20 August 2024

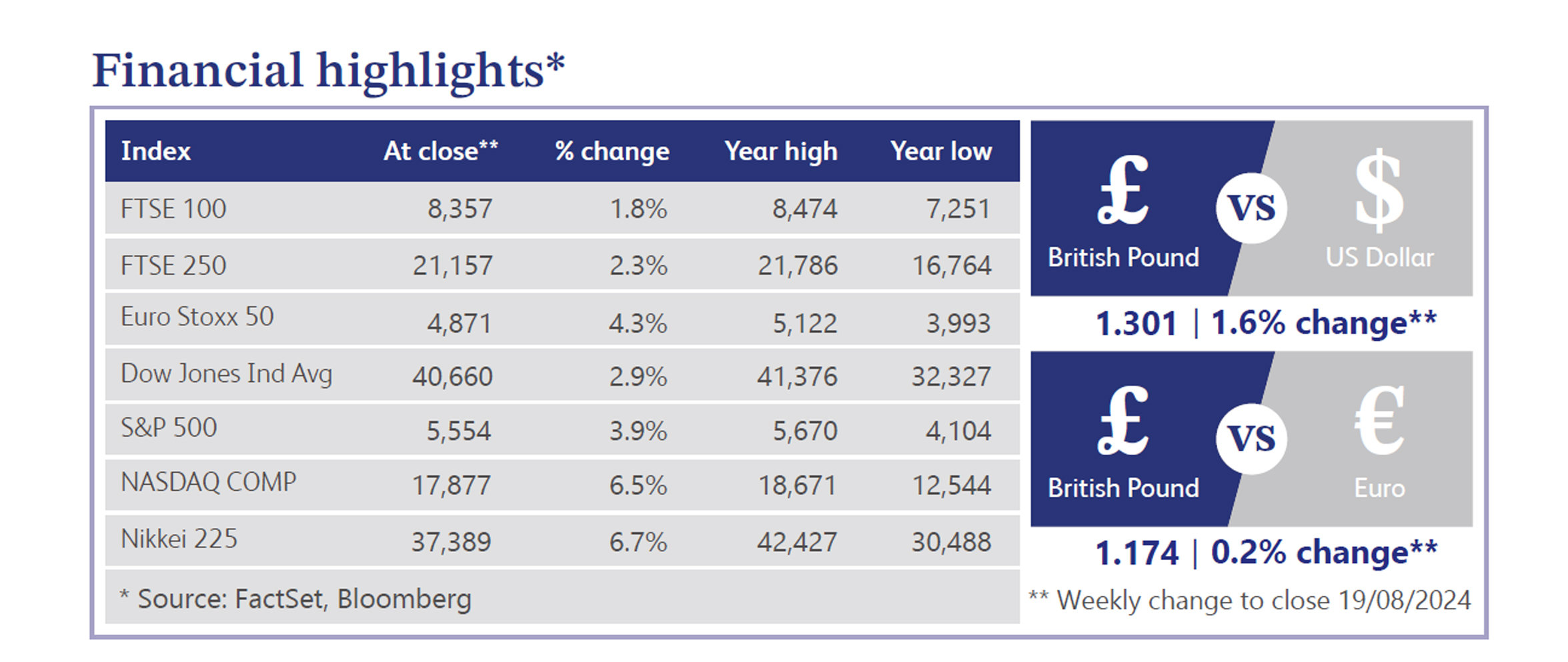

The UK economic landscape is currently marked by mixed signals, particularly regarding inflation and labour market dynamics. The Bank of England's (“BoE”) more hawkish member, Catherine Mann, remains sceptical about the disinflation process, highlighting persistent wage pressures that could take years to subside. Despite recent inflation data showing a slight dip, with July's rate coming in at 2.2%, lower than expected, and a softening in services prices, Mann's concerns echo broader caution within the BoE. Market expectations have echoed the recent cooling of wage growth and inflation, which now fully price in two BoE rate cuts by year-end, although the timing of these cuts remains debated.

The UK economy continues to expand modestly, with second quarter gross domestic product growth at 0.6%, but signs of stagnation emerged in June, raising concerns about the strength of the recovery. The labour market shows resilience, with a drop in the unemployment rate to 4.2%, though a significant rise in the benefit claimant count adds uncertainty. Additionally, grocery price inflation has risen for the first time since March 2023, signalling ongoing consumer price pressures. While the BoE may be moving closer to further rate cuts, the overall economic outlook remains uncertain, influenced by inflation, consumer behaviour and the broader global economic environment.

Sterling is holding steady, with Barclays strategists optimistic about its strength against the euro due to solid UK economic growth and potential closer European Union ties under a Labour government. Meanwhile, a Bank of America survey shows the UK stock market as the most preferred among European peers, with a significant increase in investor interest.

UK Chancellor Rachel Reeves is exerting pressure on financial services regulators to enhance the growth and competitiveness of the City of London, advocating for a review of regulatory rules to eliminate unnecessary duplication. Despite the UK’s strong economic performance, with the fastest growth among G7 nations in recent quarters, Reeves has warned that tax hikes are still on the horizon, citing a £22 billion deficit in public finances. She emphasised that tough decisions are necessary to rebuild the economy’s foundations, and these measures will be addressed in her upcoming fiscal statement on October 30.

US equities rallied this week, with the S&P 500 and Nasdaq breaking their four-week losing streak, driven by optimism around a soft landing. Big tech stocks, notably Nvidia and Tesla, led the gains. Positive economic data, including strong retail sales and rising consumer sentiment, reinforced hopes of stable growth without a severe downturn. Although concerns over sticky inflation, rising loan delinquencies, and high valuations persist, the expectations for Federal Reserve (“Fed”) rate cuts have slightly increased.

London's housing market continued its recovery, with house prices rising 0.6% in June, marking the first annual increase in over a year, driven by improved confidence from lower mortgage rates.

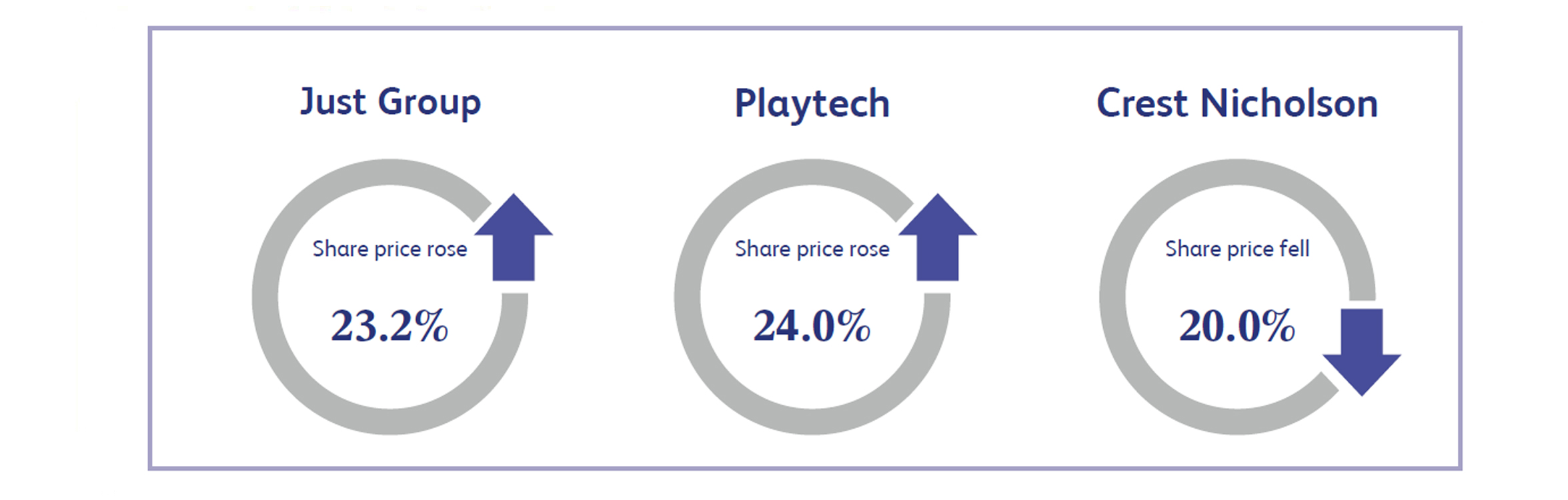

Just Group, a retirement products specialist company, saw its share price jump 23.2% last week, driven by strong growth in its bulk annuities and retail annuity businesses. The company raised its guidance due to increased cash flow from existing policies and better-than-expected margins. Although profits for the first half of 2024 fell from £82 million to £54 million and earnings per share decreased, its insurance revenue rose to £859 million. The increase in new business, up 30%, and improved dividend payments support a positive outlook, despite the stock still being below its 2013 flotation price.

Playtech is a technology company delivering business intelligence driven technology to the gambling and financial trading industries. Playtech's share price rose 24% last week following news of discussions with Flutter Entertainment regarding the potential sale of its Italian business, Snaitech, for up to £2 billion ($2.57 billion). Playtech confirmed the talks and granted Flutter an exclusive period for due diligence, boosting investor optimism. Snaitech, a leading player in the Italian gambling market, showed strong performance with a 5% revenue increase in fiscal year 2023, further enhancing its appeal. While no final deal or specific terms have been confirmed, the potential high valuation and strategic interest from Flutter have driven Playtech's share price higher.

Crest Nicholson, a real estate company, saw its share price drop nearly 20% after Bellway withdrew its £720 million takeover bid, leading to significant investor disappointment. The end of the acquisition talks erased previous gains and cast uncertainty over Crest's prospects. Analysts predict continued underperformance and potential guidance cuts as the new Chief Executive Officer takes over. Despite favourable conditions like expected interest rate cuts and government plans to ease planning restrictions, the failed bid has shaken investor confidence. Although there is a chance of a future offer from Avant Homes, no new proposals have emerged, leaving Crest Nicholson's outlook uncertain.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.