14 May 2024

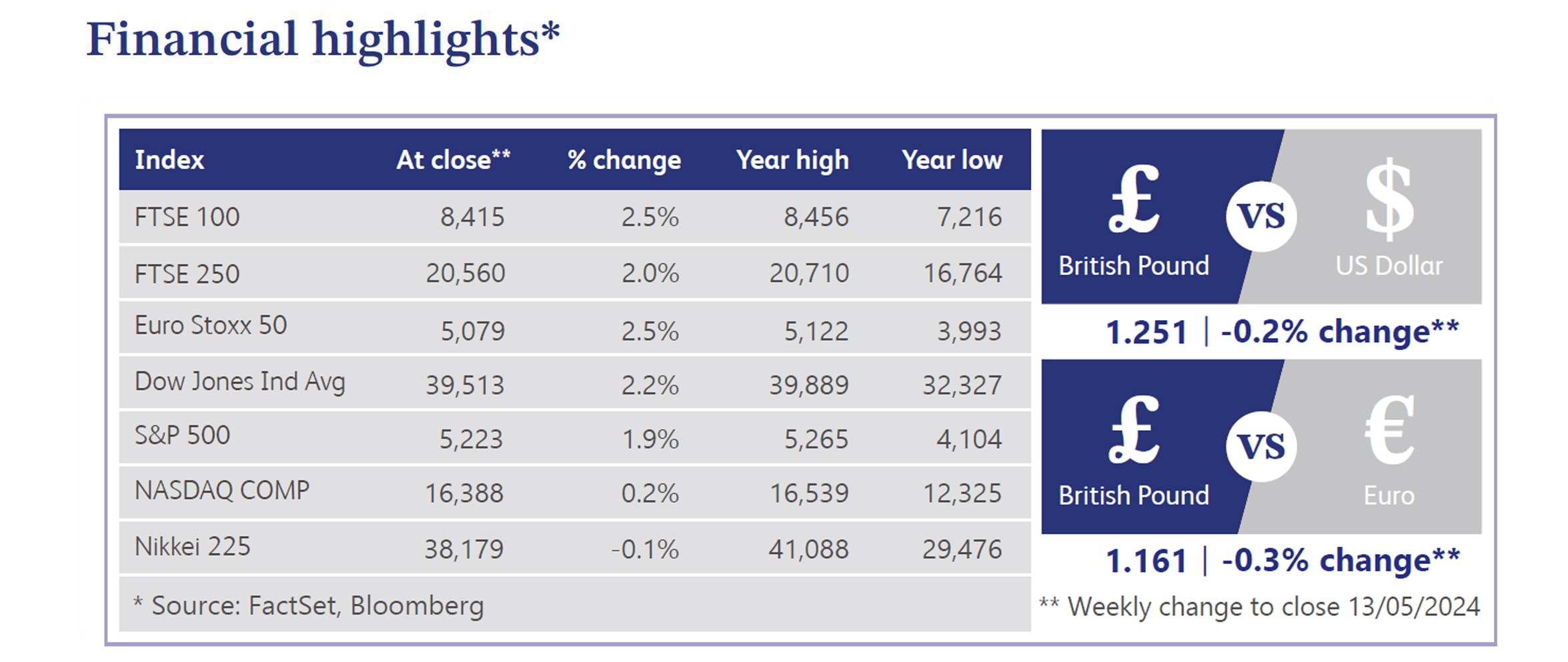

Last week, the Bank of England ("BOE") decided to maintain interest rates at 5.25%. However, two out of nine officials from the Monetary Policy Committee ("MPC") voted in favour of an interest rate cut, demonstrating a more dovish view and increasing market expectations for a rate cut in June. This shift was predominantly driven by macroeconomic forecasts indicating inflation heading back towards its 2% target shortly. The market response was relatively subdued as investors awaited incoming economic data, with two sets of inflation and labour market updates scheduled before the BOE's June interest rate decision. Notably the BOE Governor, Andrew Bailey, also hinted at the possibility of deeper interest rate cuts, highlighting the institution’s commitment to addressing economic concerns.

UK gross domestic product ("GDP") figures last week surpassed expectations, indicating a robust recovery from the recent shallow recession. The first estimate of first-quarter GDP showed an expansion of 0.6%, compared to consensus estimates of 0.4%. This follows previous declines of 0.3% and 0.1% in the third and fourth quarters of 2023 respectively. This growth has come primarily from an expansion in services and production.

Data from Calastone shows that UK investor inflows into equity funds surged in April, driven by tax-free investment opportunities. An article from Reuters also reported that the London Stock Exchange CEO, Julia Hoggett, noted London’s initial public offering pipeline is building up in anticipation of regulatory changes. It was stated that the Financial Conduct Authority is due to issue final rules in the coming weeks that combine the premium and standard listing segments to ease the red tape.

Turning across the Atlantic, US equities saw a mixed performance, with the S&P 500 and Nasdaq experiencing gains for a second consecutive week, buoyed by positive earnings reports and optimistic statements from the Federal Reserve. However, concerns over persistent inflation and stagflation fears weighed on investor sentiment. The week appeared to be largely a catalyst-free trading period with depressed trading volumes as market participants eagerly awaited next week's April consumer price index figures.

In the UK housing market, Savills' revised forecasts for UK house prices reflected growing confidence in the market, driven by more stable mortgage rates and slight improvements in economic conditions. Savills are now forecasting growth of 2.5% this year and also predicting that prices will rise by 21.6% by the end of 2028, up from its previous estimate of 17.9%. However, data from Halifax showed that house prices were little changed in April, with prices up 0.1% compared to last month versus estimates of 0.2%. The report also highlighted that the housing market is still finding its feet in the higher interest rate environment. Homebuyers were noted to be gaining confidence as activity and demand are improving, evidenced by a larger number of mortgage applications.

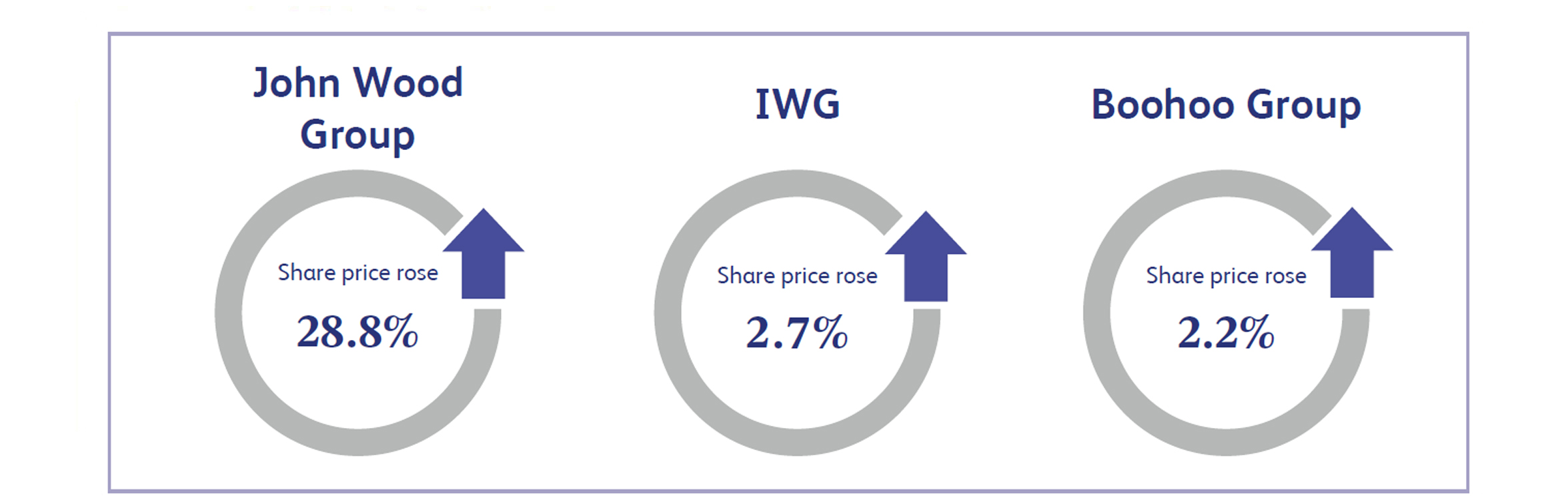

John Wood Group, the multinational engineering and consulting business, saw its share price surge by around 28.8% last week. Despite reporting a decline in revenue to approximately $1.4 billion from $1.5 billion in the same period last year, the company managed to increase its earnings before interest, tax, depreciation, and amortisation ("EBITDA") by 4%. This growth was fuelled by margin expansion across all business units, offsetting the revenue drop. However, the major share price catalyst for the week was driven by a takeover approach from Dubai firm Sidara, valuing the company at $1.78 billion - a 24% premium over the previous closing price. Despite the bid of 205 pence per share, the board unanimously rejected it during the week.

IWG, the Jersey-based workspace network, saw its share price close the week approximately 2.7% higher after its latest trading update. The company announced that group revenue for the period remained flat, coming in at £912 million compared to £911 million in the previous year. Net debt was also flat due to the one-off impact of a system change as previously guided, with net debt reduction expected to continue during 2024.

Boohoo Group, the British online fashion retailer, announced its final results for the year, resulting in the company’s shares closing the week approximately 2.2% higher. Boohoo reported revenue of £1.46 billion, falling slightly short of consensus expectations of £1.5 billion. However, EBITDA was better than expected at £58.6 million compared to an anticipated £54 million. The company also announced it remains confident in delivering a 6-8% medium-term EBITDA margin target, and it is on track to deliver annualised cost savings of £125 million by 2025.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.