26 November 2024

Last week, the Bank of England (“BoE”) emphasised the labour market's critical role in shaping monetary policy. Policymakers stressed the importance of early 2024 labour market data amidst uncertainty of the budget's potential impacts on wages and employment. Inflation rose in October, with headline Consumer Price Index (“CPI”) at 2.3% and core inflation at 3.3%, driven by higher energy costs. Meanwhile, rental inflation rebounded, and retail sales slumped amid budget concerns. Flash Purchasing Managers’ Index (“PMI”) indicated the first contraction in output since 2023, as cost pressures and weak business optimism weighed. Consumer confidence dipped slightly in November, reflecting ongoing concerns about economic prospects despite resilient pay growth and employment levels.

UK Prime Minister Keir Starmer engaged with Chinese President Xi Jinping during the G20 summit in Brazil, marking the first UK-China leader-level meeting in over five years. Starmer emphasised the importance of China's economy to UK growth, highlighting its position as the UK’s fifth-largest trading partner, with exports valued at £33 billion annually. Meanwhile, the UK faces challenges balancing transatlantic ties with Business Secretary Jonathan Reynolds, warning of a potential £20 billion hit from a US-EU trade war. Domestically, public borrowing surged to £17.4 billion in October, driven by public sector pay awards and debt servicing costs. Pension reforms to boost domestic investment remain under consideration, as UK-listed equity holdings have had a downward trajectory over the past weeks.

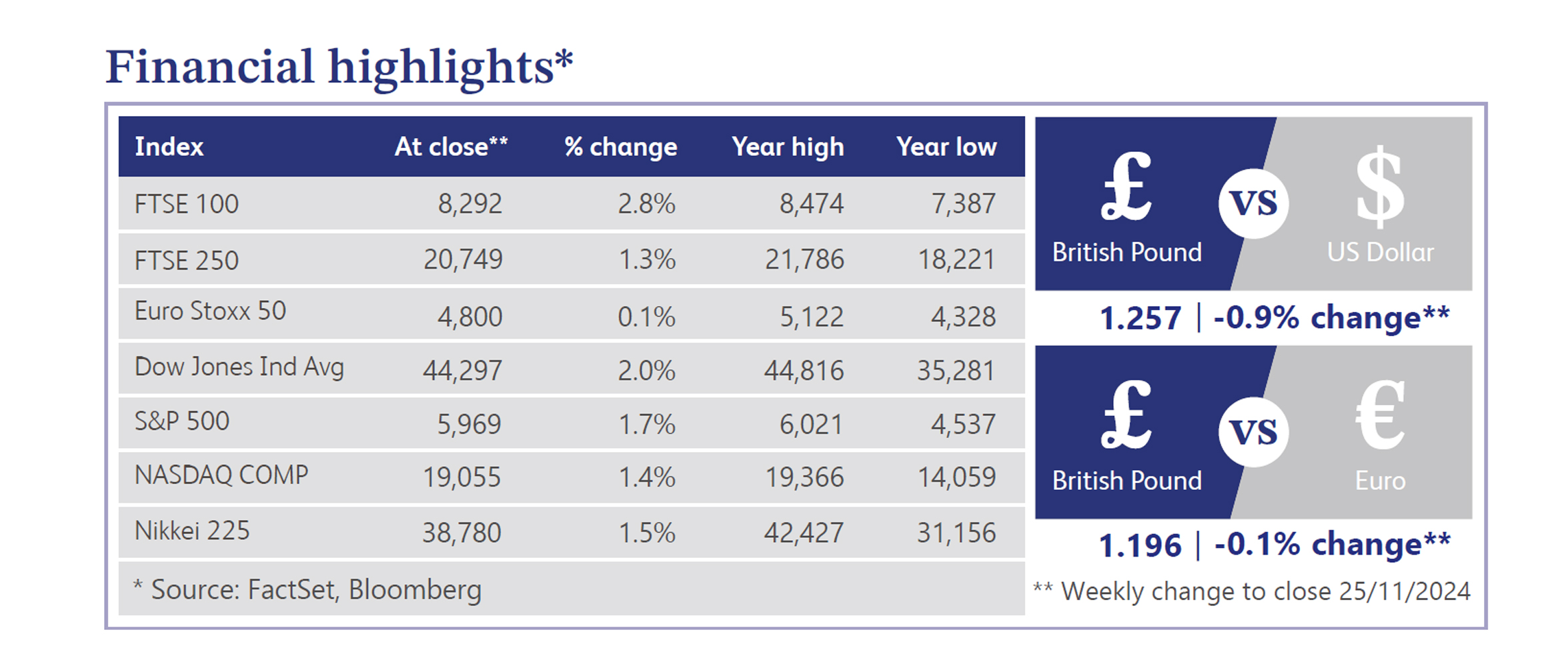

Sterling steadied after hitting a six-month low last week, supported by better performance against the euro as the UK economy shows resilience compared to the EU. UK gilts underperformed as inflation surprised on the upside, trimming bets on BoE rate cuts. Positive calls on UK assets emerged, with major banks highlighting low valuations and defensive sectors. Meanwhile, industry analysts urged the Treasury to address UK stock underperformance, and the Competition and Markets Authority (“CMA”) explored streamlining merger processes to boost economic growth. On the other hand, US equities rebounded last week, led by gains in autos, energy and regional banks, while Big Tech was mixed. Treasury yields flattened amid a mixed auction, and the dollar marked its eighth weekly gain. Economic data showed improving PMI and consumer sentiment, though housing stats missed expectations. The Federal Reserve (“Fed”) policymakers emphasised caution, raising December pause odds.

UK house prices saw a sharper-than-usual decline in November, with Rightmove reporting a 1.8% drop in average asking prices, exceeding the typical 0.8% seasonal fall. The moderation was attributed to budget-related uncertainty, aligning with broader economic trends. Despite the decline, Rightmove forecasts a housing market upswing in 2025, with prices rising by 4%. Separately, a Reuters poll indicated UK house prices are set to outpace inflation, with rents climbing even faster, challenging first-time buyers as higher rents erode disposable income and savings for deposits. Affordability, however, may improve for new buyers over time.

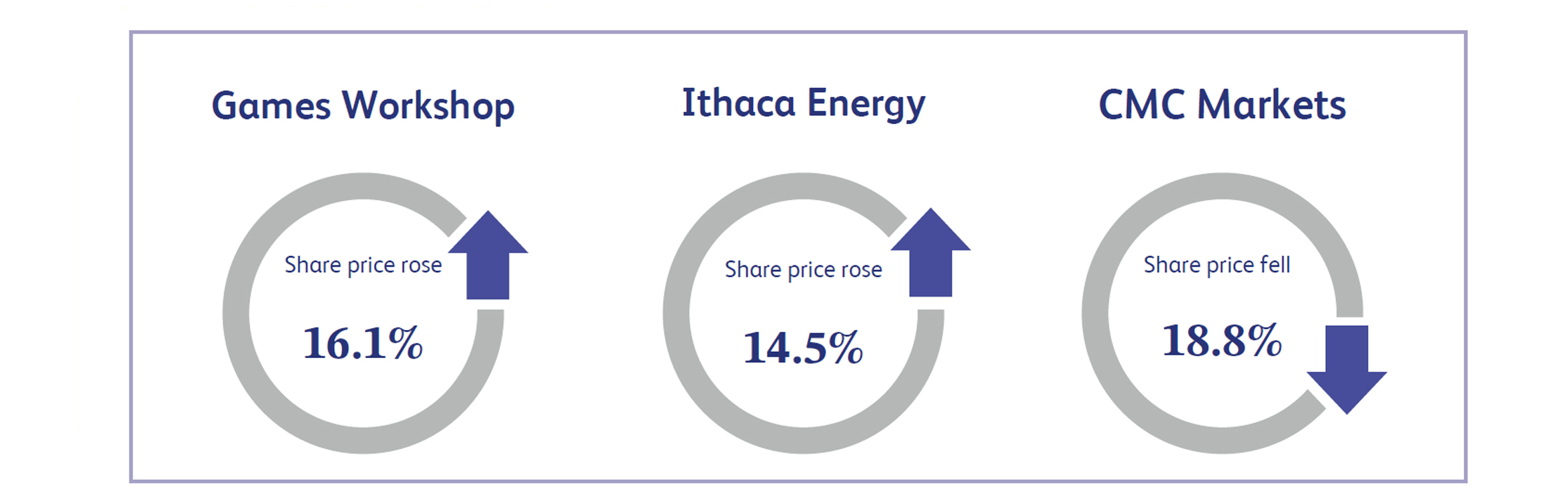

Games Workshop, designer and manufacturer of miniature figures and games, surged 16.1% to record highs after the announcement of better-than-expected sales and profit guidance for the first half of fiscal 2025. The company anticipates a pretax profit of at least £120 million, a significant jump from £96.1 million a year ago, driven by core revenue growth to £260 million and licensing revenue that has more than doubled to £30 million. This performance surpasses its pandemic-era peak, reflecting strong consumer demand for its miniature-wargaming products and robust licensing deals. Investors reacted positively to the outlook, underscoring confidence in the company’s sustained growth trajectory.

Ithaca Energy, which engages in the exploration, development, and production of oil and gas, saw its shares surge 14.5%. The upward momentum was driven after the company announced a $200 million special dividend, boosting confidence in its financial strength following its $2.25 billion refinancing and recent merger with peer firm Eni’s UK assets. The special dividend aligns with Ithaca’s $500 million full-year dividend target. Chairman Yaniv Friedman highlighted the merger's role in enhancing cash flow and growth potential. Now the UK’s second-largest North Sea oil and gas producer, Ithaca benefits from increased operational scale and support from Eni, which holds a 38.5% stake in the group.

CMC Markets, the online retail financial services and stock brokerage business, saw its shares plunge 18.8% after reporting first-half revenue of £177.4 million. This announcement missed the £180 million guidance, and the pretax income of £49.6 million was below expectations of £51 million. The disappointment was compounded by a 3% reduction in FY 2025 earnings per share estimates due to a decline in the valuation of its blockchain solutions business, StrikeX. Despite long-term growth prospects from partnerships with Revolut and ASB Bank, near-term results reflected muted profitability, prompting investor concern. Analysts noted improving operational efficiency but acknowledged a need for incremental earnings upside to regain confidence.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.