25 March 2025

The Bank of England (“BoE”) maintained its base rate at 4.5% last week, prioritising a gradual approach amid persistent inflation and wage pressures. Markets are now assigning a 70% probability of a May rate cut, with only two reductions anticipated this year, fewer than economists forecasted. The Organisation for Economic Co-operation and Development (“OECD”) has downgraded UK growth projections for 2025 and 2026, citing global trade risks. Business sentiment remains cautious, with 57% of firms expecting a recession. Manufacturing output has weakened sharply, and insolvencies are rising. Consumer confidence is improving, but investment hesitancy persists due to fiscal uncertainty. Options traders are increasingly betting on more aggressive BoE rate cuts. However, the BoE is facing challenges, balancing weak growth with persistent inflation risks, particularly in the face of global trade tensions.

Chancellor Rachel Reeves has unveiled plans to cut red tape and streamline regulators to stimulate economic growth, including restricting competition regulators’ powers and reducing regulatory costs. Ahead of her Spring Statement, Reeves has pledged to lower government debt, emphasising fiscal responsibility amid expected growth forecast downgrades. The government will announce welfare reforms aimed at saving £6 billion, despite Labour opposition, with changes expected to reduce benefit eligibility for one million people. Reeves is also set to rebuild the £9.9 billion fiscal buffer wiped out after the October budget through spending cuts and accounting shifts. No tax increases are planned, but departments face potential 7% budget reductions, marking the largest cuts since the Conservatives’ austerity programme of the early 2010s.

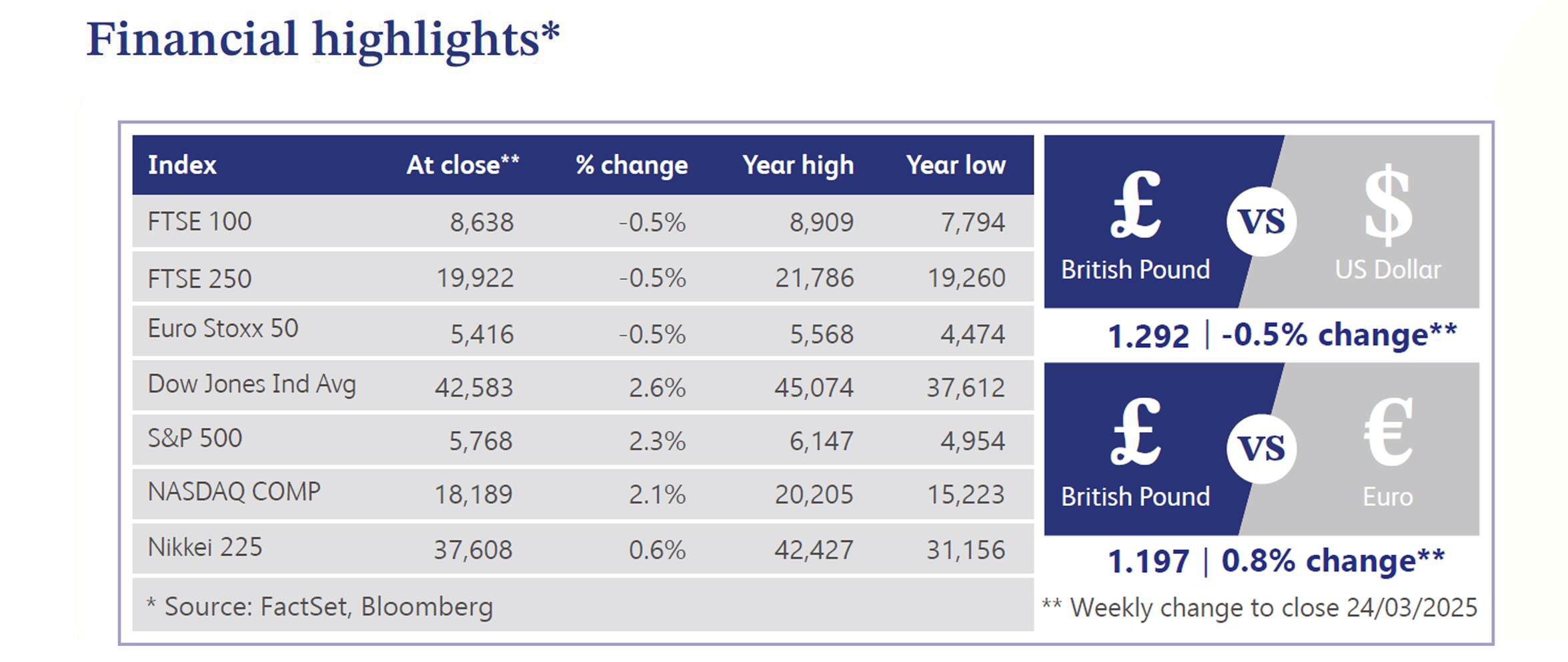

The pound climbed above $1.30 for the first time since November, driven by expectations that UK interest rates will stay elevated relative to its peers. Gilts are yielding their most versus US Treasuries since late 2023, while market pricing suggests 0.50% of BoE easing versus 0.65% for the Federal Reserve (“Fed”). Meanwhile, UK bond issuance is set to hit £308 billion for 2025-26, a near-record outside the Covid-19 pandemic, with investors urging more shorter-dated sales.

Meanwhile, US equities edged higher, breaking a four-week losing streak. The S&P saw mixed sector performance, while Treasuries firmed with curve steepening. Dovish takeaways from the Fed’s March meeting provided support, with unchanged 2025 rate cut projections. Economic data was mixed, with strong housing starts but weak retail sales revisions. Investors remained wary of potential trade policy shifts, including Trump’s upcoming tariff decisions, and geopolitical risks. Concerns also persist over weakening consumer spending ahead of the first quarter earnings season.

UK homeowners are facing intense competition, forcing them to curb prices, according to Rightmove. March, typically strong for sellers, has seen only a 1.1% price rise, with the number of sellers at its highest since 2015. Market activity is distorted by an impending stamp duty change from 1 April, with an estimated 74,000 transactions expected to miss the deadline.

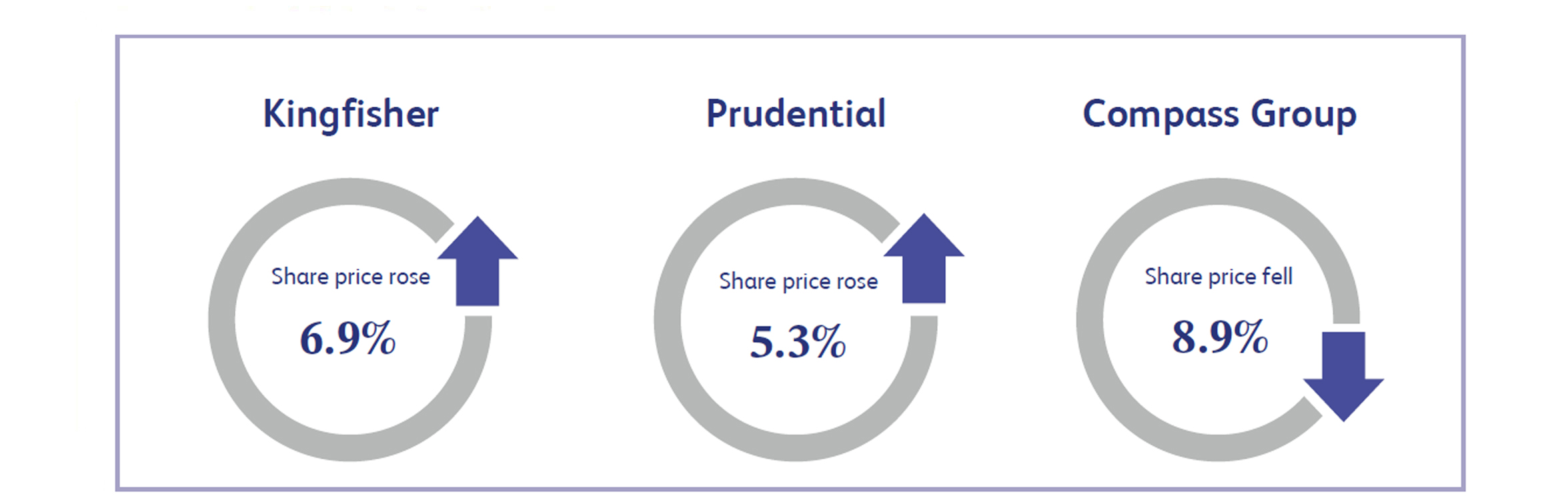

Kingfisher, the home improvement retailer, saw its shares rise 6.9% last week. The stock gained as Deutsche Bank analysts suggested its fiscal 2026 guidance may be conservative, despite concerns over performance in France. The company is expected to forecast a pretax profit of £500 - £550 million for fiscal 2026, while its fiscal 2025 profit is estimated at £512 million, within guidance. Management remained optimistic about European do-it-yourself (“DIY”) prospects post-Covid. A completed £300 million share buyback further supported sentiment.

Prudential, the insurance and financial services provider, climbed 5.3% after posting stronger-than-expected 2024 results. The company reported an 11% rise in new business profit to $3.08 billion and a 10% increase in operating profit to $3.13 billion. Analysts welcomed new targets for double-digit growth in 2025 across key metrics, as well as the decision to halt additional capital injections into its Chinese joint venture. Prudential also announced an acceleration of its $2 billion share buyback, expected to complete by 2025, with an additional $1 billion anticipated in 2026. These updates reassured investors and drove a re-rating of the stock.

Compass Group, the leading food service provider, declined 8.9% as sector-wide concerns weighed on sentiment. The sell-off followed a profit warning from French peer Sodexo, which cut its revenue growth forecast to 3-4% from 5.5-6.5%, citing weaker-than-expected North American growth. JPMorgan warned that Sodexo’s outlook could negatively impact the broader catering industry. Compass shares fell, mirroring losses in rivals Elior (-6.8%) and Sodexo (-15.9%). Investors remain cautious as macroeconomic pressures could weigh on the sector’s profitability.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.