3 December 2024

Last week, key economic updates highlighted mixed signals for the UK. Bank of England (“BoE”) Deputy Governor Clare Lombardelli expressed caution over wage growth trends, warning that a slowdown in wage disinflation might necessitate careful rate cut strategies. BoE official Swati Dhingra noted the UK is no longer an inflation outlier but stressed the difficulty of accurate inflation forecasting due to unreliable data. The Confederation of British Industry (“CBI”) painted a sombre picture, with surveys showing weakening sentiment in the retail and services sectors. Job cuts loom as firms grapple with tax hikes, while higher wages ahead of the holidays offer a short-term boost in hiring for sectors such as retail and hospitality. Consumer confidence waned slightly after the budget, reflecting concerns over economic stability. Despite reassurances about the financial system's resilience, the BoE’s financial stability report flagged heightened global risks, including geopolitical tensions and government debt vulnerabilities. This backdrop underscores challenges ahead for growth and inflation.

Ministers unveiled plans to abolish dozens of district councils, streamlining governance into unitary authorities to save £3 billion over five years. This overhaul aims to boost efficiency and growth in counties like Essex and Kent. On the fiscal front, accounting firm PwC reported a 10% rise in FTSE 100 firms’ tax contributions, hitting £93.3 billion, driven by a reversal in corporation tax cuts. However, Chancellor Reeves’ payroll tax increase raised concerns about job losses, potentially costing 130,000 jobs or lifting inflation by 0.9% if costs shift to consumers. Reeves ruled out further tax hikes but postponed a departmental spending review, prolonging uncertainty. Trade risks persisted, with UK exports more vulnerable to US tariffs compared to European peers. These factors highlighted fiscal complexity amid slowing government expenditure growth.

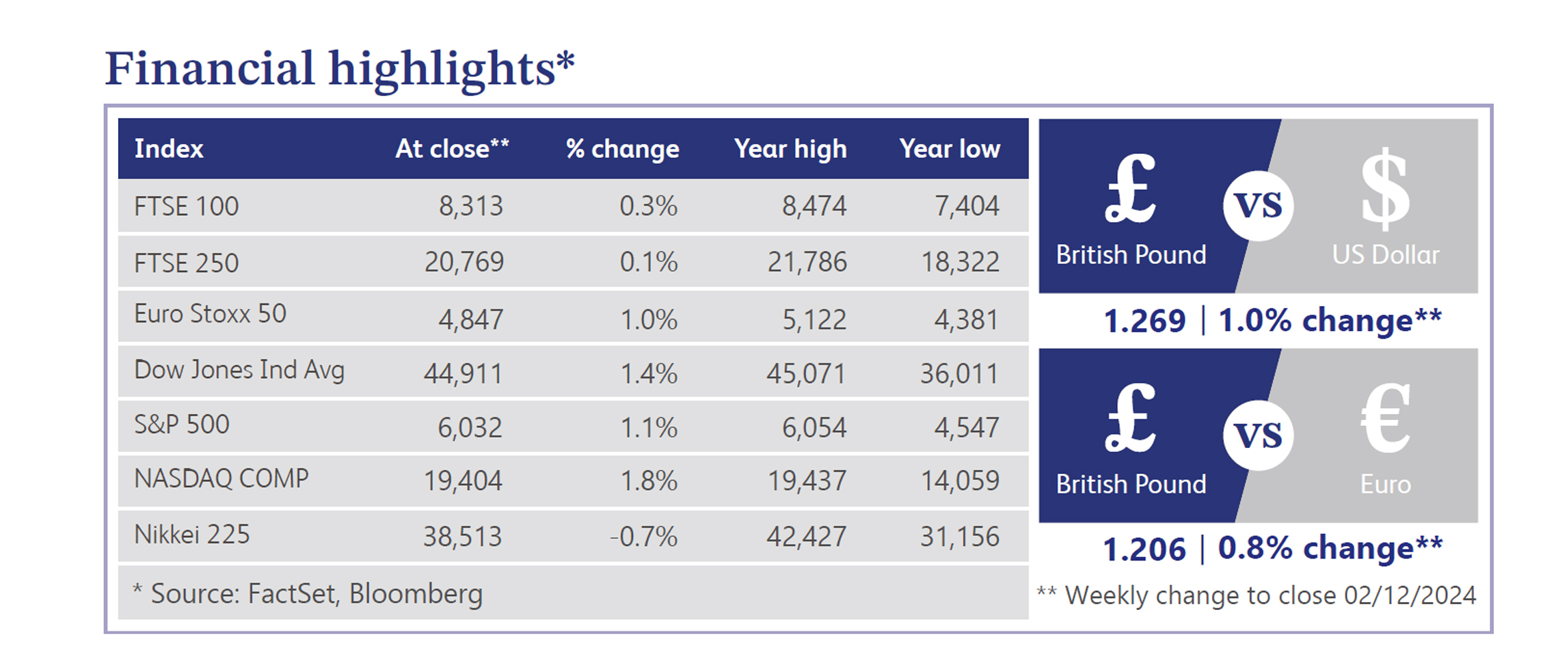

UK equity markets remained attractive despite challenges, supported by low valuations, high dividends, and robust buybacks. Mergers & Acquisitions (“M&A”) activity surged, with deals totalling $160 billion, doubling Germany’s volume, fuelled by FTSE 350 bids worth £52 billion. Despite political concerns, London's market remains a hub for European M&A due to its accessibility and valuations. US equities posted another strong week, with the Dow Jones and S&P 500 indices reaching record highs. Investor sentiment was buoyed by domestic policy developments and geopolitical considerations. A key driver was President-elect Donald Trump’s nomination of hedge fund veteran Scott Bessent as Treasury Secretary. Bessent’s Wall Street experience and emphasis on economic stability and inflation control reassured markets and calmed fears of aggressive and unconventional policies on trade tariffs. The market's positive momentum reflected optimism around continuity in pro-business policies.

The UK property market faces mixed signals amid higher borrowing costs. Knight Frank downgraded its house price growth forecasts for 2025-2027, reflecting concerns over prolonged financing challenges post-budget. However, affordability has improved, with Halifax noting average house prices relative to wages fell to 6.55 times annual income, down from mid-2022 peaks. Zoopla projects a rebound in 2025, forecasting 2.5% price growth and a 5% rise in transaction volumes, supported by income growth and innovative mortgage solutions. Despite headwinds, regional year-on-year growth averaged 1.5% in 2024.

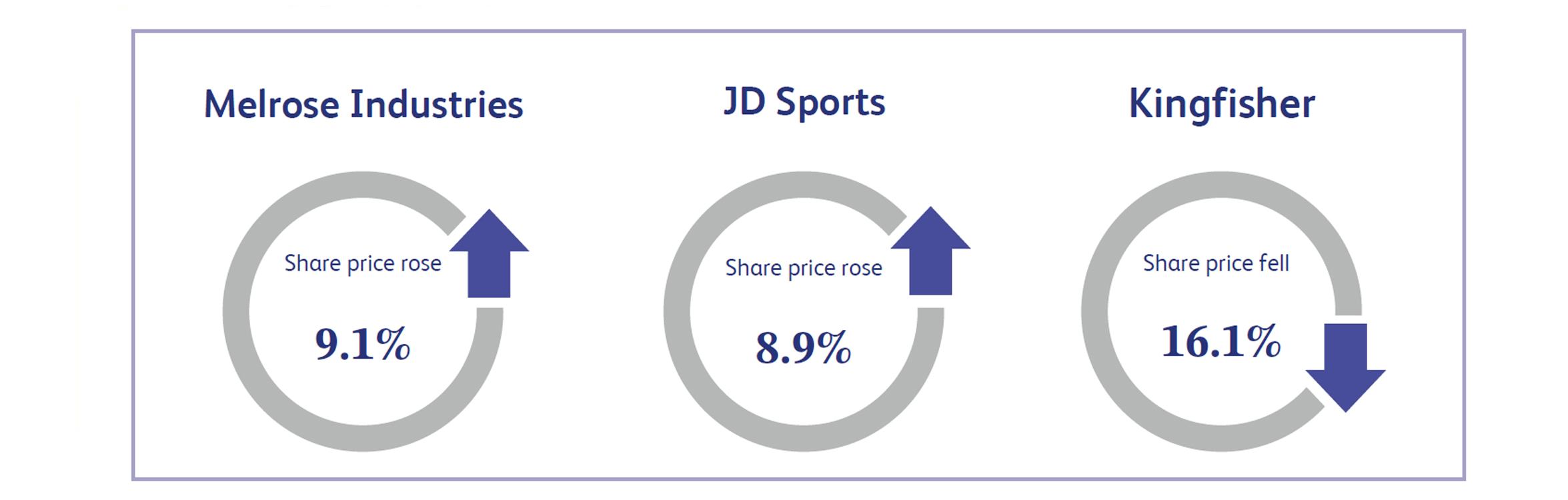

Melrose Industries, a manufacturer of aerospace and industrial systems, surged 9.1% after reporting strong revenue growth and projecting a significant increase in free cash flow by 2025. JPMorgan boosted its target price for the stock, citing undervaluation in its aerospace and defence business. Industry analysts highlighted Melrose’s potential to benefit from aftermarket earnings on new-generation engines and projected double-digit earnings growth and cash flow improvements through 2030. Speculation about a future division of the company, potentially unlocking takeover premiums, further bolstered investor sentiment.

JD Sports, retailer and distributor of sports fashionwear and outdoor clothing and equipment, saw its share price rebound 8.9% after weeks of decline. Despite challenges in October, including weaker sales due to heavy discounting and mild weather, analysts highlighted the retailer’s resilience and long-term growth potential. Industry analysts emphasised that restoring US performance is key to boosting investor sentiment, while JD's ambition to achieve £1 billion annual profits remains a significant milestone. The rally reflects optimism about its ability to navigate headwinds and maintain a competitive edge in the global sneaker and fashion market.

Kingfisher provides home improvement products and services through a network of retail stores and other channels. Kingfisher's shares plummeted 16.1% after the company warned of a £45 million profit hit for 2025/26 due to new tax measures in the UK and France. The announcement heightened concerns over Kingfisher's ability to navigate challenging market conditions, with analysts noting its growth struggles amid weak consumer sentiment and slow economic growth. Investors remain wary of the company's outlook, with fears that ongoing macroeconomic pressures could further impact its performance, dragging the stock deeper into a downward trajectory.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.