4 June 2024

The Bank of England's ("BOE") outgoing Deputy Governor, Ben Broadbent, defended the bank’s policy-making process against accusations of groupthink, highlighting robust discussions at meetings. While acknowledging progress on inflation, Broadbent hinted at possible rate cuts ahead of the BOE's next meeting in the coming months. Meanwhile, there has been positive news on the consumer front; the British Retail Consortium reports UK shop price inflation has returned to normal levels, with May seeing the lowest annual shop prices since late 2021. This decline, likely due to subdued consumer demand, coincides with the fastest growth in UK retail sales since December 2022, as reported by the Confederation of British Industry Distributive Trade Survey, suggesting rising consumer confidence.

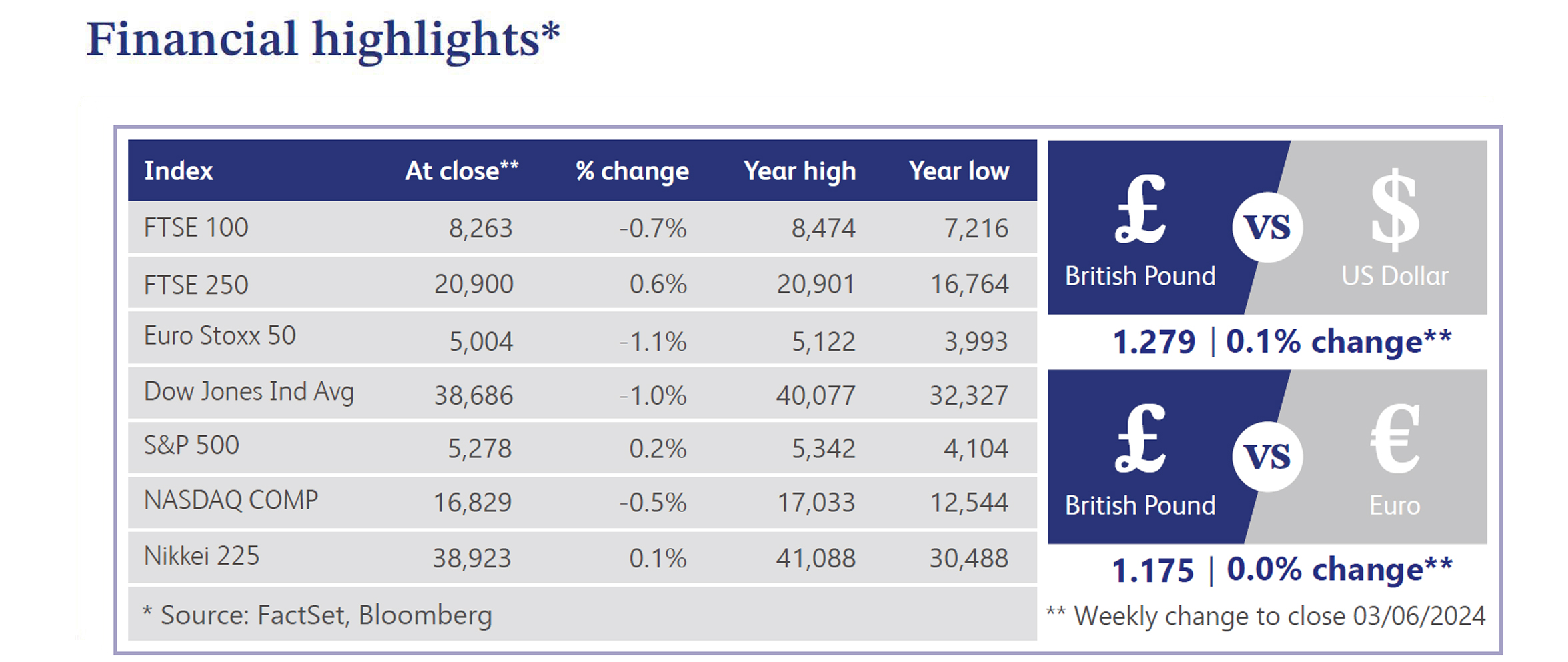

US equities closed mostly down in the week, ending a five-week winning streak for the S&P 500 and Nasdaq. The equal-weight S&P outperformed, suggesting a shift away from large-cap tech (except Nvidia, which was up 2.9%). Key themes included a flattening yield curve, mixed consumer earnings, and a heightened focus on software companies' financials. The market remains cautious, with expectations of a minimal rate cut by year-end. The Personal Consumption Expenditures (PCE) inflation report, in line with forecasts, offered dovish hints due to slightly lower personal spending. This suggests weakening consumer demand and potential pricing pressure, though overall spending remains resilient. Beyond PCE, May's consumer confidence improved, first-quarter GDP fell short, and jobless claims were steady.

A recent Bloomberg article highlighted that hedge funds and leverage investors have turned bullish on sterling, reversing previous bearish bets. This sentiment is based on expectations that the BOE will maintain higher interest rates for longer than other central banks. Consequently, sterling is nearing its strongest levels in years against the yen and euro and is set for its best month against the dollar since November.

The London Times has reported that investment trust buybacks are on track for a record high this year as London's listed funds continue to trade at significant discounts to their underlying values. The article states that investment companies spent £2.2 billion on buybacks in the first 4 months of the year, an increase of over 100% in comparison to last year. It was also noted that investment trusts make up more than a third of the FTSE 250 index. CityAM also reported that London's status as a global tech capital remains strong, retaining its top position in think tank Z/Yen's ranking. It was stated that this may ease fears that the UK is losing ground to EU locations as a global hub for start-ups.

The number of UK homes for sale reached an eight-year high in May, with average agent listings up 20% from last year. The supply of 3- and 4-bedroom houses increased significantly. Despite recent declines in mortgage rates and rising sales volumes, cautious buyers are keeping prices in check. The number of sales agreed in May rose 13% year-over-year.

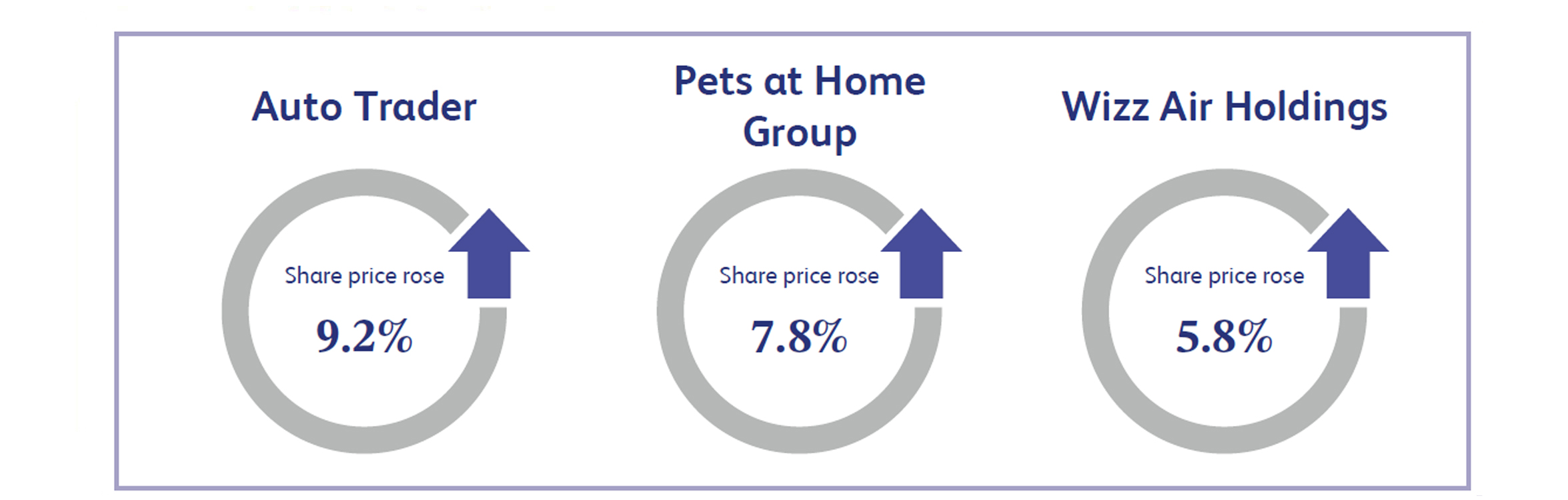

Auto Trader, a UK-based automotive marketplace, saw its share price surge by approximately 9.2% last week after the company reported its full-year results. The company announced that group revenue increased by 14% to £571 million and its operating profit increased by 25% to £349 million. Autotrader has also returned £250 million to shareholders in the latest year with £170 million in share buybacks and £80 million in dividends, an increase from last year’s figure of £225 million.

Pets at Home Group, a UK-based company engaged in the pet care business, announced its full-year results, which saw the company’s share price close the week approximately 7.8% higher. The company announced that total group revenue increased by 5.2% to £1.5 billion, with Vet Group revenue growth of 16.8%. Pets at Home also announced that they have launched their digital platform to consumers, which is viewed as an important milestone in the digitisation of their business. Their new app and website, coinciding with the completion of their new distribution centres, are expected to increase their capacity to drive further growth.

Wizz Air Holdings, a Hungarian-based airline company, saw its share price close the week approximately 5.8% higher as positive momentum continued from the company’s latest financial results. The company reported its full-year results on the 23rd of May, which showed total revenue of €5.1 billion, an approximate 31% increase when compared to last year’s figure of €3.9 billion. Wizz Air also guided net income in the range of €500 - €600 million for the full-year 2025, above median analyst estimates.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.