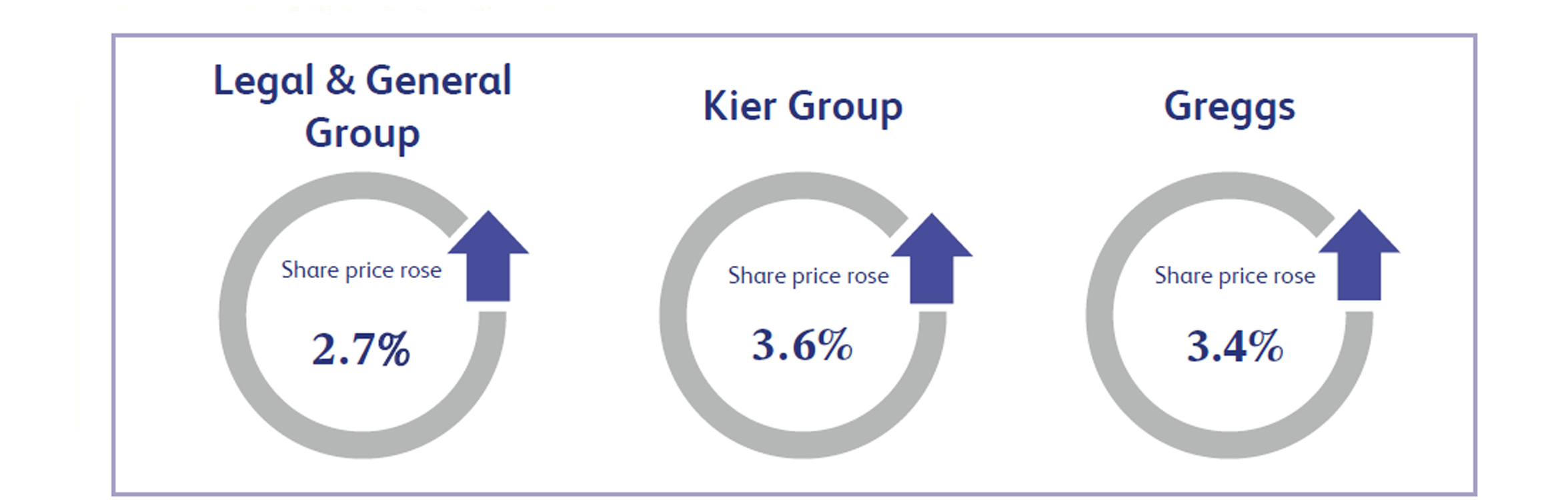

Legal & General Group, the multinational financial services provider, last week announced its final results, which saw the company’s share price close the week approximately 2.7% higher. The company reported a decline in profit after tax with this year's figure showing £457 million, compared to £783 million in the previous year. The company did, however, maintain a positive outlook and remains on track to achieve its five-year ambitions, as set out in 2020. Alongside this, the company announced a dividend of 20.34p per share, up 5% from last year’s figure of 19.37p.

Kier Group, the construction, services and property firm, saw its share price close the week approximately 3.6% higher after the company announced its final results. The company reported strong revenue growth with the latest revenue figure showing £1.9 billion compared with last year’s £1.5 billion. Profit before tax was also higher, with the latest figure showing £49 million compared to last year's figure of £45.8 million. Management stated that the company was trading in line with analyst expectations, and continues to be well positioned to continue benefiting from the UK Government infrastructure spending commitments.

Greggs, the high street bakery chain, announced its final results last week which saw its share price end the week approximately 3.4% higher. The company reported its total sales increased by approximately 20% to £1.8 billion for the current year, alongside underlying pre-tax profit increasing approximately 13% to £167.7 million. Greggs now has 2,473 shops trading as at 30 December 2023, with more than 1,200 shops staying open until 7pm or later to increase potential revenues as part of its growth strategy. The market viewed the results positively, resulting in the shares closing the week higher.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.