10 December 2024

The UK economy is grappling with challenges as business confidence falters and retail sales dip. The Lloyds Bank business barometer fell to a five-month low of 41%, highlighting economic uncertainty, though firms remain optimistic about their trading prospects. Surveys from the Confederation of British Industry and the Institute of Directors indicate shrinking private sector activity and the lowest business confidence since April 2020. Elevated borrowing costs and higher employment taxes are straining businesses, dampening hiring and investment. Despite these difficulties, the Organisation for Economic Co-operation and Development (“OECD”) forecasts stronger growth by 2025, driven by public spending, though inflation is expected to stay above target.

UK Prime Minister Keir Starmer emphasised a balanced approach to foreign policy, rejecting the notion that Britain must choose between the US and EU, particularly with Trump's return. He highlighted Britain's commitment to Ukraine and a post-Brexit reset with the EU, framing stability as essential for economic growth. The OECD warned of fiscal challenges, urging tax reforms to sustain public finances amid potential shocks. Speculation about another national insurance tax hike looms, as Chancellor Rachel Reeves navigates tight fiscal constraints. Trade relations remained a concern, with confidence in averting US tariffs offset by public preference for closer EU ties. A YouGov poll revealed 44% of voters prioritise the EU over the US for the UK's economic future.

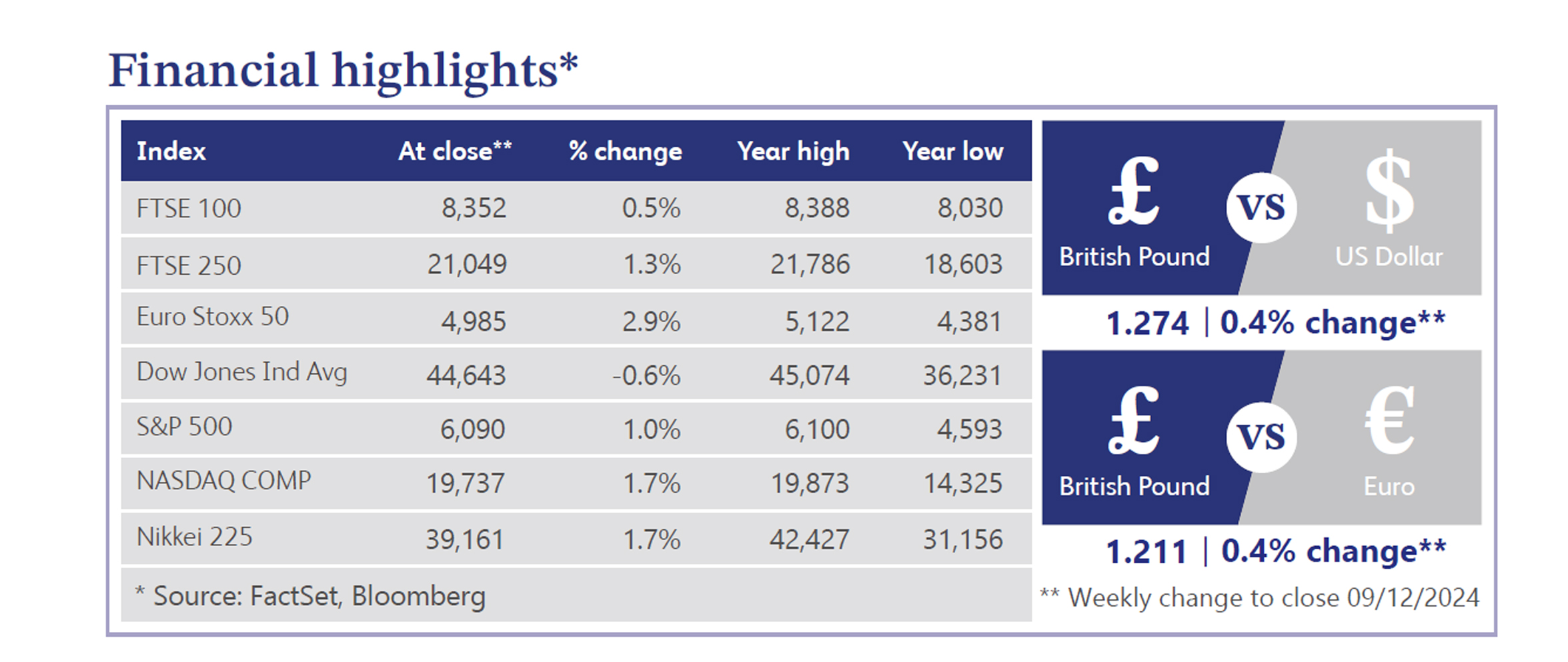

UK investors returned to equity funds in record numbers after the budget, with November seeing a net inflow of £3.06 billion, surpassing the £3 billion threshold for the first time. This included the first net inflow into UK equity funds in 42 months. However, concerns linger as London’s stock market shrinks rapidly, with 45 firms delisted in 2024, the highest since 2010. Experts urge government action to stem the exodus of capital from the UK market. US equities had a mixed week, with the S&P 500 and Nasdaq reaching record closes. Technology led gains, buoyed by strong earnings and Artificial Intelligence optimism. Outperformers included semiconductors, software and electric vehicles, while energy, banks and industrial metals lagged. Treasuries firmed slightly, and the dollar strengthened. Economic data showed resilient payrolls and improved Institute for Supply Management manufacturing. Federal Reserve sentiment leaned dovish, with a December rate cut now 90% likely.

UK house prices saw their fastest growth in two years, with Nationwide reporting a 3.7% annual increase and Halifax posting a 4.8% gain in November. Monthly growth for October and November was robust, at 1.2% and 1.3%, respectively, driven by easing mortgage rates, strong labour markets and rising incomes. However, affordability remains a key challenge. Meanwhile, Prime Minister Starmer pledged to tackle planning bottlenecks to boost housebuilding, targeting 1.5 million homes in five years. His agenda aims to stimulate economic growth and improve affordability, countering long-standing barriers posed by bureaucratic and environmental opposition.

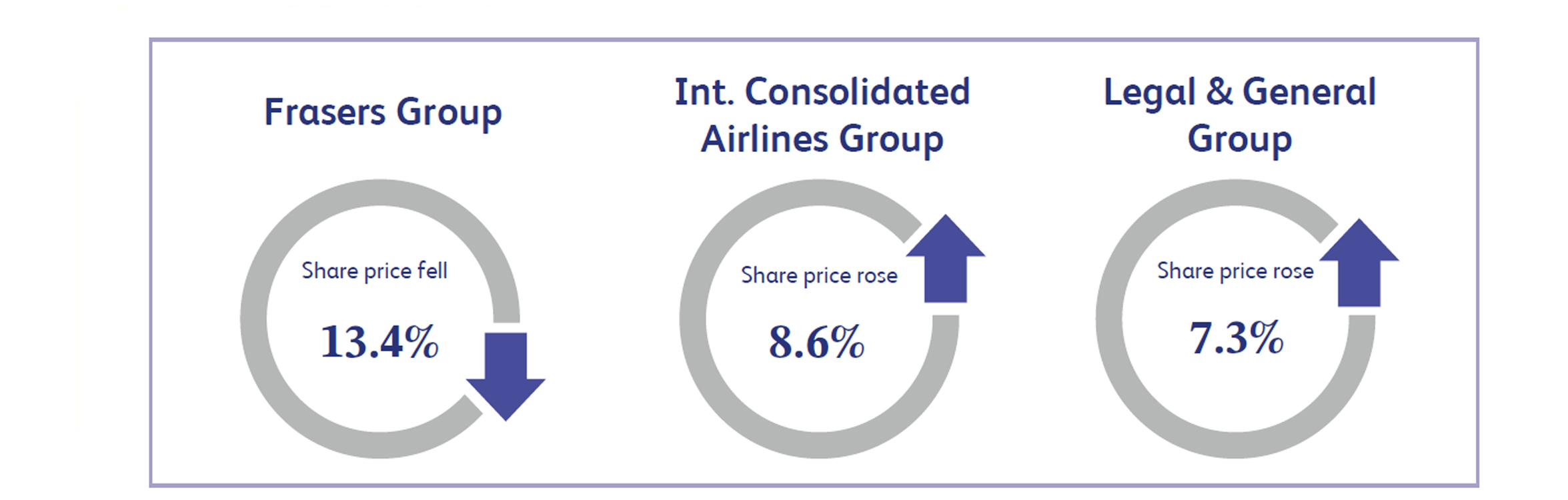

Frasers Group, provider of sports, premium and luxury brands, saw its share price fall 13.4% following a disappointing fiscal first-half performance and reduced guidance for fiscal 2025. The retailer reported a 33.7% drop in profit attributable to equity holders and a £230 million revenue decline year-over-year, citing weaker consumer confidence and challenging retail conditions. Its adjusted pretax profit forecast was lowered to £550–600 million from £575–625 million. Additionally, the group's failed Mulberry acquisition bid and public disputes with Boohoo leadership compounded investor concerns, underscoring broader sector struggles and eroding confidence in its growth outlook.

International Consolidated Airlines Group (“IAG”), provider of passenger and freight air transportation services, rose 8.6% buoyed by positive sector dynamics and strategic opportunities. JP Morgan’s outlook for 2025 highlighted stable airline demand, with 6% passenger growth matching supply increases and the potential for steady or slightly higher ticket prices. Additionally, interest from IAG in Portugal's privatisation of TAP Air Portugal signals potential expansion opportunities. This combination of steady demand forecasts and strategic growth prospects boosted investor confidence in IAG’s long-term performance.

Legal & General Group engages in the provision of risk, savings and investment management products and services. Its share price rose 7.3%, driven by optimistic growth projections and plans to return capital to shareholders. The company reaffirmed its mid-single-digit operating profit growth target for 2024, with an expected compound annual growth rate of 6% to 9% in core operating earnings per share. A trading update ahead of an investor presentation highlighted plans to return capital from its institutional retirement business to shareholders, signalling financial strength and shareholder-friendly policies. This bolstered market confidence, driving strong investor interest.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.