11 March 2025

The UK economy faced continued headwinds last week, with slowing growth and persistent inflation concerns. The British Chamber of Commerce cut its 2025 gross domestic product (“GDP”) growth forecast to 0.9% from 1.3%, citing rising cost pressures. The Bank of England (“BoE”) monthly survey of UK Chief Financial Officers (“CFOs”) showed inflation expectations ticking up, with year-ahead consumer price index (“CPI”) at 3.1% from 3.0%, whilst most economists expect gradual cuts, bringing rates to 3.75% by year-end. Investor sentiment remained fragile, with UK takeovers by foreign firms plunging to £4.5 billion in Q4 2024, the lowest since the Covid-19 pandemic. However, domestic mergers and acquisitions surged to £8.6 billion from £1.9 billion in Q3, reflecting a shift towards local consolidation. In fiscal policy, Chancellor Rachel Reeves hinted at further public spending cuts to remain within fiscal constraints, as higher borrowing costs, increased future defence spending and downgraded growth forecasts limit fiscal flexibility. The Treasury is now preparing deep budgetary reductions, with several billion pounds in spending cuts under review ahead of the Spring Budget, with the Institute of Fiscal Studies saying that the chancellor could even be forced to raise taxes to plug any gap in finance.

Following last week’s failed negotiations between Volodymyr Zelenskyy and Donald Trump, the US halted all aid to Ukraine, escalating diplomatic tensions. Meanwhile, EU leaders endorsed Ursula von der Leyen's €150 billion defence loan plan, despite Hungary blocking a unified Ukraine support statement backed by 26 nations. Additionally, the UK announced a £1.60 billion package for Ukraine to acquire 5,000 air defence missiles. Continued talks between the US and Ukraine are set for this week in Jeddah, Saudi Arabia. Trump also threatened tougher sanctions on Russia and Iran, though oil prices continued falling, with prices hitting three-year lows as the Organisation of the Petroleum Exporting Countries (“OPEC”) announced an April production hike. In the Eurozone, Q4 GDP grew 0.2%, beating forecasts, as the European Central Bank cut the interest rate by 0.25% while signalling a less restrictive policy stance.

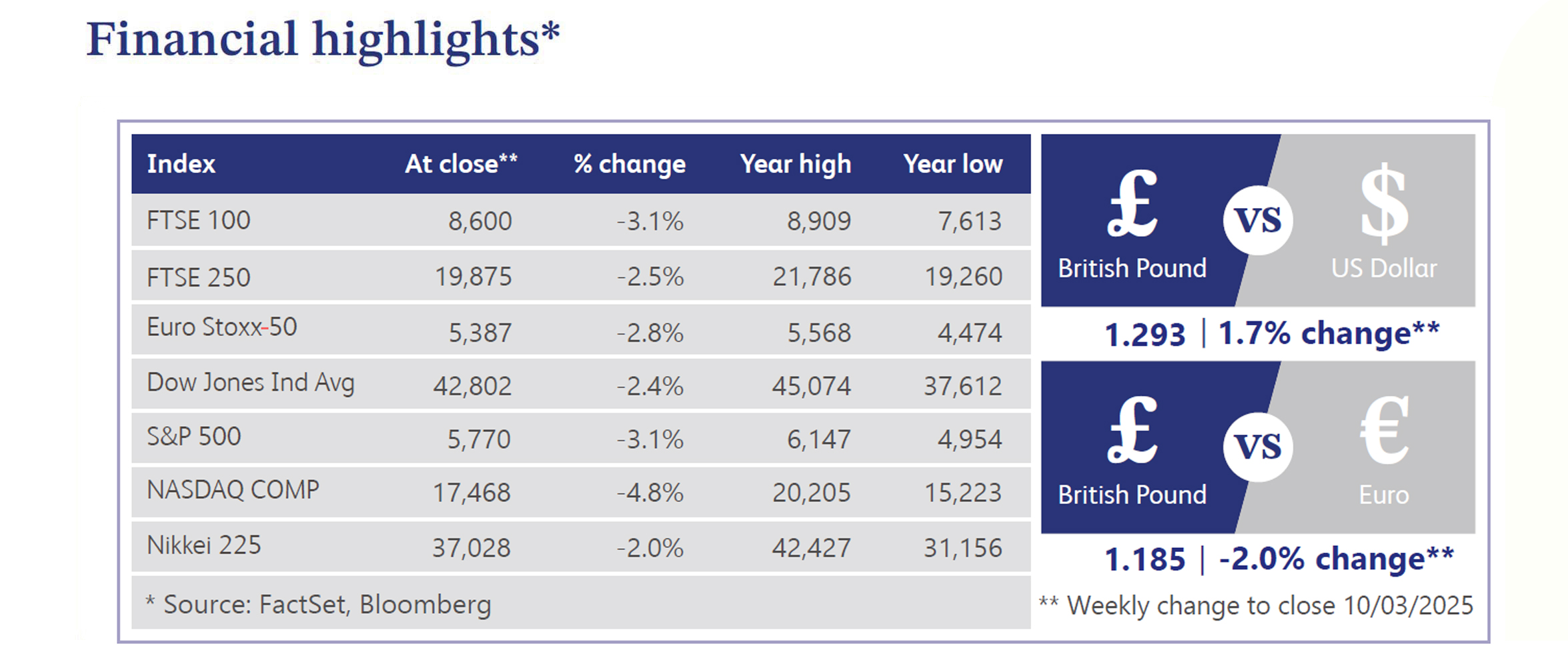

The UK gilt market saw a sharp sell-off in January, with foreign investors cutting holdings by £22.3 billion, the steepest decline in two years. However, 10-year gilt yields have eased from approximately 4.9% to 4.6%, as investors sought attractive income streams and tax-free gains. Meanwhile, global markets remained under pressure, with Wall Street extending its recent decline. The S&P 500 dropped 2.7% on Monday, following last week’s 3.4% slide, its worst weekly performance in six months, as major US banks turned more bearish on equity outlook. Trade tensions further weighed on sentiment, with new US tariffs taking effect last week, prompting China to impose retaliatory duties on $22 billion of US goods.

Despite ongoing economic challenges, the UK housing market has shown resilience. BoE mortgage approval data revealed 66,190 new approvals in January, slightly surpassing expectations as buyers looked to secure deals ahead of April’s tax changes. Looking ahead, building suppliers Ibstock and Breedon anticipate a market recovery in 2025, driven by increased demand for materials such as bricks and cement. However, challenges remain for the government’s housing targets, with planning approvals in 2024 falling to a 10-year low. The Home Builders Federation reported only 242,610 approvals last year, 2% lower than in 2023 and 25% below the 2019 peak, highlighting persistent structural weaknesses in the sector.

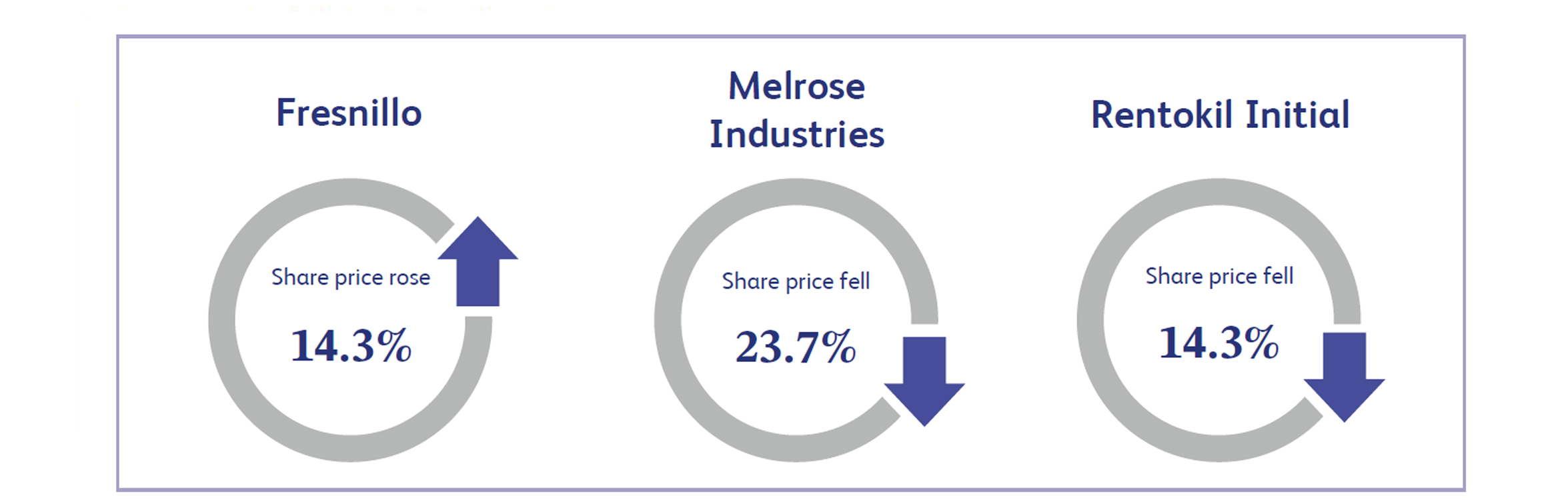

Shares in precious metals mining company Fresnillo have surged 14.3% over the past week, continuing a strong rally since the start of the year, reflecting investor optimism following better-than-expected dividend payouts and strong cash flow generation. A special dividend of 41.8 US cents, on top of a higher underlying dividend per share, has fuelled confidence, with strong precious metal prices suggesting the potential for another special dividend in 2025. Despite a larger-than-expected impairment, operating cash flows of $1.25 billion exceeded estimates, highlighting efficient cost management. With $340 million - $410 million in surplus cash expected next year and no immediate major growth projects, further shareholder returns appear likely, supporting the recent share price rally.

Melrose Industries has faced a sharp 23.7% decline in its share price over the past week. Despite strong 2024 results, shares fell due to weaker-than-expected 2025 guidance. The aerospace supplier reported a 42% rise in operating profit to £540 million, but its £3.70 billion revenue forecast fell short of analyst expectations. Investor sentiment was dampened by supply chain challenges, slower short-term growth and potential trade tariffs, despite strong long-term prospects in defence. With high single-digit annual growth targets and £5 billion revenue ambitions by 2029, Melrose remains well positioned. But investors may need patience as short-term headwinds persist in the coming quarters.

Rentokil Initial shares dropped 14.3% over the past week, following an 8.1% decline in adjusted pre-tax profit for 2024. The pest control company reported revenue growth of 1.1% to £5.44 billion, but North America lagged behind, with an organic revenue growth of 1.5%, despite accounting for approximately 60% of total revenue last year. Adjusted operating margin fell to 15.3% from 16.7%, primarily due to a decline in North American margins. CEO Andy Ransom attributed the weakness to challenges in integrating Terminix, a recent acquisition, but reaffirmed that the process remains on track for completion by 2026. While North America remains sluggish in Q1 2025, Rentokil expects full-year results to meet market expectations as it refines sales and marketing strategies.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.