14 January 2025

The UK economy faced significant headwinds in 2024, marked by stagnation and subdued growth. December’s Purchasing Managers’ Index (“PMI”) data revealed the weakest private sector performance since October 2023, with composite PMI at 50.4 and a sharp decline in new orders. Rising payroll costs and declining demand drove the steepest fall in employment since January 2021, while business confidence fell to a two-year low following tax increases in the Autumn Budget. Although KPMG raised its 2025 Gross Domestic Product (“GDP”) forecast to 1.7% due to expansionary fiscal policy, 2024 growth remained modest at 0.7%, with inflation averaging persistently high levels. Despite signals of gradual rate cuts from the Bank of England, bond market volatility added uncertainty to the outlook.

The UK fiscal outlook has become increasingly challenging, as rising gilt yields threatened fiscal headroom and forced difficult policy decisions. Chancellor Rachel Reeves faces a £6.4 billion increase in borrowing costs, reducing her fiscal buffer from £9.9 billion to just £3.5 billion by 2030, according to Oxford Economics. Concerns over fiscal sustainability may necessitate additional tax hikes or spending cuts, with economists suggesting Reeves is close to breaching her fiscal rules. Reeves has urged her cabinet to propose alternative growth strategies, though inflationary pressures and weak economic activity pose further obstacles. Public sentiment reflects scepticism, with 72% believing the economy is heading in the wrong direction.

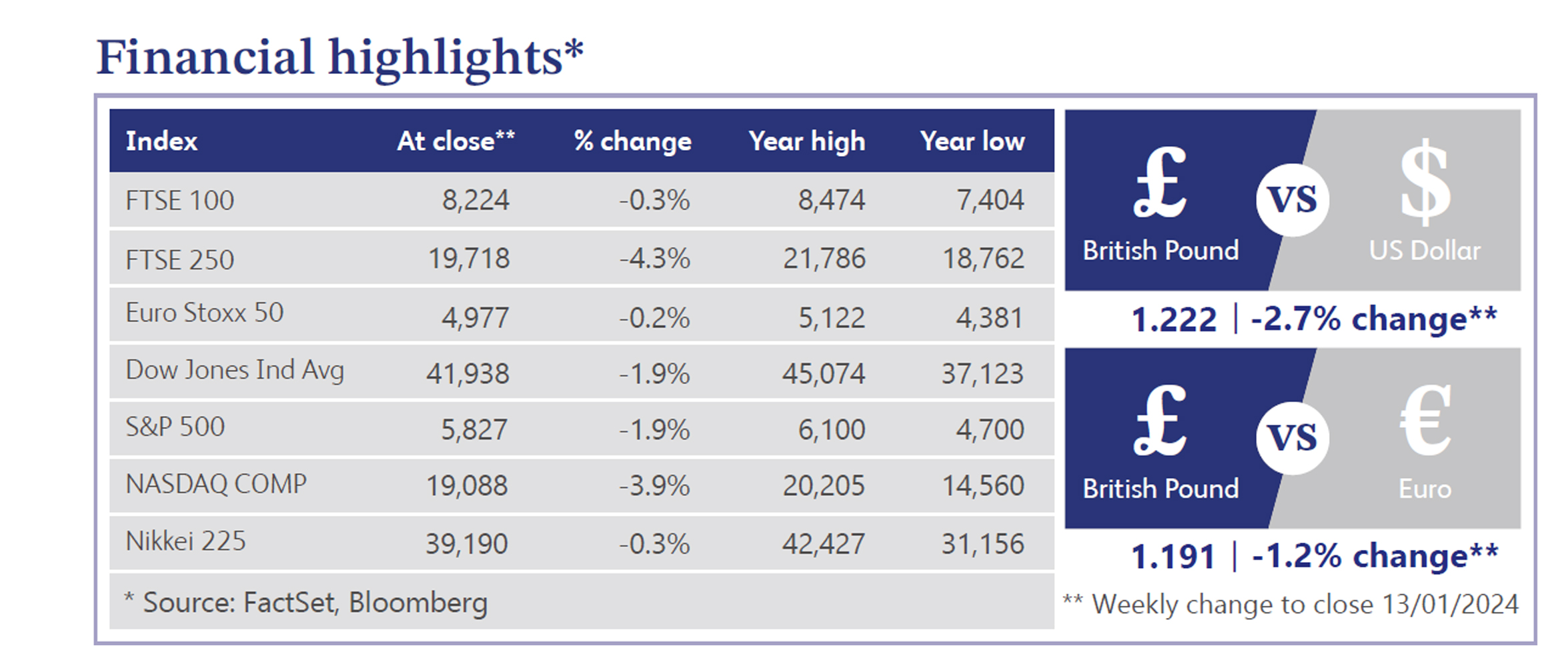

UK markets faced heightened volatility last week as rising borrowing costs and fiscal concerns weighed on sentiment. Gilt yields surged, with the 30-year yield reaching 5.4%, the highest since 1998, exacerbating fiscal challenges and sparking fears reminiscent of past crises. Sterling hit a year low, while the FTSE 250 declined amid concerns over the Labour government’s ability to manage escalating deficits. Meanwhile, UK equity funds saw £221 million of net outflows in December, reflecting cautious investor sentiment.

US markets too ended the week lower, with the S&P 500, Nasdaq and Russell 2000 all declining amid rising yields and a strengthening dollar. The 2-year and 10-year Treasury yields reached their highest levels since October 2023, following robust economic data, including December payrolls surpassing expectations at 256,000 and a decline in the unemployment rate to 4.1%. Megacap tech stocks, including NVIDIA and Tesla, faced pressure from valuation concerns and dollar strength, which also raised revenue headwinds ahead of fourth quarter earnings. Hawkish commentary from the Federal Reserve (“Fed”) and market expectations for fewer rate cuts in 2025 added to the week's cautious sentiment.

The UK housing market showed signs of cooling in December, with the Halifax house price index dipping 0.2% month-on-month, the first decline after five months of gains. Year-on-year growth slowed to 3.3%, underperforming consensus and contrasting with Nationwide's more optimistic reading. Elevated borrowing costs and subdued consumer confidence weighed on residential activity, which contracted for the third consecutive month according to S&P Global's construction PMI, which fell to 53.3. Meanwhile, inflation expectations among UK households continued to rise, with 12-month expectations at 3.7%, up from 3.3% in October, reflecting persistent concerns about cost-of-living pressures.

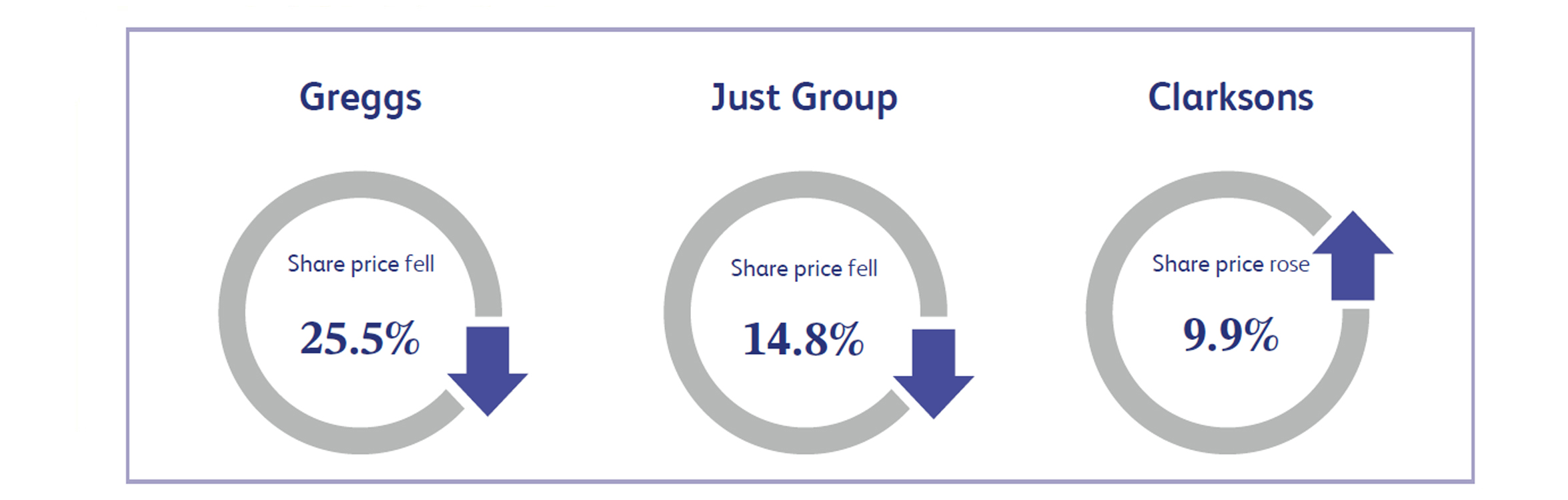

High street bakery, Greggs, saw its share price drop 25.5%, driven by disappointing Christmas trading and a cautious outlook for 2025. The bakery chain reported underlying sales growth of 2.5% for the fourth quarter, down from 5% in the third quarter, as lower consumer confidence dampened demand for festive offerings. The broader UK retail sector also faced challenges, with trading updates falling short of expectations amid turmoil in bond and currency markets. Greggs' CEO highlighted the difficulties ahead, further pressuring investor sentiment. This combination of slowing growth and a challenging macroeconomic environment led to the sharp decline in the company’s stock price.

Just Group's share price fell 14.8%, reflecting short-term pressures on new business margins due to narrowing credit spreads in the bulk purchase annuity market. Just Group is a financial service company which engages in the provision of retirement income products and services. While industry analysts remain positive about the company's long-term prospects, citing solid new business growth and improving cash generation, the downgrade in its rating following a strong share price performance over the past year weighed on investor sentiment. The combination of margin pressures and valuation concerns drove the sharp decline, despite confidence in Just Group’s ability to sustain growth over the coming years.

The integrated shipping services provider, Clarksons, saw its share price rise 9.9%, driven by an upbeat annual outlook and better-than-expected earnings guidance. The company announced that its 2024 underlying pretax profit is anticipated to exceed market expectations, reaching at least £115 million, compared to the consensus forecast of £111.3 million. This positive update, reflecting strong operational performance and a robust demand in the shipping services sector, bolstered investor confidence and positioned Clarksons as a standout performer among FTSE midcaps. The announcement highlighted its resilience and growth potential, fuelling the share price rally.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.