10 September 2024

Recent data from Reed Recruitment shows UK wage growth is no longer declining and is now stabilising, which may pose a challenge to the Bank of England (“BoE”) and Prime Minister Keir Starmer. As sectors like construction and hospitality face skill shortages, rising wages could force a rethink on easing policies. Despite this, analysts remain optimistic about the economic outlook, citing strong balance sheets, a rebound in business investment and stabilising inflation. A BoE survey also indicated that companies expect price increases to slow, even as wage growth holds steady at 4.1%, which has been unchanged since July. Business uncertainty has decreased post-election, and investors are anticipating a potential BoE interest rate cut in November, though further cuts may not come soon.

Chancellor Rachel Reeves is under pressure as she prepares for the Autumn Budget, where tax hikes are expected to address a £22 billion fiscal deficit. Critics argue that Labour should have anticipated these challenges before the election. Reeves plans to close the gap through benefit cuts and program reviews, with analysts predicting that the Budget could generate an additional £10-15 billion in revenue. However, there is growing concern among UK venture capitalists and entrepreneurs that these measures could negatively impact the technology sector.

The UK saw strong demand in its latest bond sale, with over £100 billion in orders for a new gilt. This marks a significant test of investor confidence following Labour's landslide election win. The bond, maturing in 2040, is expected to raise £6 billion, signalling robust demand and confidence in the new government's ability to navigate fiscal challenges.

August saw a boost in UK retail sales, driven by warm weather that spurred purchases of summer clothing and barbecue essentials. Retail sales rose by 1%, exceeding the three-month average. This positive trend in consumer spending could support the UK's economic outlook in the latter half of the year. However, UK investors showed caution, pulling back from equities and moving funds into money market instruments amid market turbulence, indicating a more cautious investment climate.

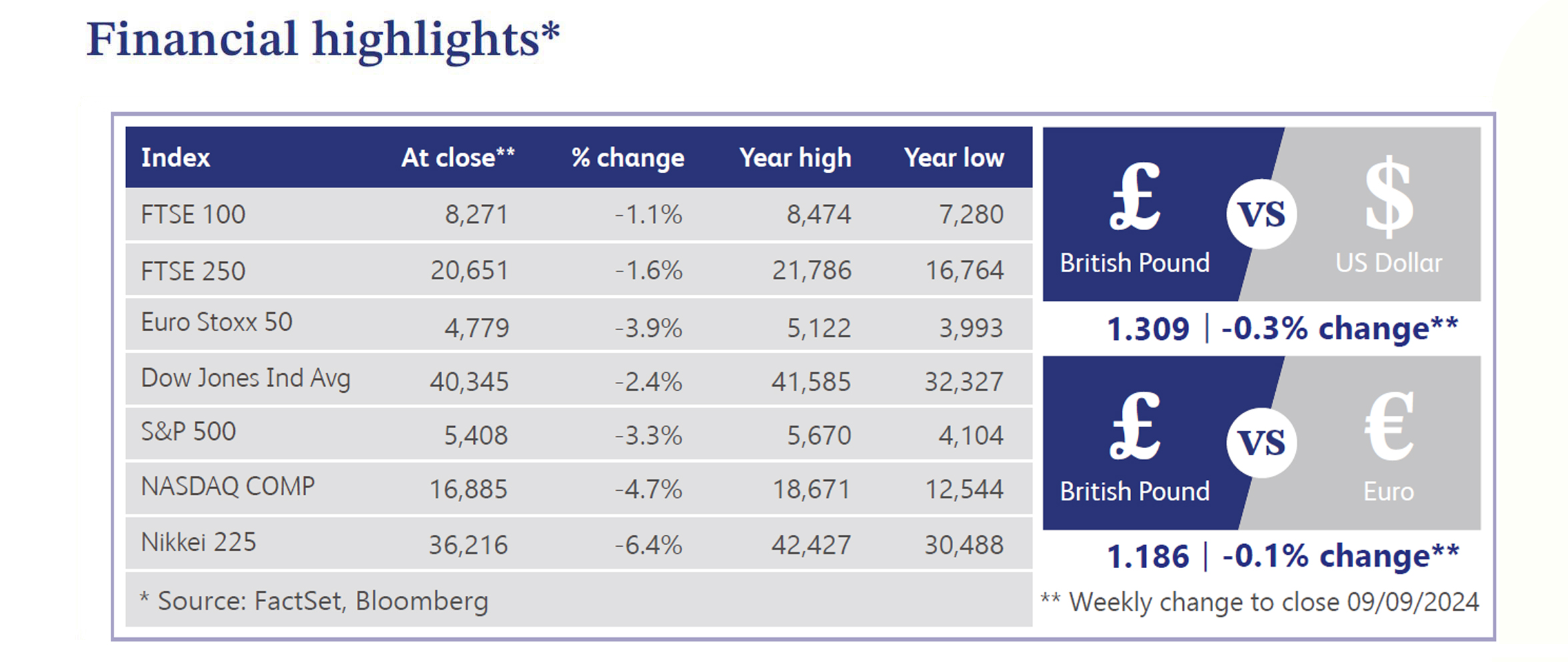

US equities had a tough week, with the S&P 500 and Nasdaq posting their worst weekly performances since earlier in the year. Small caps also struggled, and big tech saw notable declines, particularly with bellwether stock Nvidia down 13.9%. Treasury yields rallied, with a notable fall across the curve, signalling market uncertainty. Key economic data, including softer-than-expected payroll numbers and declining job openings, raised concerns about growth. Despite this, some Federal Reserve officials hinted at potential rate cuts, though the path forward remains uncertain.

Growth in the UK construction sector slowed in August, even as housing activity reached its highest level in nearly two years. The S&P Global UK Construction Purchasing Managers Index dropped, missing expectations, as uncertainty over infrastructure projects weighed on civil engineering. While the sector is performing better than earlier in the year, supported by a BoE rate cut and the Labour government's housing initiatives, challenges remain.

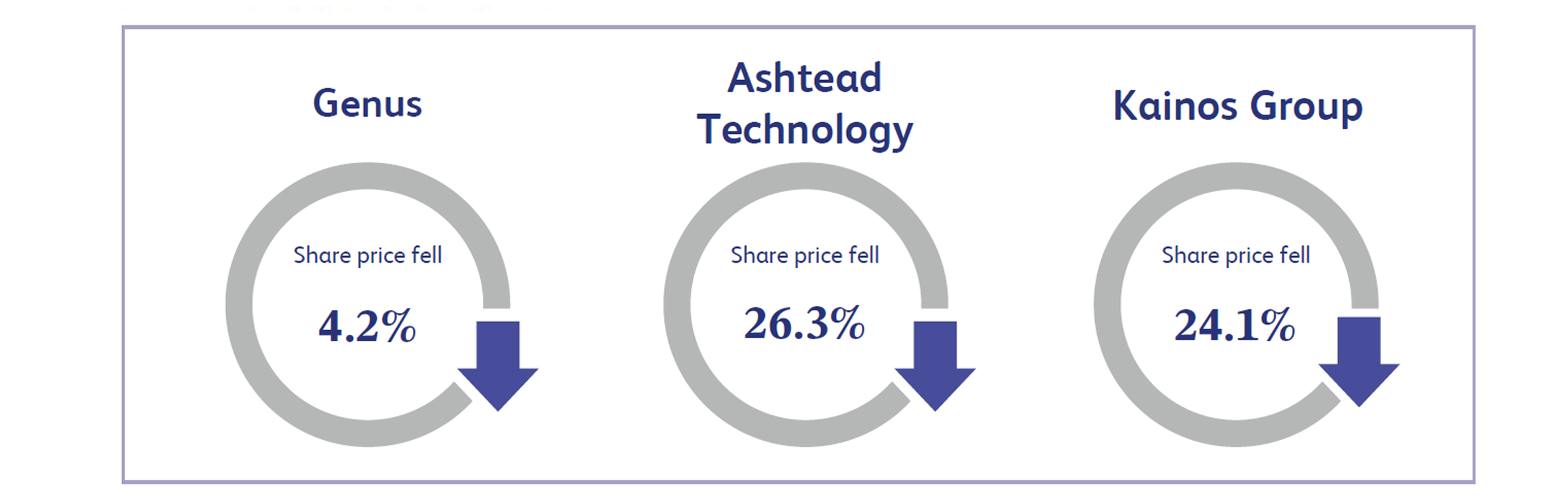

Genus, the UK-based animal genetics company, saw its share price drop by around 4.2% this week following the release of its 2024 preliminary results. The company reported revenues of £668.8 million, slightly below market expectations of £671.3 million. Basic earnings per share declined by 23% to 65.5 pence, compared to 84.8 pence the previous year, primarily due to challenging market conditions in China. Despite these challenges, management indicated that market conditions are stabilising and gradually improving, though they remain cautious. Looking ahead, the company expects strong growth in the next financial year on a constant currency basis.

Ashtead Technology, a provider of subsea equipment rental and solutions for the global offshore energy sector, experienced a significant share price decline of approximately 26.3% last week following the release of its half-year results. The company reported strong revenue growth of £80.5 million, up 61.4% from £49.8 million in the previous year. However, the gross profit margin fell to 75.8%, down from 78.8% in the same period last year. Despite management highlighting record trading performance, investor sentiment turned negative due to concerns over the UK’s fiscal challenges and their potential impact on the oil and gas sector.

Kainos Group, a UK-based information technology provider, saw its share price fall by approximately 24.1% last week following the release of its latest trading statement. The company indicated that a tougher trading environment in its services division has led management to expect profit before tax to be in line with market expectations, but with only a modest increase in overall revenues, which will fall below forecasts. This challenging outlook and lowered revenue expectations were met with a negative reaction from investors.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.