28 January 2025

The UK economy is grappling with significant challenges as consumer confidence slumped in January, which was reflected in weak survey data from the British Retail Consortium. Industrial sentiment is at a two-year low, with output volumes falling at their steepest rate in four years, signalling more contraction ahead. Bloomberg warned of more frequent recessions due to weak growth potential, while stagnant wages since 2008 compounded economic pressures. The labour market is softening, with rising unemployment and declining vacancies, although wage growth remains high, adding to inflationary risks. Despite these headwinds, the Guardian reported that the UK remains the second most attractive country for investment, indicating long-term resilience. The Purchasing Managers' Index (“PMI”) data shows a slight improvement in activity, led by the services sector, but new work continues to decline.

The UK's fiscal position remained under significant strain as borrowing rose to £17.8 billion in December, marking the highest level for the month in four years. The total deficit for the fiscal year stands at £129.9 billion, exceeding the Office for Budget Responsibility’s (“OBR”) forecast, with surging debt costs compounding fiscal pressures. This raises concerns over a potential breach of fiscal rules when reviewed in March. Chancellor of the Exchequer Rachel Reeves is maintaining a focus on growth, defending her tax policies as essential for stability. Reeves has signalled readiness to announce new fiscal measures in March if needed, emphasising careful monitoring of bond market moves. Meanwhile, trade optimism grows as the UK seeks sector-specific carve-outs in potential US trade negotiations, avoiding panic despite fiscal and trade challenges.

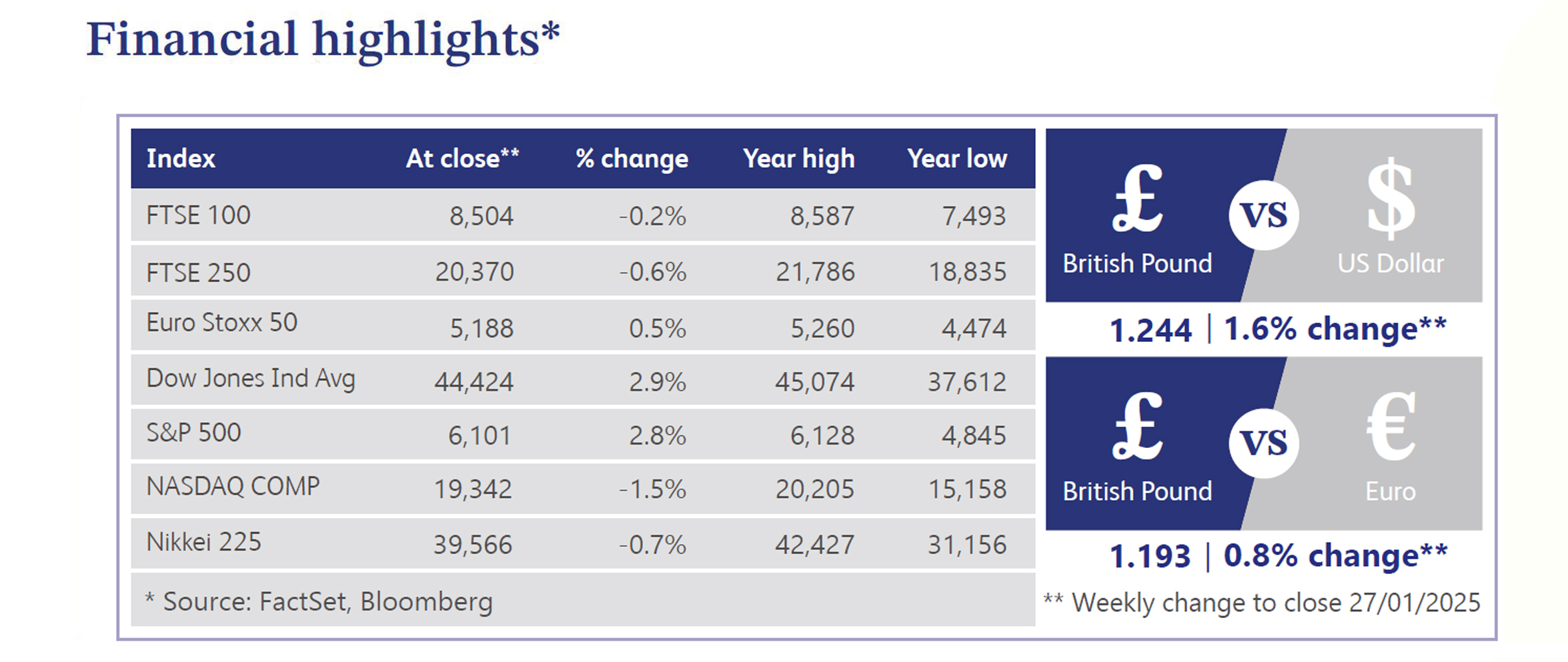

The UK equity market faced headwinds as fiscal concerns and a weak macroeconomic environment dampen rally prospects. Despite strong trading updates from major retailers, rising payroll costs and subdued consumer sentiment weigh on outlooks. Industry analysts project FTSE 100 earnings growth of 6% for 2025, trailing the broader European market's 8%. The UK bond market remained volatile, with 10-year Gilt yields hitting 4.70% and 30-year yields peaking at 5.45% before retreating on softer data.

US equity markets advanced for a second consecutive week, driven by strong gains in big tech, with Netflix soaring 13.9% but Apple lagging 3.1%. However, the recent emergence of Chinese firm DeepSeek and its Artificial Intelligence (“AI”) model sent shockwaves through US tech firms, causing Nvidia to experience the largest single-day loss in market value in Wall Street history. S&P's official index outperformed its equal-weighted counterpart. Strength was seen in telecoms, software, hospitals and machinery, while energy, beverages and industrial metals underperformed. Investors navigated mixed headlines, including optimism around AI investment ($500 billion "Stargate" deal) and relief over softer-than-expected tariff rhetoric from the White House. Washington developments and early fourth quarter earnings also influenced sentiment.

The UK housing market began the year with strong momentum, as Rightmove reported a record number of properties listed since Boxing Day. Average asking prices rose 1.7%, marking the biggest start-of-year increase since 2020. Buyer activity also surged, with a 9% rise in agent inquiries and an 11% increase in agreed sales compared to last year. Nationwide highlighted a slight improvement in housing affordability, though it remains stretched.

Shares of Intermediate Capital Group, provider of flexible capital solutions, surged 10.2% after the alternative asset manager reported robust third quarter results, beating fundraising expectations with $7.2 billion versus the $3.1 billion forecast. Assets under management (“AUM”) rose 5.1% year-over-year to $107 billion, while fee-earning AUM increased 2.8% to $71 billion, slightly below estimates due to foreign exchange impacts. Analysts welcomed the strong fundraising performance, viewing it as a key driver of future growth. Despite concerns over past valuation inflation, the positive results and outlook outweighed minor shortfalls, boosting investor confidence and driving the stock higher.

Games Workshop, designer and manufacturer of miniature figures and games, saw its shares rise by 7.0% after the company reported strong fiscal first-half results. Profit attributable to owners surged to £95.2 million, a 33% increase from the prior year, with earnings per share rising to £2.88 from £2.16. Revenue grew 21% year-over-year, driven by robust demand for its board games. The impressive performance reflects the company's ability to capitalise on its loyal customer base and growing market appeal. Investors welcomed the solid growth in both profit and revenue, boosting confidence in Games Workshop's ongoing success and market position, driving the stock higher.

Associated British Foods (“ABF”) engaged in the business of manufacturing and trading of consumer goods, saw its shares fall 6.3% after reporting weaker-than-expected performance at its Primark division, with fiscal first-quarter sales down 4% in the UK and Ireland. The challenging retail environment, marked by a consumer shift to online shopping and weaker trading following the UK budget, weighed on Primark’s results. ABF also cut its annual sales forecast for Primark, further dampening investor sentiment. While Primark remains a key division for the company, its struggles in adapting to current market trends raised concerns about growth prospects, prompting the sell-off.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.