8 April 2025

Donald Trump’s long-anticipated tariff plan was unveiled last week, marking a significant escalation in US trade policy. At its core is a universal 10% tariff on all imports, supplemented by steep country-specific duties including 34% on China, 32% on Taiwan, 46% on Vietnam and 20% on the European Union (“EU”). These rates were calculated using a deficit-to-export ratio methodology. The United Kingdom, which maintains a goods trade surplus with the US, was subject only to the baseline rate, and is expected to prioritise securing a bilateral trade agreement rather than pursuing immediate retaliation. Canada and Mexico retained their existing 25% tariffs, though USMCA (United States - Mexico - Canada Agreement) compliant goods remain exempt. In response, China imposed a blanket 34% tariff on all US imports, intensifying global trade tensions and catalysing a broad market sell-off.

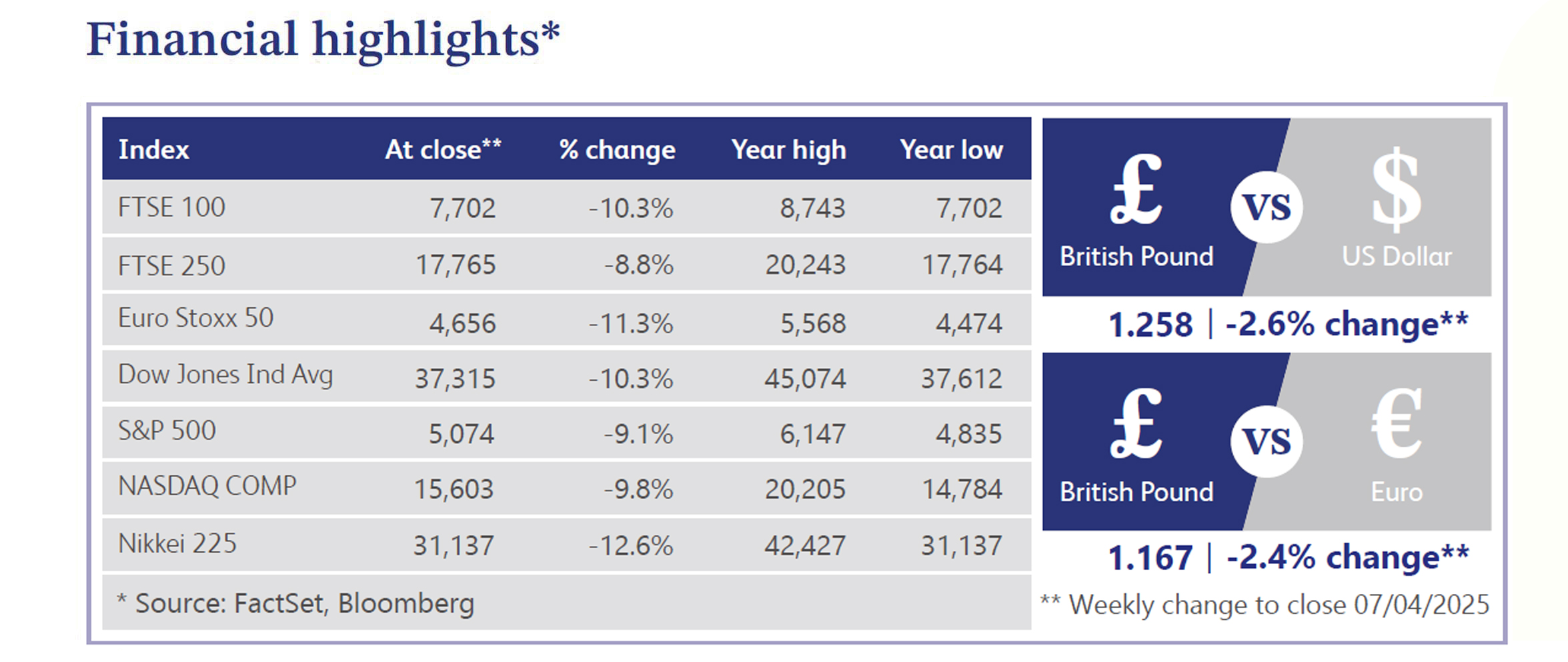

Global equities tumbled, with the MSCI World Index down 8.5% and the S&P 500 losing 9.1%, led by sharp declines in high-valuation technology shares. European markets also came under pressure, as the Euro Stoxx 50 fell 11.3% and the FTSE 100 declined 10.3%, although the UK’s relatively limited exposure to US trade, just 2.2% of GDP, provided some insulation. Defensive sectors, including Healthcare, Food & Beverage and Telecoms, held up comparatively well across all regions. Investors sought refuge in safe-haven assets, driving US 10-year Treasury yields below 3.9%. However, gold fell 2.5% as investors took profits following its significant recent gains, while oil prices dropped to $64 per barrel after OPEC+ (the Organisation of the Petroleum Exporting Countries) announced a supply hike.

The longer-term impact of rising tariffs is expected to weigh heavily on both inflation and growth, with effects varying by region. In the United States, core inflation is projected to remain above the Federal Reserve’s 2% target, with forecasts ranging from 3% to 4.5%, depending on the final tariff burden, dollar strength and the degree of consumer pass-through. The most recent reading came in higher than expected at 2.8% year-on-year. Growth expectations have also been revised down, with consensus now pointing to sub-1% annual growth by late 2025. This leaves the Federal Reserve in a challenging position. Markets still anticipate three 0.25% cuts this year, but Chair Jerome Powell noted on Friday that tariffs could push inflation higher while suppressing output. In Europe, easing price pressures support further monetary policy loosening. March inflation in the eurozone edged down to 2.2%, paving the way for another rate cut at the European Central Bank’s April meeting. Similarly, UK rate cut expectations have risen, with three cuts now priced in.

Despite mounting headwinds, recent data pointed to continued resilience in the global economy, particularly in labour markets. Unemployment remained stable at 4.2% in the US and 4.4% in the UK. US non-farm payrolls rose by 228,000 in March, well above expectations. However, forward indicators suggest labour demand may be softening, with declines in job openings, subdued hiring plans and rising corporate layoffs. In the US, manufacturing activity slipped back into contraction territory at 49 points, after two months of expansion. The services sector remained more robust, registering its ninth consecutive month of growth with a reading of 51 points. Meanwhile, Europe’s composite Purchasing Managers’ Index climbed to 50.9 points, the highest in seven months, reflecting renewed strength in manufacturing output and continued growth in services.

St. James’s Place, the wealth management firm, experienced a decline of 19.1% over the past week. While no specific negative news directly affected the company, its share price has been on a downward trajectory since February, following a significant rally since last April after regulatory changes required the company to adjust its charging structure and address client servicing issues. Despite reporting strong full-year profits in February, investor sentiment has shifted towards profit-taking, likely exacerbated by recent tariff uncertainties, which appear to have acted as a catalyst for the sell-off.

Glencore, the global mining company, saw a 19% decline in its share price over the week. The company’s 2024 annual report revealed a pre-tax loss of approximately $1 billion, as rising expenses outpaced revenue, putting significant strain on the bottom line. Additionally, concerns surrounding US tariffs and the potential for a global economic slowdown further weighed on the stock, with Glencore being particularly vulnerable given its cyclical nature.

The share price of Associated British Foods (“ABF”), the multinational food processing and retailing company, bucked the trend in gaining 0.8% over the week. This resilience can be attributed to several factors. Despite broader market volatility and concerns surrounding recent tariff developments, ABF's defensive positioning within the consumer sector allowed it to navigate these challenges more effectively. Additionally, its limited exposure to the US market, accounting for just 8% of total sales, provided further protection from any substantial impacts of tariff-related disruptions.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.