23 July 2024

On Friday, a global IT outage linked to issues with a CrowdStrike cybersecurity update affecting Microsoft software disrupted businesses and services worldwide. In the UK, train companies, major airlines, airports and GP surgeries experienced significant disruptions, with Edinburgh and Birmingham airports particularly affected. Financial sectors were hit as major oil and gas trading desks in London and Singapore faced outages, and the London Stock Exchange Group's Workspace platform experienced service interruptions. Even media outlets were impacted, with Sky News temporarily going “off-air.”

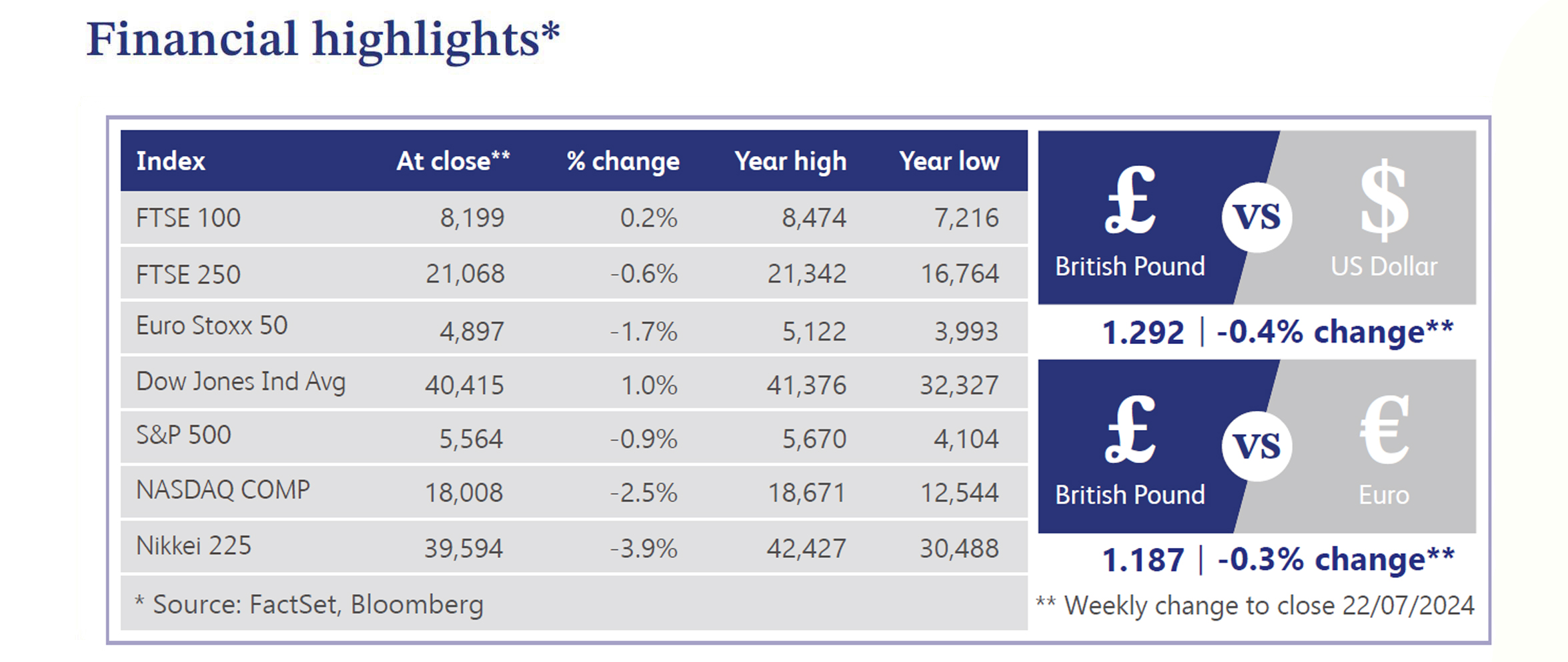

Meanwhile, UK grocery inflation dropped to its lowest level in three years to stand at 1.6%, aiding sales of branded products. Despite overall inflation aligning with the Bank of England's (“BoE”) target of 2%, elevated service prices persisted. This influenced BoE rate cut expectations, with chances of an August rate cut decreasing after firmer inflation data.

Economists revised their growth forecasts for the UK following better-than-expected gross domestic product (“GDP”) data, with the economy expanding by 0.4% in May. Goldman Sachs, Capital Economics and Deutsche Bank now predict growth of around 0.7% for the second quarter, matching first quarter performance. The International Monetary Fund (“IMF”) forecasts the UK to be the fastest-growing major European economy in the next year, with GDP growth projected at 0.7% this year and 1.5% in 2025.

Official UK labour market data indicates an easing, with the claimant count rising and vacancies continuing to drop. Despite this, the British Chamber of Commerce reported ongoing skills shortages. Retail sales in June missed expectations, declining 1.5% month-on-month, versus an expected decline of 0.5% and growth of 2.9% in May.

US equity indices had mixed performance this week, with a shift from big tech, growth and momentum stocks into value, cyclicals and small-caps. The S&P 500 had its worst week since mid-April, while the Nasdaq saw significant losses due to tech weakness, particularly NVIDIA. Elsewhere, treasuries weakened, the dollar rose and gold and oil prices declined. Economic data showed flat June retail sales, an uptick in jobless claims and mixed manufacturing results. US Federal Reserve (“Fed”) commentary indicated confidence in inflation control without clear signals for future rate cuts. Political developments included President Biden's withdrawal from the election race and Donald Trump’s acceptance of the Republican nomination, with plans for corporate tax cuts and increased energy production.

The UK housing market is experiencing strong demand, with sales up 15% from last year as buyers anticipate BoE rate cuts and post-election political stability. Despite sellers reducing asking prices by 0.4% in July, market resilience remains. However, construction growth is threatened by a worker shortage, impacting Labour's growth plans and delaying increased housing supply.

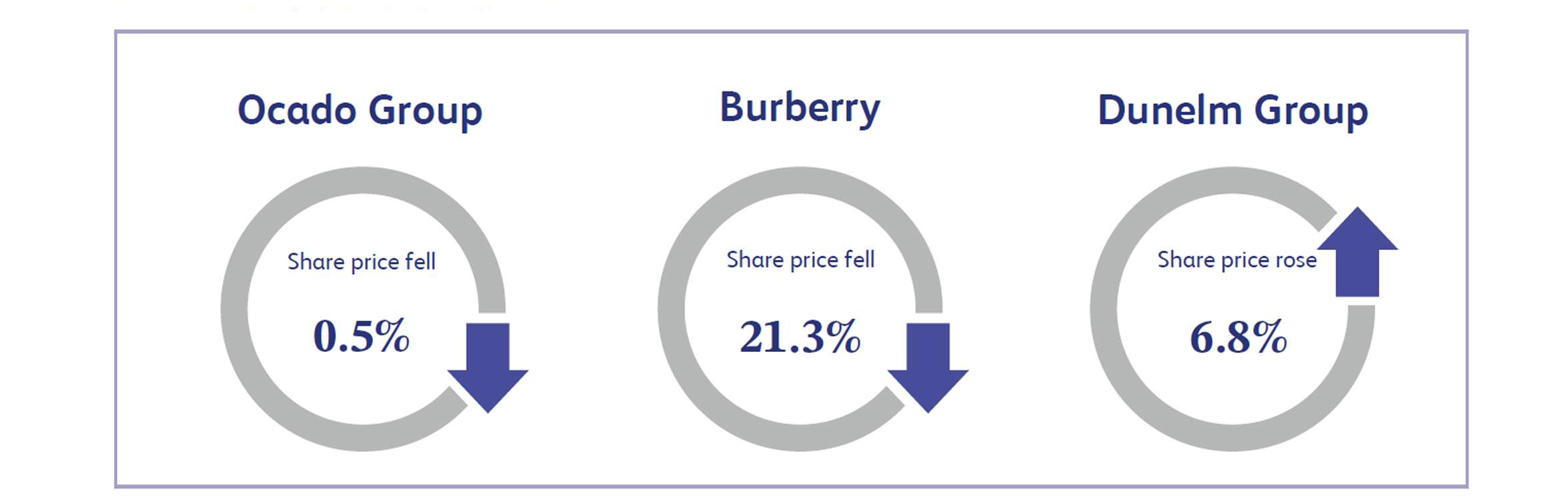

Ocado Group, the online grocery technology business, announced its first half results last week which saw the company’s share price end the week relatively flat, declining 0.5%. Despite negative sentiment at the start of the week following a downgrade from Bernstein and a delayed technology rollout with one of its customers, the share price recovered by week's end. The company reported positive results including a group adjusted earnings before interest, tax, depreciation and amortisation (“EBITDA”) of £71.2 million, up 329% from £16.6 million the previous year. Management also improved their cash flow guidance, aiming for positive cash flow by 2026, which was viewed positively by investors.

Burberry, the British luxury fashion brand, announced its latest quarterly results last week, resulting in a share price decline of approximately 21.3%. The company reported first quarter retail revenue of £458 million, a decline of around 22% compared to last year’s £589 million. Burberry attributed this weakness to a significant reduction in consumer spending in China. The company warned that if this trend continues, it expects to report a loss for the first half of the year. This profit warning, coupled with the suspension of its dividend, was the main driver behind the negative share price movement for the week.

Dunelm Group, the UK homewares retailer, saw its share price increase by approximately 6.8% last week after reporting its full year results. The company announced that profit before tax is now expected to be slightly ahead of market expectations, with a gross margin projected to be 1.7% higher than the previous year. This improvement was largely driven by lower year-on-year freight rates and strong margins during the summer sales period, with both full price and discounted margins outperforming the previous year. This positive performance in a challenging consumer environment was well received by the market, boosting the share price.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.