21 May 2024

There is a continued expectation that the Bank of England ("BOE") will be cautious in lowering interest rates, unlike during past rate-cutting cycles. Bloomberg and Reuters reported concerns about inflation reaccelerating if rates are lowered too quickly due to past downturns such as those in 1998, 2001 and 2008. Markets are currently pricing in the first interest rate cut in August of 0.25%, followed by another potential cut in November.

A recent survey by the Chartered Institute of Personnel and Development indicates that UK employers plan to raise wages by 4% over the next 12 months, consistent with previous expectations. This suggests businesses are reluctant to take on higher labour costs despite the economic recovery. With British consumer price inflation slowing to 3.2% in March and the BOE projecting a further reduction to around 2% in April, the Resolution Foundation think-tank has suggested that the current growth in inflation-adjusted wages may not be sustainable.

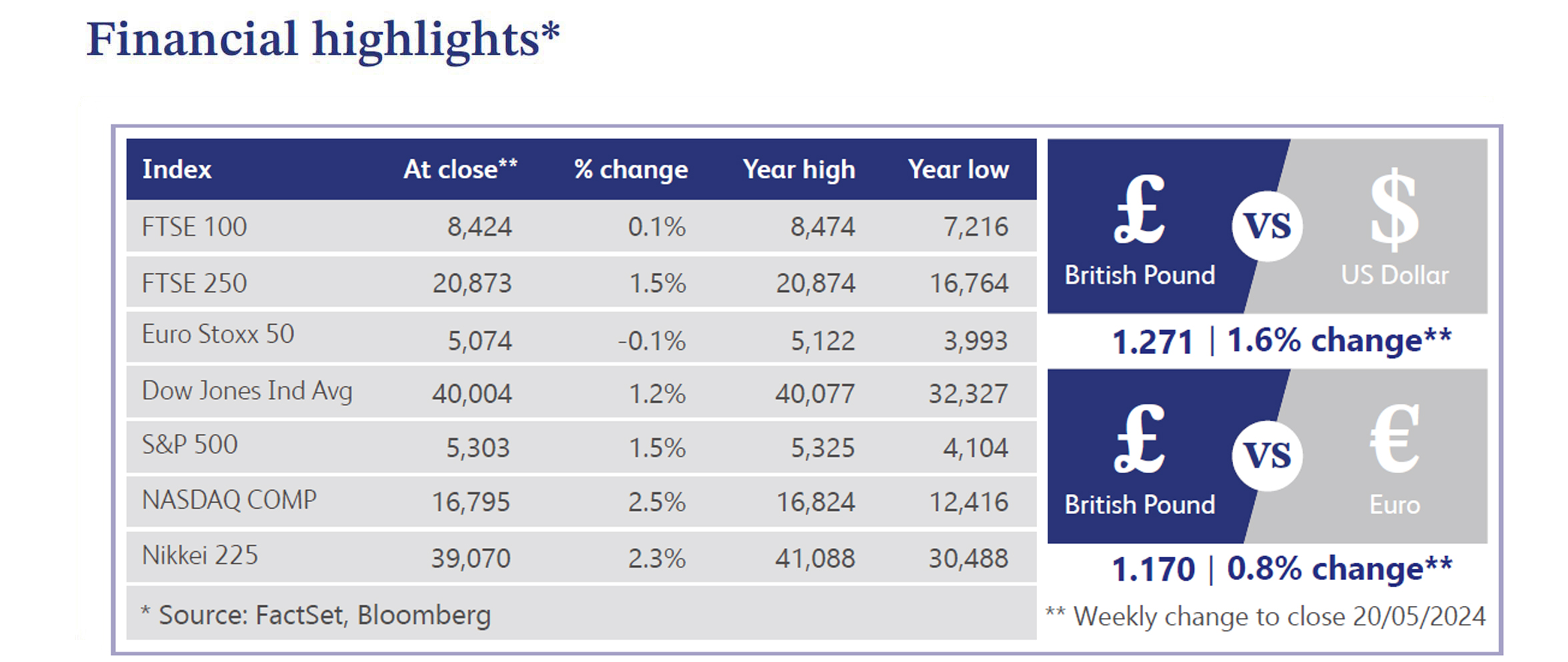

Recent sentiment towards the UK stock market has turned positive. The FTSE 100 has surged to record highs, outperforming other major indices including the Euro Stoxx 50 and the S&P 500 over the past months. Bloomberg noted the FTSE 100’s inverse relationship with sterling has been a significant driver, as currency weakness boosts the competitiveness of UK exports. Energy companies and miners, making up the majority of the FTSE 100, benefited from rising commodity prices. Additionally, there have also been a number of share buyback announcements alongside merger and acquisition developments which have contributed to the recent strong performance.

The Financial Times reported that UK takeover interest has surged to the highest level since 2018. The value of bids for London-listed companies has surged, driven by beaten-down share prices and expectations that interest rates have peaked alongside inflation being under control. London-listed companies have received more than $78 billion worth of bids this year, with the majority coming from overseas buyers. Major targets include big international companies such as Anglo American and groups like International Distributions Services, the owner of Royal Mail.

In the US, equities moderately increased during the week, with major indices logging their fourth consecutive week of gains. The Dow, S&P 500 and Nasdaq set fresh all-time closing highs, with the S&P 500 up 5.3% month to date at the end of the week, on track for its best month of the year. Memestocks also saw renewed momentum, including GameStop which closed the week 27.2% higher. Big tech was mostly higher, while outperformers included semiconductors, tech hardware, drug stores, autos, staples, retailers, biotech, asset managers, homebuilders, software and China tech. Laggards for the week included machinery, building materials, energy, food-beverage, property, casualty insurers and pockets of specialty retail.

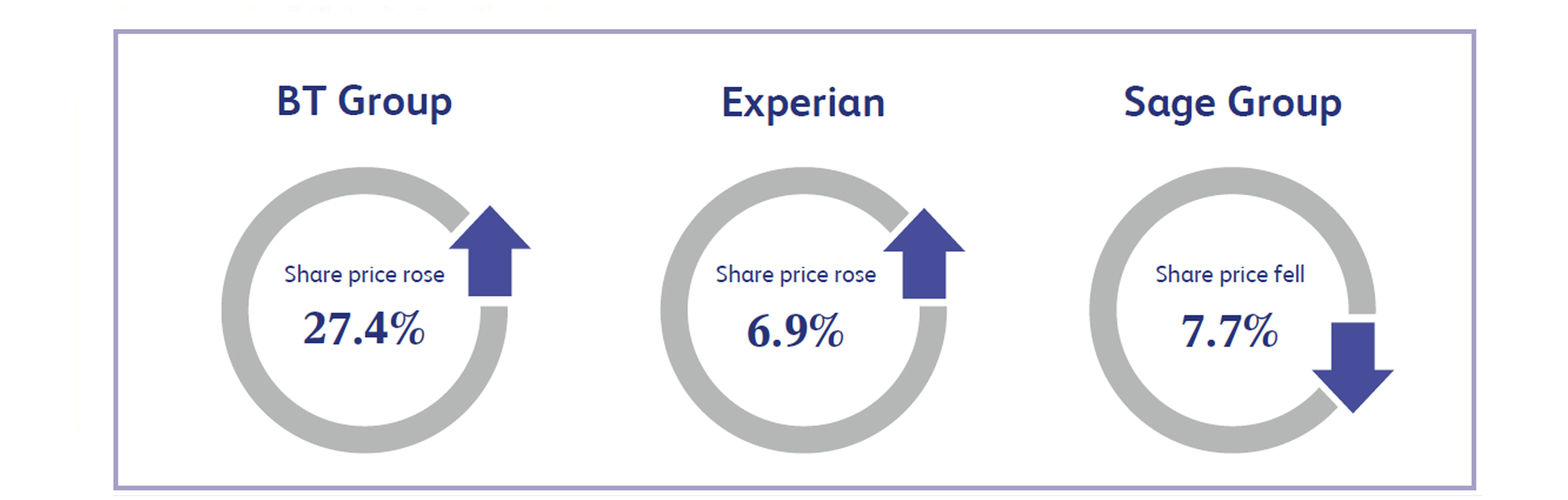

BT Group, the British multinational telecommunications company, announced its full-year results last week, which saw its share price close the week approximately 27.4% higher. The company reported revenue of £20.8 billion in 2024, a slight increase from the previous year's figure of £20.7 billion. The company also announced that its dividend for 2024 was 8 pence per share, an increase from 7.7 pence per share in the prior year. The management team also updated its guidance, for significantly increased cash flow, more cost savings and a higher dividend for shareholders alongside its fiscal 2024 earnings.

Experian, the data analytics and consumer credit reporting company, saw its share price close the week approximately 6.9% higher after the company announced its full-year results. The company announced revenue of $7.1 billion, an increase of 7.6% compared to last year’s figure of $6.6 billion. Experian also announced an increase in operating profit, to $1.7 billion, a 30.8% jump from the $1.3 billion figure in 2023. The company also announced a positive outlook, with an expectation for organic revenue growth in the range of 6-8%, alongside good margin expansion in the range of 0.3-0.5%.

Sage Group, the cloud business management solution company, saw its shares decline 7.7% last week as the company reported its first-half results. The company reported an increase in its annual recurring revenue to £2.3 billion, compared to £2.0 billion in the same period last year. Operating profit also increased to £215 million, compared to £157 million a year earlier. Despite this growth, organic revenue growth slowed in comparison to last year, leading to concerns about the future growth potential for the company in the current economic climate.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.