2 July 2024

Last week, the UK's economic landscape presented a nuanced view. The Office for National Statistics revised first quarter gross domestic product ("GDP") growth up to 0.7%. Growth was driven by robust expansions in services and production, despite the construction sector experiencing a decline. Despite a 0.7% positive uptick in real household disposable income, April's GDP showed no growth for the month. The June Purchasing Managers Index fell to a seven-month low, indicating a quarterly growth rate of just 0.1%, suggesting cautious economic momentum.

Meanwhile, the labour market exhibited signs of sluggishness. Job vacancies stayed stable, but the jobseeker-to-vacancy ratio increased to 1.91, pointing to an ongoing imbalance. Advertised salaries also saw a marginal decline of 0.1%, reflecting a potential easing in labour market conditions. The Resolution Foundation highlighted stagnant UK living standards attributed to weak productivity growth since the Global Financial Crisis, resulting in minimal wage increases since 2010. This trend has narrowed the pay gap between middle-class and lower-earning households to its lowest on record, spurred in part by a significant 9.8% increase in the National Living Wage in April.

UK business confidence showed a notable decline from an eight-year high, with the Lloyds business barometer falling to 41% in June. Although this remains above the long-term average of 28%, the drop signals tempered expectations about business prospects and economic conditions. Fewer firms anticipated issuing pay rises above 5%, indicating cautious optimism amidst economic uncertainties. Hiring intentions also weakened, highlighting potential challenges in labour market dynamics despite earlier signs of wage growth.

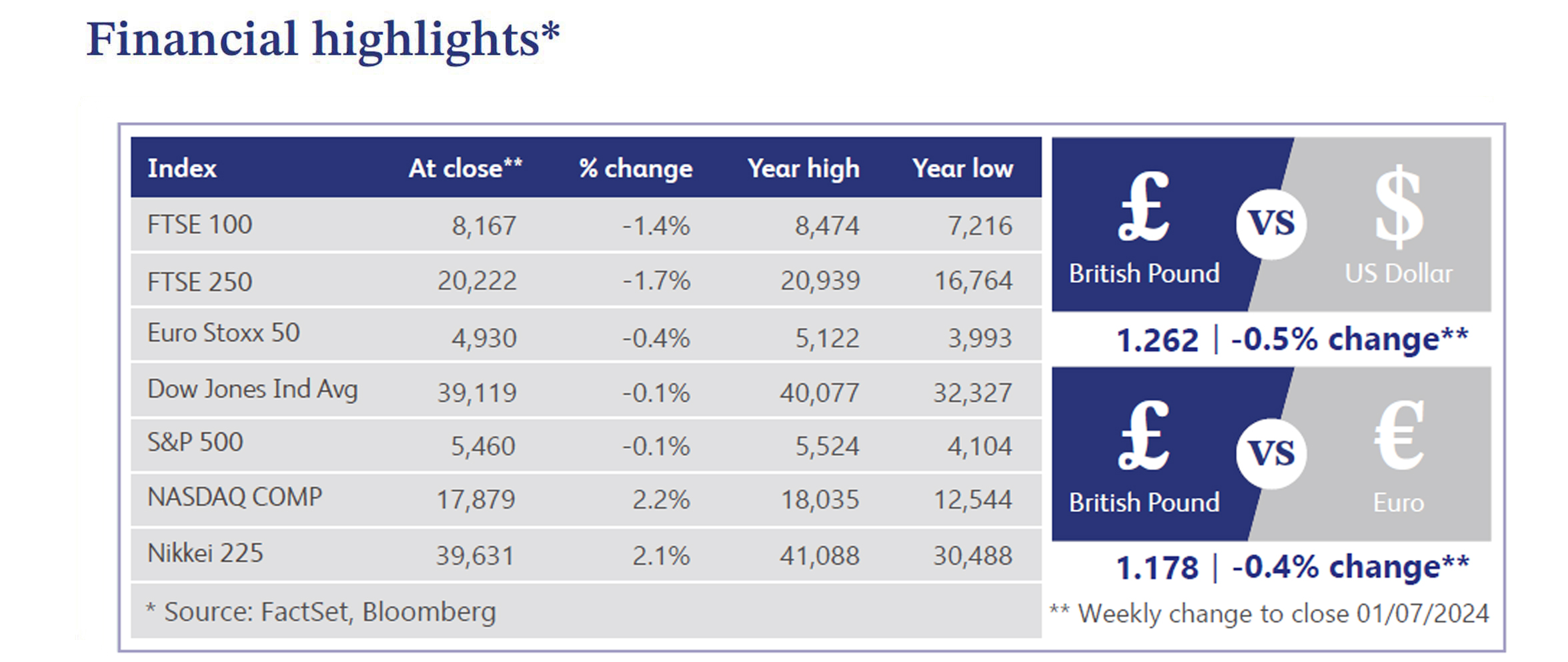

In global markets, US equities witnessed a mixed performance. Technology stocks and the Russell 2000 index outperformed, contrasting with struggles seen in sectors such as utilities and medical devices. Treasuries weakened, the dollar held steady and crude oil saw a third weekly gain. Key events included disappointing corporate updates, the Trump-Biden debate, and the May inflation figures. The US Federal Reserve’s stress test indicated sufficient bank capital and remarks highlighted ongoing inflation concerns. Positives included signs of disinflation and artificial intelligence ("AI") momentum, while negatives involved concerns over consumer resilience and the risk of strong pullbacks if elevated AI expectations aren't met by company performance.

Furthermore, first-time homebuyers in the UK have faced a daunting 60% increase in mortgage payments since the last election, rising from £667 to £1,075 per month due to elevated interest rates. This surge outpaced wage growth, which grew by 27% over the same period. However, there were anticipations that mortgage rates could ease following adjustments by Barclays, who reduced rates on various mortgage products in response to declining swap rates. Nonetheless, the Bank of England's Financial Policy Committee warned of potential financial strains ahead, projecting significant mortgage payment hikes for millions of households over the next two years amidst prevailing economic uncertainties.

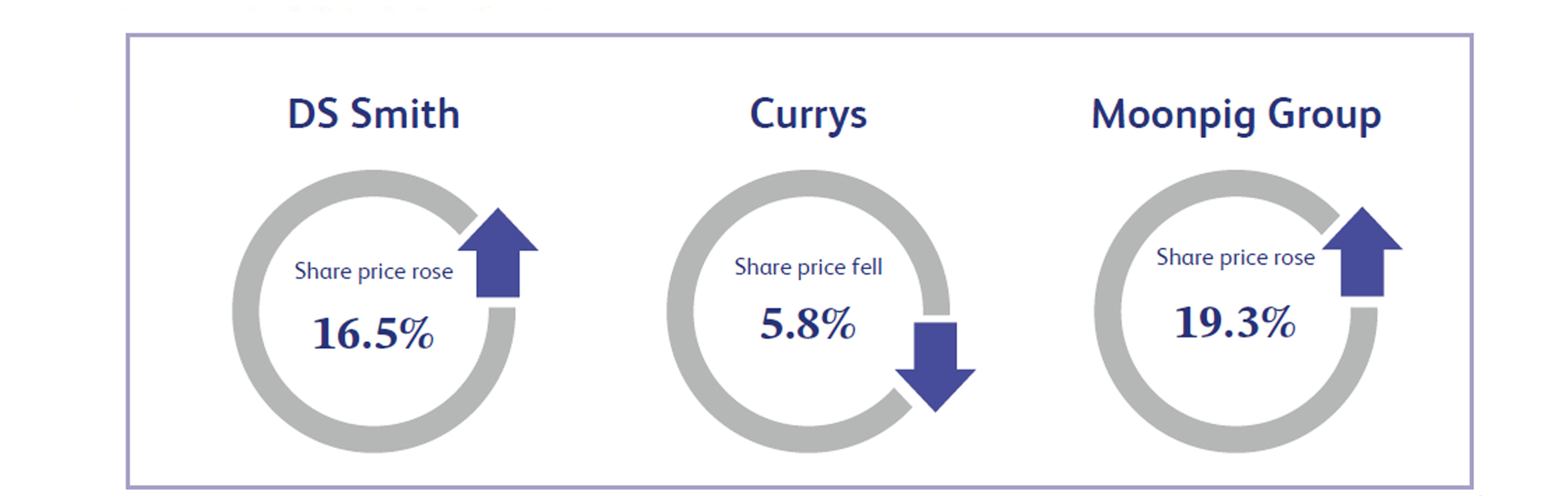

DS Smith, a UK-based provider of sustainable fibre-based packaging across Europe and North America, saw its share price surge approximately 16.5% last week. The company’s shares rose after it was announced that Brazilian pulp maker, Suzano, had ended talks to buy International Paper. It was announced that this deal would have been conditional on International Paper abandoning its bid to purchase DS Smith. Therefore, it now looks more likely that the deal between International Paper and DS Smith will occur.

Currys, the British electrical retailer, saw a share price decline of 5.8% last week as it reported its latest full-year earnings. The company reported earnings per share of 7.9 pence, below consensus estimates of 8.3 pence. Profit before tax was reported at £118 million, slightly above consensus estimates of £117.6 million. Analysts generally viewed the results as broadly in line with their expectations; however, the share price reaction appears to be driven by management’s expectations, which are viewed as very conservative.

Moonpig Group, a UK-based online greeting cards and gifting platform, saw its shares rise by 19.3% last week following the release of its latest full-year results. The company reported a 6.6% increase in revenue, reaching approximately £341 million compared to last year's £320 million. Additionally, basic earnings per share rose by 28.2% to 10 pence from 7.8 pence. Management emphasised that the business is well-positioned for sustained growth in revenue, profit, and free cash flow, driven by its focus on data and technology.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.