11 June 2024

UK inflation expectations continue to ease with the Citi/YouGov inflation tracker for May showing a decline to 3.1%, ahead of expectations and the lowest since July 2021. The Bank of England’s ("BOE") Decision Maker Panel survey indicated steady short-term inflation expectations but noted a potential stall in the disinflationary process. Encouragingly, wage growth expectations fell, which could reduce inflationary pressures. The British Chamber of Commerce revised growth forecasts upward, but anticipates inflation to remain above the BOE's target in the medium term. The British Chamber of Commerce also projects modest BOE rate cuts with the key Bank Rate being at 4.75% by the end of 2024. Meanwhile, Purchasing Managers Index data showed the services sector continues to support economic expansion, and the manufacturing sector expanded at its quickest pace in over two years.

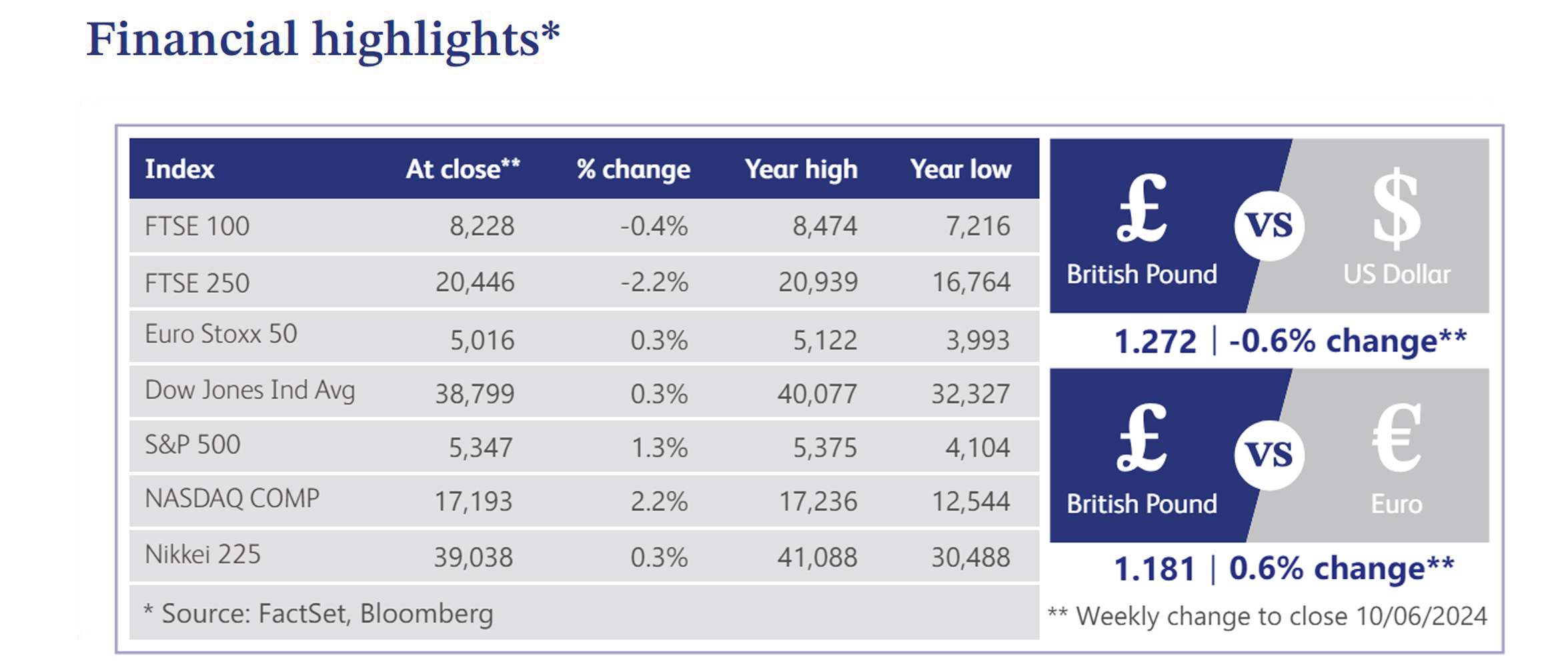

US equities were mostly higher this week, with the S&P and Nasdaq both logging gains and setting record highs. Big-tech strength was notable, particularly with Nvidia surpassing a $3 trillion market capitalisation. Meme stocks and various sectors like semiconductors and retail outperformed, while energy, industrial metals and other sectors lagged. Treasuries were stronger, especially those with longer maturity dates. The dollar strengthened slightly against the euro and sterling, while oil saw its third consecutive weekly decline. Economic data was mixed, with a strong nonfarm payroll report contrasting weaker job openings and manufacturing data. The upcoming US Federal Reserve meeting is not expected to result in a rate move and the market anticipates a potential rate cut in September.

The UK's high debt levels are expected to constrain the ambitions of the next government, with debt servicing costs running at an extra £60 billion annually. Recent initial public offerings in London have underperformed, losing significant market value, though there is optimism for future listings like Shein, the online fast fashion retailer. The Institute for Fiscal Studies issued a warning about the UK's debt, emphasising the challenges any ruling party will face in reducing the debt ratio.

House prices in the UK remained stable in May according to Halifax, with a minor monthly decline of 0.1% but a yearly increase of 1.5%. The stability in housing is supported by strong nominal wage growth and improved economic confidence. Zoopla's report of easing rental inflation, now at 6.6% which is the lowest since October 2021, suggests a shift as more renters opt to buy homes due to slightly lower mortgage rates. However, the supply of rental homes remains significantly below pre-Covid levels, indicating a tight rental market despite easing inflation. These dynamics reflect ongoing adjustments in the UK's housing and rental markets as they adapt to changing economic conditions and consumer behaviour.

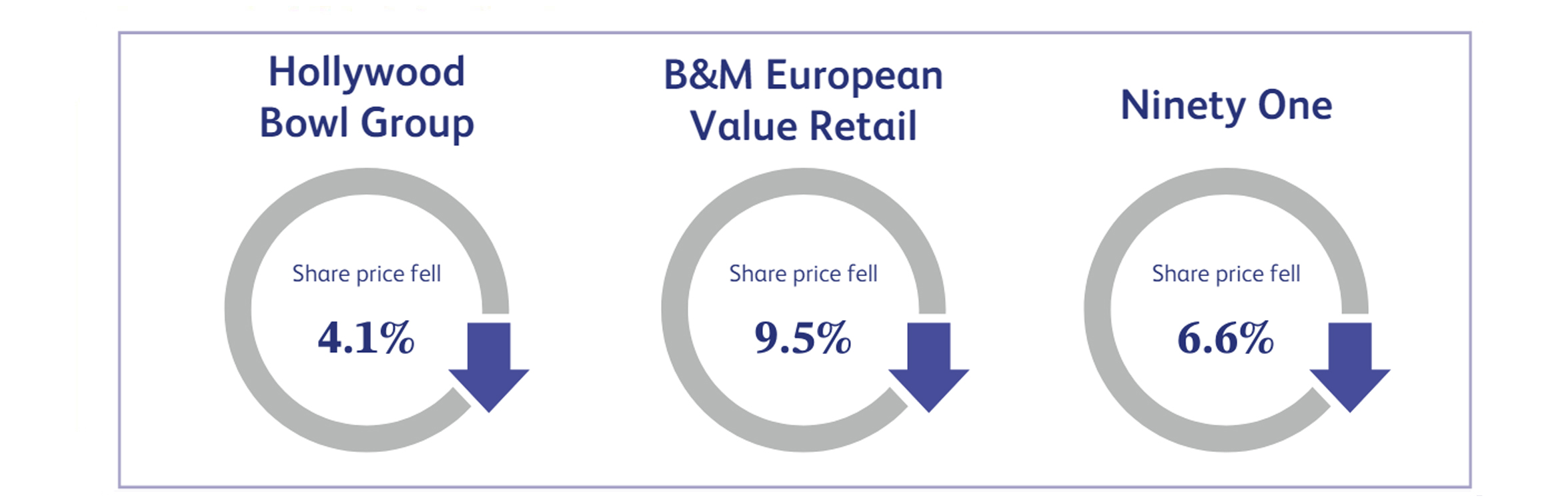

Hollywood Bowl Group, a UK-based international leisure operator of ten-pin bowling and mini-golf centres, announced its half-year results last week resulting in its share price closing the week approximately 4.1% lower. The company reported revenue of £119 million, an increase of approximately 8% compared to last year’s figure of £110 million. Hollywood Bowl Group also announced that profit after tax rose to £23 million compared to the £22 million figure reported last year. Overall, the results appeared to be reasonably positive, however they were slightly short of analyst expectations.

B&M European Value Retail, the holding company behind the B&M retail chain, saw the company’s share price decline approximately 9.5% last week after it announced its full-year results. The company reported that group revenues increased by approximately 10% to £5.5 billion in comparison to the previous year. Profit before tax was £498 million for the period compared to £436 million last year.

Ninety One, a UK-based investment manager, witnessed a share price decline of approximately 6.6% last week after the company announced its latest full year results. Ninety One reported that assets under management declined by approximately 3% to £126 billion during the period, alongside its dividend per share decreasing from 13.2 pence last year to 12.3 pence this year. Adjusted earnings per share also declined by approximately 8% to 15.9 pence, compared to 17.3 pence a year earlier.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.