29 October 2024

The UK economy saw mixed signals last week, highlighted by an upgraded International Monetary Fund (“IMF”) growth forecast to 1.1% for 2024, boosting Chancellor Reeves ahead of the upcoming budget. However, October’s Purchasing Managers Index (“PMI”) revealed a slowdown in private sector growth, with hiring contracting for the first time in 2024. Business sentiment also fell sharply, with the Confederation of British Industry’s (“CBI”) report marking the steepest decline in two years amid budget uncertainties. Meanwhile, wage growth stagnated, and UK consumers grew more pessimistic, as indicated by a decline in the Growth from Knowledge’s consumer confidence index. Despite the positive IMF outlook, the broader economic environment remains cautious, with concerns about growth momentum and budgetary impacts shaping market sentiment.

Last week, the UK political landscape was dominated by budget preparations as Chancellor Reeves readied plans for tax reforms and increased borrowing. A joint study by the US Tax Foundation and the UK’s Centre for Policy Studies warned that a capital gains tax increase could make the UK one of the least competitive countries in the Organisation for Economic Co-operation and Development (“OECD”). Concerns over capital gains tax hikes and reversed stamp duty breaks have led to business liquidations and fears of a landlord exodus. September borrowing surged to £16.6 billion, exceeding forecasts and adding pressure on Reeves to balance fiscal prudence with spending needs. Despite this, bond investors indicated a willingness to lend up to £80 billion if clear spending plans were provided, avoiding market panic. Reeves' plans could include raising taxes on online retailers to support high-street shops. Despite internal tensions, Reeves has secured agreements on spending allocations with cabinet ministers.

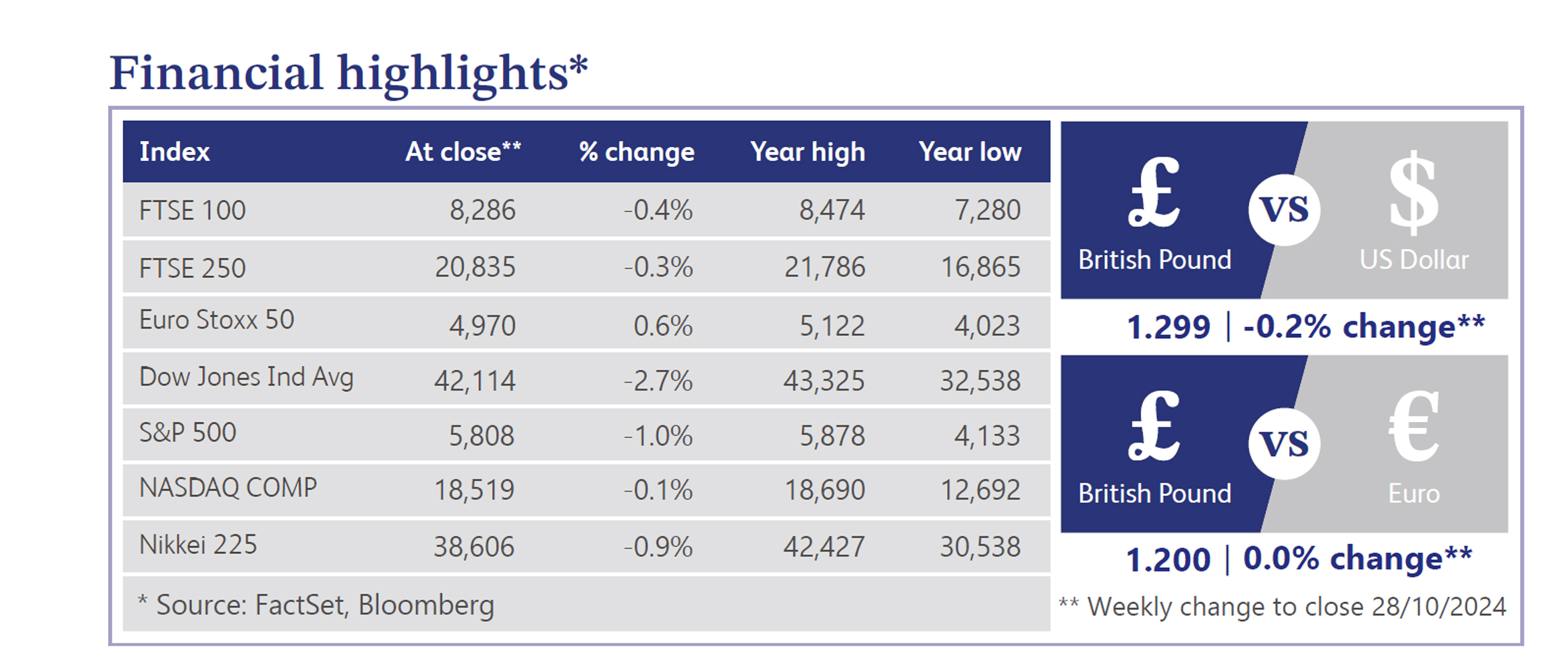

UK markets saw significant pressure on bonds and currency. Investors sold off UK Gilts, fearing increased borrowing under Chancellor Reeves' budget, causing the risk premium to reach its highest level in over a year. As a result, UK government bond yields rose sharply, reflecting expectations of heightened debt issuance. Meanwhile, in the foreign exchange market, hedge funds and money managers were selling the pound in anticipation of further sterling weakness. These moves highlighted the market's cautious stance ahead of potential fiscal changes in the upcoming UK budget. US markets were mixed last week, with the S&P 500 breaking a six-week winning streak while the Nasdaq Composite posted a seventh consecutive weekly gain, buoyed by strength in big tech, especially Tesla, increasing 22%. Rising Treasury yields influenced sentiment, reflecting concerns about rising deficit risks and potential policy impacts from a Trump victory. Cautious corporate earnings and scepticism over China’s stimulus weighed on sentiment. Nonetheless, optimism around a soft/no-landing scenario persisted, supported by resilient economic data and continued equity inflows.

The UK housing market saw a muted rise in October, with Rightmove reporting a 0.3% increase in the average asking price. Buyer uncertainty ahead of Chancellor Reeves' upcoming budget has limited the typical autumn price bounce. In the commercial sector, the market is showing signs of revival after a pandemic-induced slowdown, according to Reuters. Demand remains strong for high-quality new office spaces, while older properties require conversion efforts. Despite recent slumps, there is optimism about a potential rebound in the UK property market as activity picks up and the economic landscape adjusts.

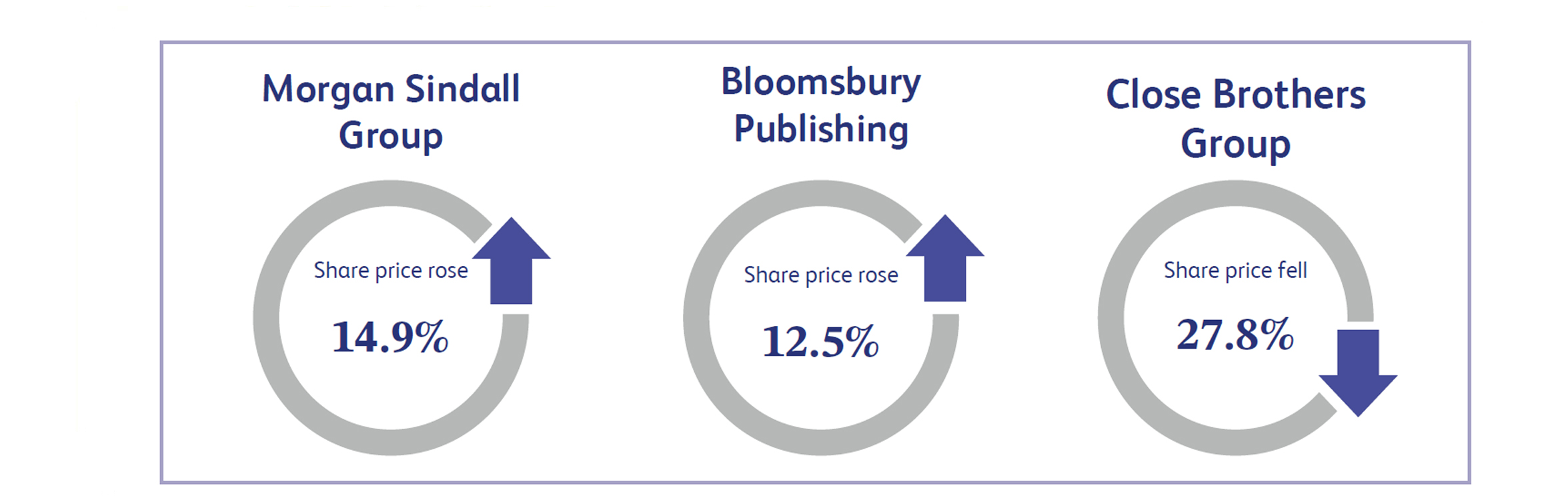

The construction and infrastructure services company Morgan Sindall Group saw a share price rise of 14.91% last week following a strong trading update. The update highlighted better-than-anticipated performance, prompting analysts to increase earnings per share (“EPS”) forecasts for 2024 and 2025 by 7%. The company’s Fit Out division showed robust growth, with an order book worth £1.3 billion, up 15% from the end of 2023. Additionally, the Partnership Housing division is expected to deliver slightly higher profits. Analysts noted Morgan Sindall’s strong management track record and lower one-off costs compared to peers, emphasising the company’s good value proposition.

Bloomsbury Publishing, publisher of books and reference databases, saw its shares jump 12.54% last week after the company reported stronger-than-expected trading performance for fiscal 2025. The publisher, known for the Harry Potter series, announced that profit attributable to owners rose to £16.6 million in the first half of fiscal 2025, up from £11.2 million a year earlier, with revenue increasing to £179.8 million from £136.7 million. EPS improved significantly, and the board proposed an increased interim dividend. Bloomsbury expects full-year results to exceed the market consensus of £319.3 million in revenue and £37.5 million in profit, boosting investor confidence.

Close Brothers Group, the merchant banking group, saw its share price plunge 27.82% last week after the UK Court of Appeal ruled that motor finance brokers must fully disclose commissions when arranging car loans. The decision was tied to a commission case involving Close Brothers, with analysts suggesting it could have significant industry-wide implications. The ruling may prompt retrospective regulatory actions from the Financial Conduct Authority (“FCA”). Close Brothers disagreed with the court's decision and plans to appeal to the UK Supreme Court. Additionally, the company announced a temporary halt to new UK motor finance loans as it reassesses its documentation and processes, further weighing on investor sentiment.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.