18 March 2025

The UK economy showed signs of strain last week, with a cooling jobs market, weak consumer spending and rising corporate distress. Hiring slowed in February, with the smallest increase in starting salaries in four years, while permanent job appointments declined for the 29th month. Consumer spending growth lagged behind inflation, signalling cautious sentiment amid economic uncertainty. Business distress hit a post-pandemic high, with 11.2% of firms struggling due to high debt costs. The economy contracted 0.1% in January, driven by a manufacturing downturn, adding pressure on Chancellor Rachel Reeves ahead of the Spring Statement. Meanwhile, the government faces economic challenges as growth remains sluggish, casting doubt on its ambitious targets.

The UK fiscal landscape saw significant developments, with planning reforms, budget cuts and trade negotiations all in the headlines. The government unveiled a Planning and Infrastructure Bill to accelerate decisions on housing and major projects, aiming for 1.5 million new homes. Meanwhile, plans to halve NHS England’s central staff sparked concerns about the impact on healthcare. On trade, the UK opted for a diplomatic approach to US steel tariffs but left retaliation open. Defence spending is set to rise to 2.5% of Gross Domestic Product (“GDP”) by 2027, partially funded by foreign aid cuts.

UK infrastructure stocks surged last week as the government’s growth plans boosted investor confidence. Costain Group and Kier Group raised their dividend outlooks, anticipating gains from the government's commitment to 150 major projects by 2029. Meanwhile, officials pushed pension funds to allocate 10% of assets to British equities, aiming to unlock capital for domestic investment.

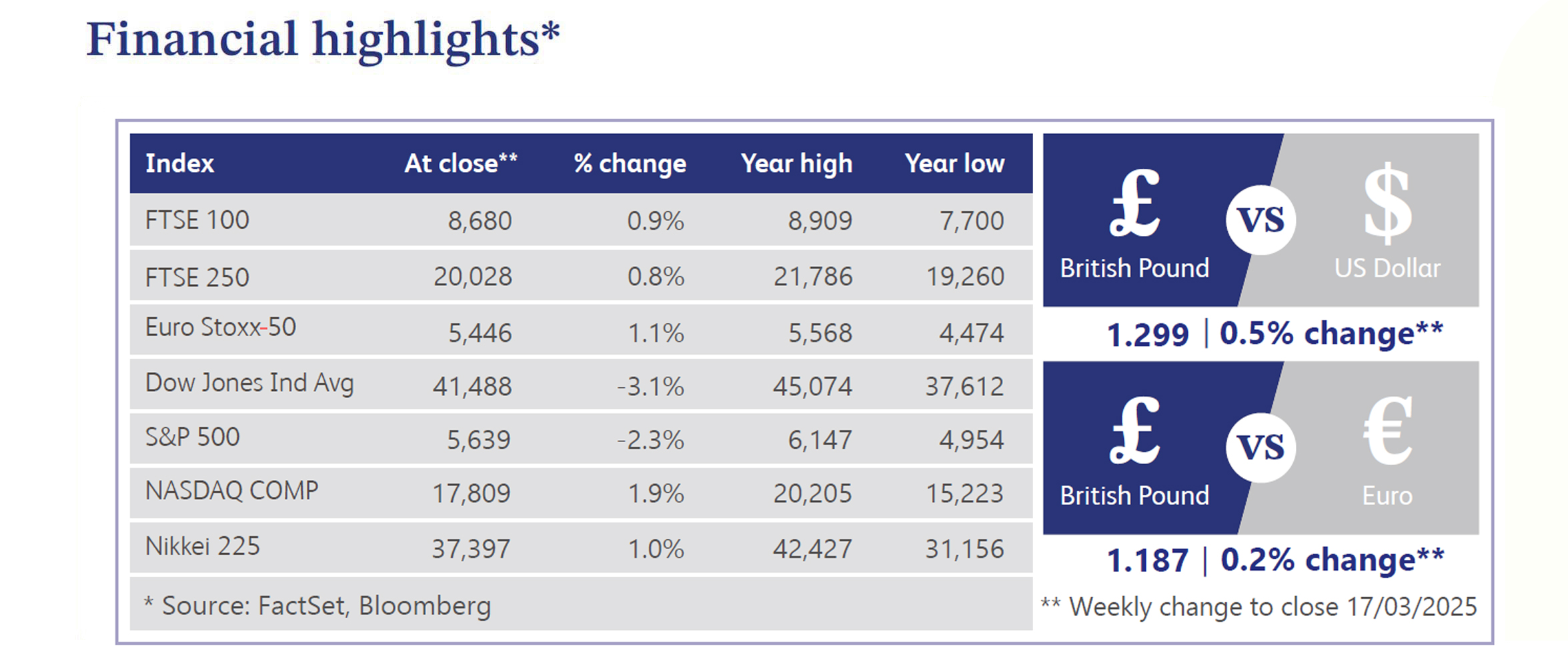

Meanwhile, US markets remained under pressure, with the S&P 500 entering correction territory. Tech stocks showed resilience, but broad-based weakness persisted, particularly in retail and banking. Gold hit a record high above $3,000/oz, while oil logged its eighth consecutive weekly decline. Trade tensions escalated with new US tariffs, while softer inflation data failed to shift risk-off sentiment. Washington averted a government shutdown, and geopolitical focus turned to a ceasefire in Ukraine. Positive signs included easing US-Canada trade tensions and steady consumer spending, but macro uncertainties continued to weigh on market sentiment.

The UK housing market saw its weakest month since late 2023, as buyer demand hit its lowest level since November, according to a Royal Institution of Chartered Surveyors' (“RICS”) survey. House prices and agreed sales declined, with London experiencing a sharp drop in transactions. The slowdown follows the end of a rush to close deals before a tax break expired, dampening market momentum. Agents expect further price declines over the next three months, reflecting a cooling property sector amid cautious sentiment. The data highlights ongoing challenges in the housing market as economic uncertainties weigh on buyer confidence and affordability concerns persist.

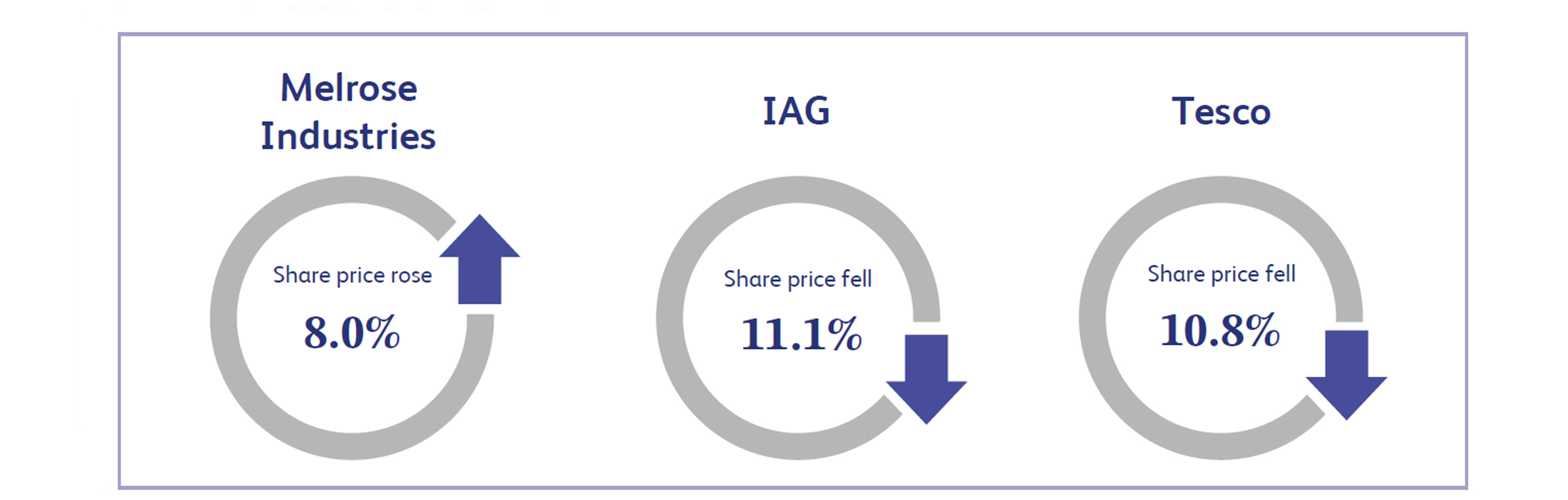

Melrose Industries, which engages in aerospace manufacturing and industrial businesses, surged 8% after RBC Capital Markets raised its earnings forecast and reaffirmed an "outperform" rating. The aerospace company provided solid 2025 guidance, with projected revenue between £3.55 billion and £3.7 billion, and adjusted operating profit of £700 million - above analyst estimates. Long-term targets were also strong, exceeding consensus estimates. RBC analysts responded by increasing their forecasts through 2027. Despite a muted initial market reaction to Melrose’s full-year results, RBC viewed the update as highly supportive, particularly due to strong free cash flow projections.

IAG, provider of passenger and freight air transportation services, shares tumbled 11.1% after Barclays downgraded the stock to "underweight," citing concerns over weakening transatlantic travel demand. Barclays warned that US airline profit warnings could extend to European carriers, given their high exposure to North American markets. Geopolitical tensions between the US and Europe might also deter American travellers, impacting premium leisure demand. While major airlines are expected to remain profitable, Barclays now anticipates lower profitability than previously forecast. The downgrade triggered a sector-wide sell-off.

Tesco, the grocery retailer, fell 10.8% after Asda’s profit warning sparked concerns about intensifying competition in the UK grocery market. Asda announced plans to invest heavily in pricing and store improvements in 2025, raising fears of a price war that could pressure margins across the sector. Analysts at Jefferies noted uncertainty over whether Asda can sustain aggressive price cuts but warned that competitors might need to react pre-emptively. The prospect of tighter margins and shifting market dynamics led to a sector-wide sell-off. Investors remain cautious, awaiting sales volume trends before reassessing valuations in the coming months.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.