19 March 2024

Market News

As the financial world braces for the Bank of England's ("BOE") meeting on 21st March, analysts are closely scrutinising signals of potential policy shifts. Despite nearing the 2% inflation target, the consensus among experts, as indicated by Reuters polling, suggests that the BOE is likely to maintain a status quo on interest rates for the time being. However, a dovish tilt is emerging, with expectations leaning towards a cautious approach to rate adjustments. This sentiment reflects the BOE's desire for more concrete evidence of inflation control before contemplating any significant monetary policy changes.

In comparison to the BOE's stance, the Banque de France chief’s remarks on potential rate cuts in the Eurozone have drawn attention. Francois Villeroy's suggestion of a policy easing in June, rather than April, underscores a nuanced approach to managing inflationary pressures. The revised projections for average salaries, reflecting a downward adjustment, signal a concerted effort to navigate the delicate balance between inflation containment and economic stability.

Recent economic data from the BOE's survey paints a nuanced picture of consumer sentiment and labour market dynamics in the UK. While there has been a notable decline in the UK public's inflation expectations, reaching the lowest level since August 2021, concerns linger over the trajectory of unemployment. The recent uptick in unemployment, the first since July, suggests a cooling of the once vibrant jobs market, raising questions about the sustainability of wage growth and overall labour market health.

Further corroborating these observations, the Recruitment and Employment Confederation ("REC")/KPMG Index reflects a slowdown in wage growth and declining demand for staff, amplifying calls for policy measures to stimulate economic recovery. Reed Recruitment's data, indicating a prolonged decline in job postings for 21 consecutive months, underscores the persistent challenges facing the labour market. Despite an uptick in job applications, signalling heightened competition among jobseekers, the prevailing trend points towards a loosening labour market, potentially alleviating upward pressure on wages in the near term.

Amidst economic uncertainties, the UK housing market exhibits signs of stabilising and cautious optimism. Data from the Royal Institution of Chartered Surveyors suggests a "soft landing" following a period of price volatility. Increased buyer confidence, fuelled by decreased mortgage interest rates, has contributed to the resilience of the housing market, with agents expressing optimism regarding future sales and price trends.

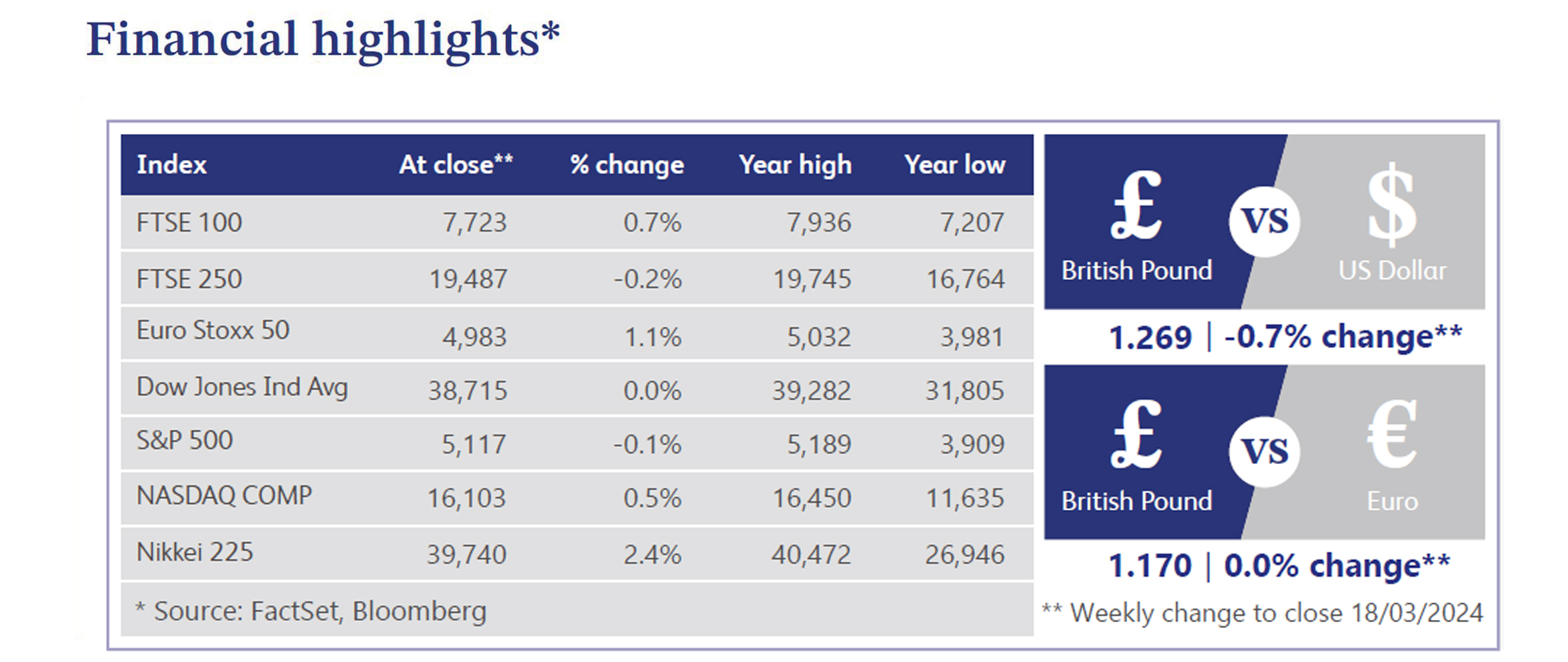

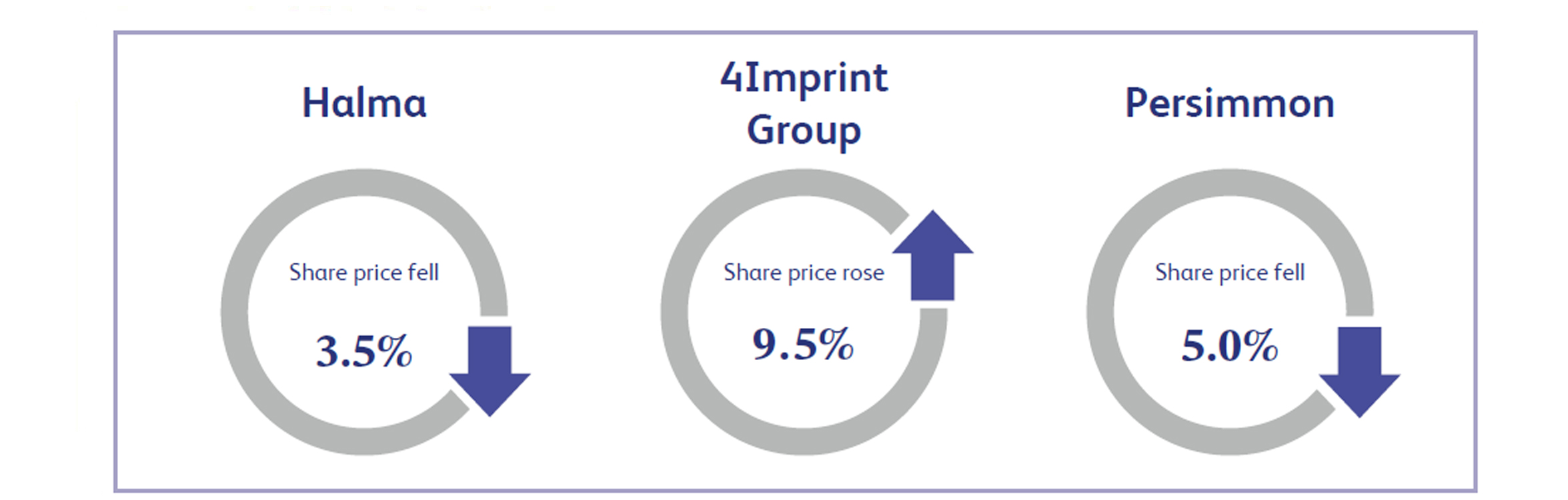

Halma, the safety equipment company, announced its latest trading update last week which saw its share price decline by approximately 3.5%. The company reported strong growth within varied market conditions, whilst continuing to make substantial strategic investments to enhance future growth prospects. The company also maintained its guidance for the full year, with adjusted profit expected to be in line with consensus expectations with a range between £376 million and £393.5 million. However, the company noted that the appreciation of sterling has continued to have a negative translation effect on results.

4Imprint Group, the direct marketer of promotional merchandise, saw its share price close the week approximately 9.5% higher as the company reported its final results. The company reported strong growth, with revenue increasing to £1.3 billion, a 16% increase when compared to last year’s figure. Profit before tax also saw strong growth, with the latest figure increasing 36% from last year to £140 million. Analysts viewed the strong set of results positively, contributing to the positive share price performance for the week.

Persimmon, the UK housebuilder, reported its final results last week which saw its share price end the week approximately 5% lower. The company reported results that were largely in line with expectations, with revenue of approximately £2.8 billion, a decline from last year’s figure of £3.8 billion. The company also noted that new home completions for the year stood at 9,922, a decline of approximately 33% in comparison to last year’s figure of 14,868. This demonstrates the challenges in the housing market at present as a result of the high interest rate environment. The company noted that market conditions are expected to continue to be challenging in 2024, putting a halt on growth and contributing to the negative sentiment for the shares.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.