12 November 2024

Due to geopolitical uncertainties and a cautious market response to changes in fiscal policy, UK economic indicators were mixed. Growth slowed in the services sector, with the Purchasing Managers’ Index (“PMI”) hitting 52.0, reflecting hesitation from the Autumn Budget and geopolitical influences. Inflation data showed some improvement, especially in goods prices, providing a case for the Bank of England (“BoE”) to consider reducing policy restrictions. Meanwhile, the Monetary Policy Committee (“MPC”) voted towards a BoE rate cut to 4.75% to support confidence. The BoE downplayed the impact of an expansionary fiscal policy, but hinted that budget decisions might lengthen the rate cycle.

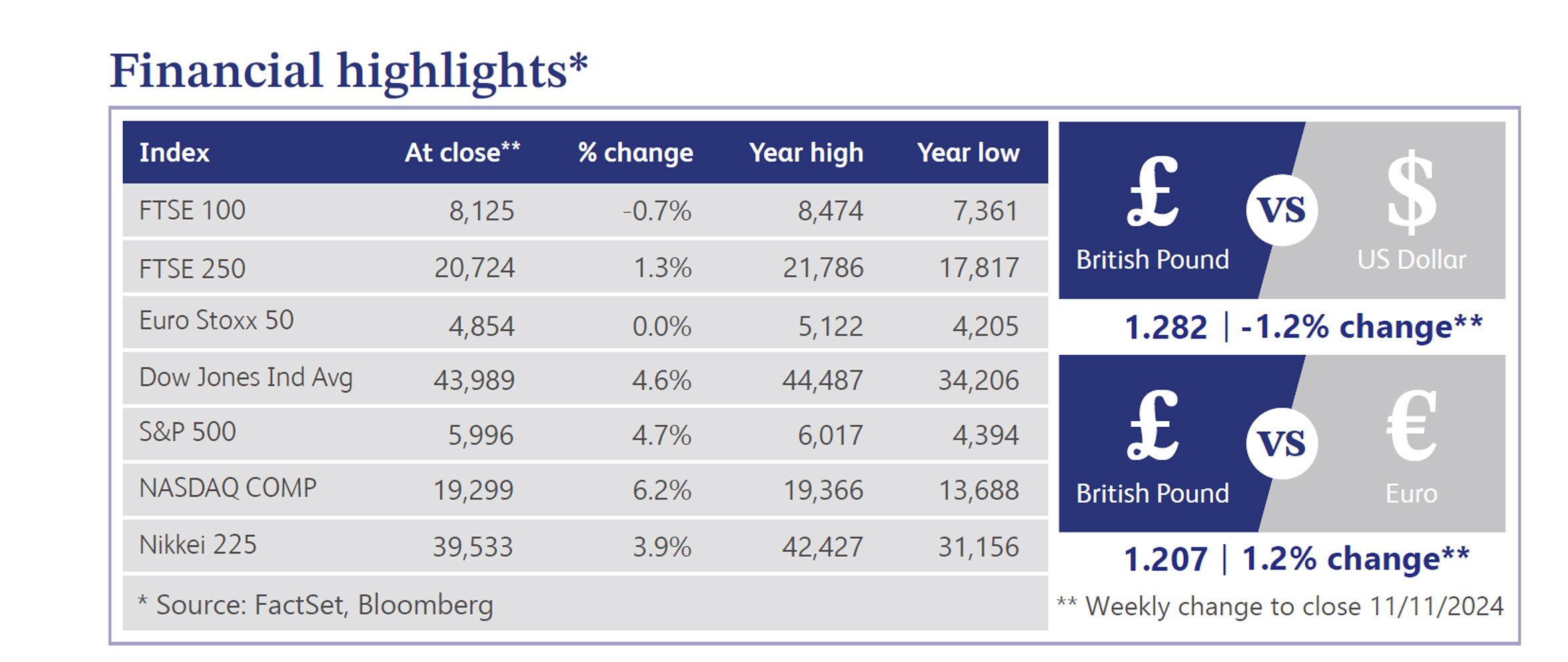

The UK’s recent fiscal policies, led by Chancellor Rachel Reeves, aimed towards driving growth have faced both market and institutional challenges. Reeves’ first budget introduced foundational reforms, such as increasing housing targets, accelerating clean energy project approvals and overhauling public sector operations, which she described as essential steps towards revitalising the UK economy. However, rising borrowing costs have eroded Reeves’ fiscal headroom, as higher gilt yields have tightened the government’s ability to sustain public spending without exceeding debt targets. The Office for Budget Responsibility (“OBR”) warned against “fiscal illusions” in debt management, emphasising transparency in loan valuations on the government’s balance sheet. Compounding these challenges, a Trump administration in the US could add trade uncertainties, limiting Reeves’ fiscal flexibility. UK markets faced significant outflows in October, with investors withdrawing a record £2.7 billion from equity funds amid concerns over potential capital gains tax hikes. This sell-off, largely driven by pre-budget tax planning, eased post-Budget. Meanwhile, the FTSE 100 surged, benefitting from weaker sterling and heavy US revenue exposure, which rose following Trump’s election win. The FTSE 250 also saw gains, buoyed by positive sentiment and due to the BoE interest rate cut.

US equities climbed last week, with the S&P 500 and Nasdaq hitting record highs. Key drivers included Trump's election victory, boosting sectors such as banking and semiconductors, and an easing in regulatory expectations fuelling gains for credit cards and investment banks. Meanwhile, the dollar grew in strength for the sixth consecutive week adding bearish overtones to export-oriented sectors. In support of its 2% inflation and employment growth goal over the longer run, the Federal Open Market Committee (“the Committee”) decided to lower the target rate range for its federal funds to between 4.50% and 4.75%. This is bolstered by Fed Chair Powells’ stronger-than-anticipated observations on economic activity. Post-election market expectations have shifted to only two 0.25% cuts next year, down from four in mid-October.

The UK housing market shows mixed dynamics, with recent stamp duty changes expected to spark a rush of home sales ahead of a March 2025 deadline, potentially followed by a slump due to ongoing high interest rates. The average property price is forecast to rise by 23.4% over five years, with mortgage rate trends playing a key role in buyer decisions. Data from Halifax indicates resilience, as house prices rose for a fourth consecutive month. Rightmove maintains a positive outlook for 2025, noting stable mortgage rates and optimism for modest price growth.

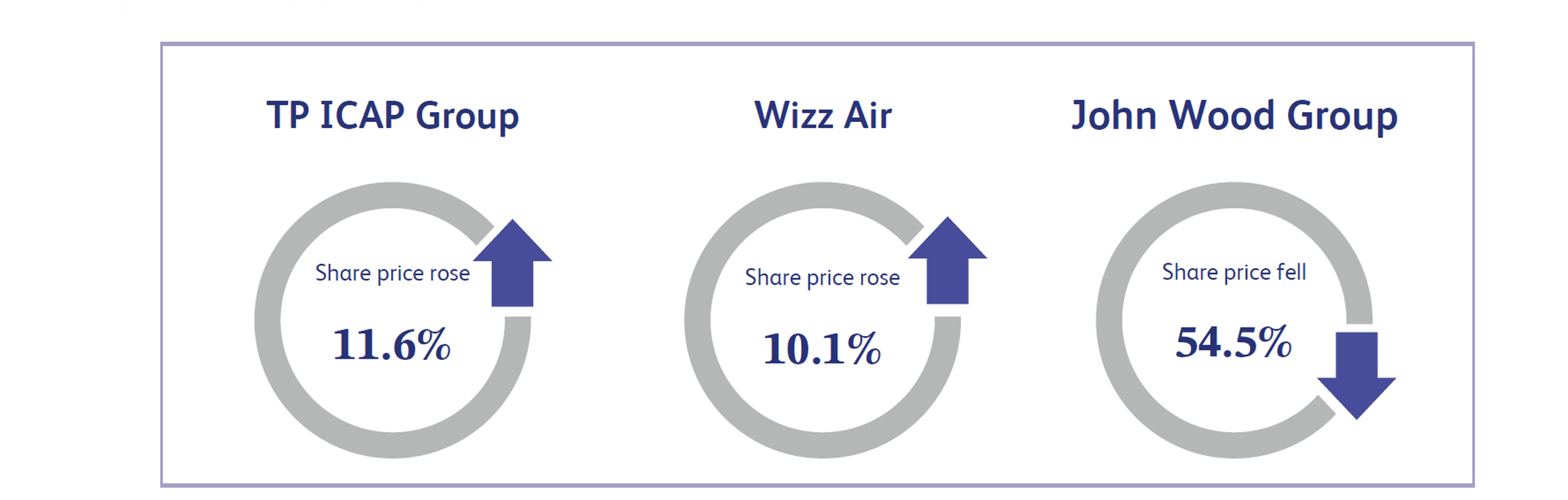

TP ICAP Group, the UK-based liquidity and data solutions company, saw its shares rise by 11.6% following strong third-quarter results. Revenues increased by 10% to £557 million, driven by robust performances in its “Global Broking” and “Liquidnet” segments. The Global Broking unit saw a 9% revenue jump, with rates growing by 14%, benefitting from recent interest rate volatility. Additionally, TP ICAP’s exploration of strategic options, including a potential US listing for its data and analytics business, Parameta Solutions, boosted investor optimism. Industry analysts highlighted these moves as value-unlocking steps for Parameta, adding to the market’s positive response to TP ICAP’s growth and strategic initiatives.

Wizz Air, a provider of passenger air transportation service, saw its share price rise by 10.1% as investors responded positively to the airline’s fiscal 2025 outlook, despite a year-over-year decline in first-half profit. While net income fell to €323.5 million from €405.1 million, Wizz Air's total revenue remained steady at €3.07 billion, showing resilience amid challenging market conditions. The company provided an optimistic forecast, projecting full-year net income between €350 million and €450 million, which helped buoy investor confidence. This outlook, combined with strong demand for low-cost carriers, likely contributed to the stock’s gain as the market looked beyond near-term profitability pressures.

John Wood Group provides project, engineering, and technical services to energy and materials markets. Its shares fell 54.5% following its third-quarter update, which revealed disappointing earnings and weak revenue growth, particularly in its projects division. The Scottish energy-services provider reported a decline in adjusted earnings before interest, taxes, depreciation, and amortisation (“EBITDA”) due to delays in chemicals projects and ongoing struggles in minerals and life sciences. While revenue rose slightly to $1.49 billion, its order book shrank 8% year-over-year, with significant declines from June’s $6.1 billion. The weaker performance led to investor concerns about the company’s growth and operational stability.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.