18 June 2024

UK unemployment grew and wage growth stabilised last week after UK labour market data presented a mixed economic outlook. The May unemployment claimant count increased by 50,400, increasing the unemployment rate to 4.4%. Payrolled workers dropped by 3,000, and vacancies declined by 12,000 to 904,000. Despite these signs of a cooling job market, average weekly earnings remained strong at 5.9%, partly due to an April minimum wage increase. This wage growth complicates the Bank of England's ("BOE") efforts to balance economic cooling with inflation control.

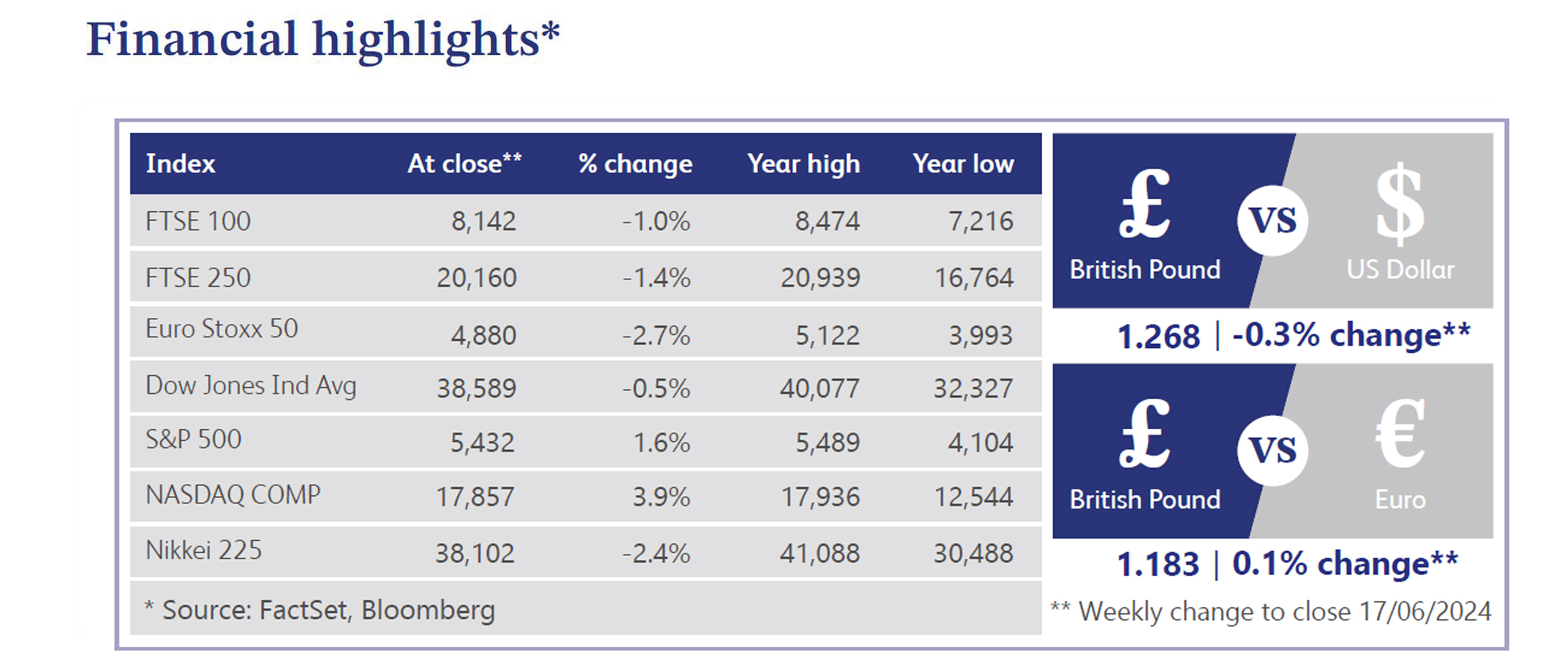

The BOE/Ipsos Inflation Attitudes Survey showed inflation expectations remain above target, though slightly reduced for the next 12 months at 2.8%. Economists warn against imminent interest rate cuts due to strong wage growth, suggesting the BOE will hold rates steady at its next meeting. A Reuters poll shows most economists expect the BOE to cut rates in August, projecting the Bank Rate to end the year at 4.75%, down from 5.25%. Meanwhile, the S&P 500 and Nasdaq ended the week higher, driven by disinflation optimism from May's consumer price inflation and producer price index reports. Enthusiasm around artificial intelligence, reduced Treasury supply fears and a rebound in the macro surprise index also contributed to the positive sentiment. However, concerns about extended positioning and market concentration persist, with big tech leading gains and cyclicals underperforming.

Cloud-based software company, Xero, released a report highlighting a decline in UK small business productivity. Yet despite weaker demand, businesses are retaining staff. UK gross domestic product data for April was flat, following a 0.4% expansion in March. The economy grew by 0.7% over the three months to April, driven by services, while production and construction saw declines. The Resolution Foundation predicts UK households will face an £800 annual tax increase post-election due to irreversible fiscal decisions.

UK house prices are expected to stagnate in 2024, with Capital Economics revising its forecast from a 2% rise to just 0.5% growth, following a survey from the Royal Institute of Chartered Surveyors indicating higher mortgage rates are reducing buyer demand. Despite a slowdown in the housing market, sales volumes are expected to improve over the next three months, with an increase in properties coming to market for six consecutive months. The London office market also experienced a slowdown, with a Deloitte survey reporting a 20% drop in new office construction and a 25% fall in refurbishments. Despite this, new office constructions remain above the 10-year average, though developers continue to delay projects until a substantial portion of schemes have been pre-let to mitigate risks.

Finally, British computer maker Raspberry Pi saw its shares soar by 40% on its London debut, providing a positive sign for the city's initial public offering market. This strong performance offers hope for London's struggling market for new stock listings, which has seen fewer technology companies in recent years.

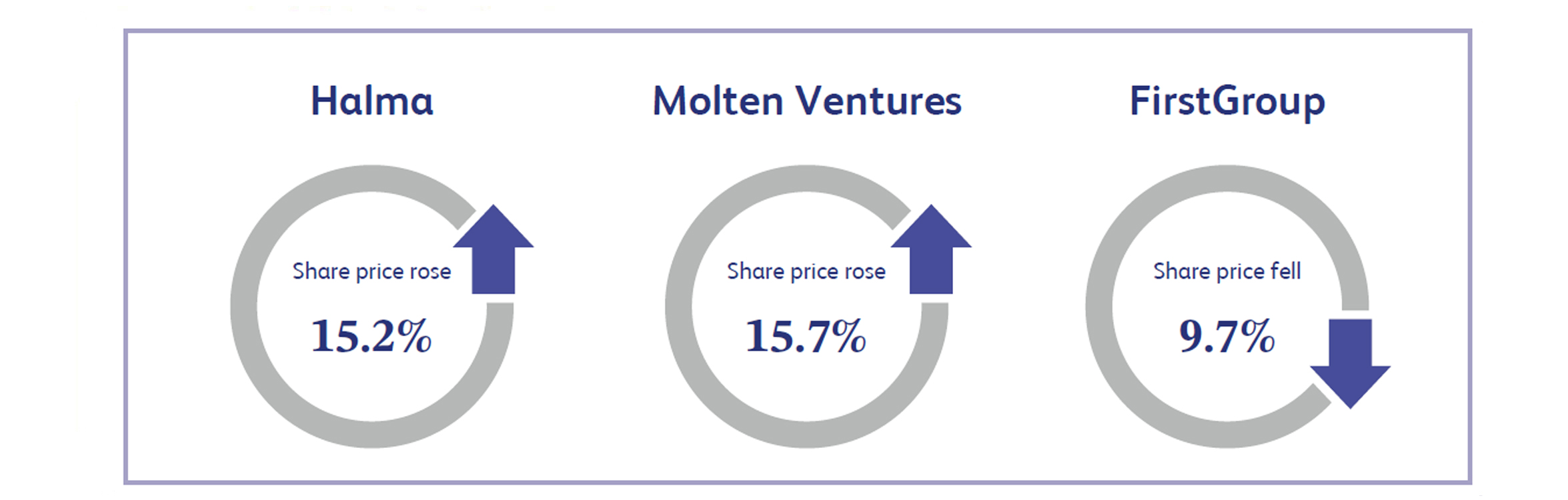

Halma, a life-saving technology company, saw its share price increase by approximately 15.2% last week after it reported its full-year results. The company reported revenue of approximately £2.3 billion, a 10% increase when compared to the previous year. Halma also announced that earnings per share increased by 15% year-on-year, to 71.23 pence per share.

Molten Ventures, a UK-based venture capital firm investing and developing disruptive, high-growth technology companies, announced its full-year results last week, which saw its shares close the week approximately 15.7% higher. The company reported a loss of £41 million for the period, which was a strong improvement from last year’s loss of £243 million. Realisations remained low for the company during the period; however, the group sees a stronger market for exits in the next year. This demonstrated a strong improvement in the business in comparison to last year, along with a more favourable outlook.

FirstGroup, the British multinational transport group, saw its share price decline by approximately 9.7% last week after its latest financial results. The company reported a loss for the year of £24.4 million, compared to a profit of £128.7 million in the previous year. This was largely due to a local government pension scheme settlement and related charges during the period totalling £146.9 million.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.