6 May 2025

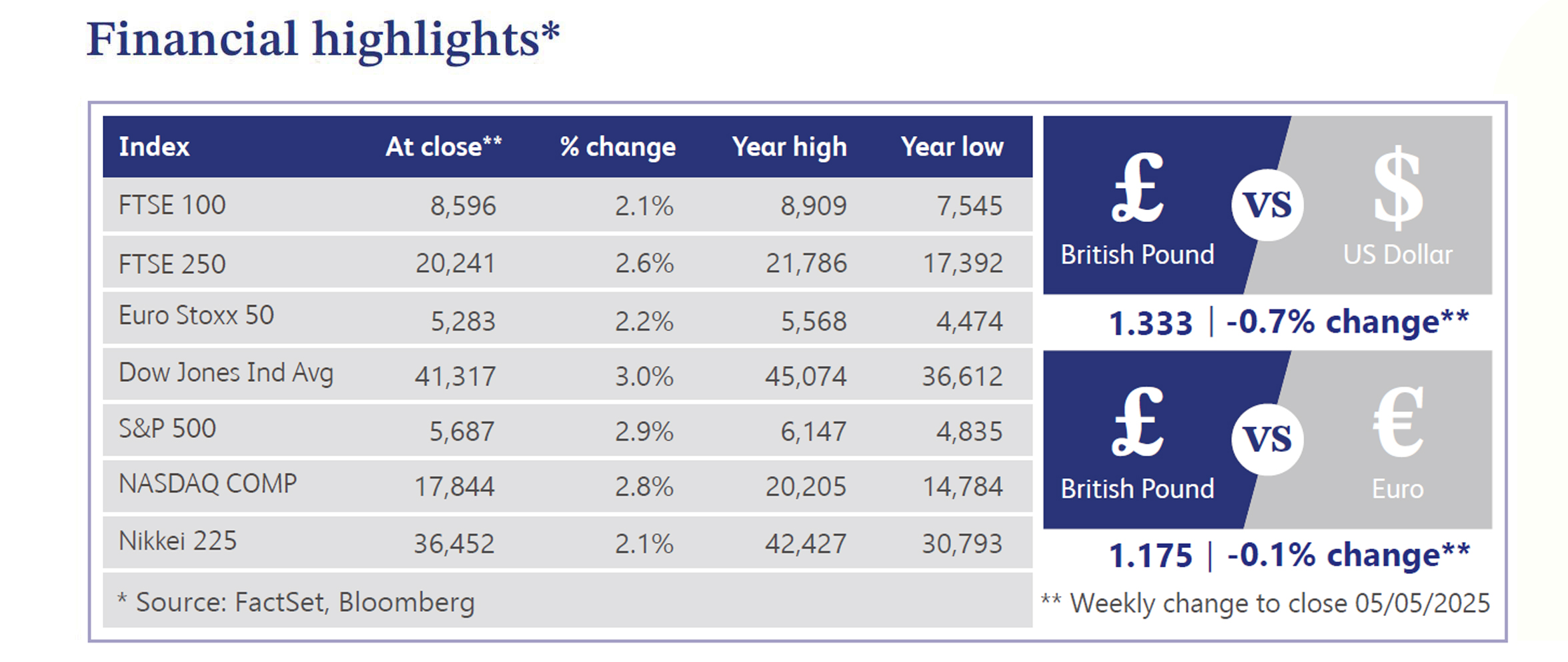

Markets rebounded last week, led by the United States (“US”), as global risk sentiment improved amid signs of de-escalating trade tensions. China confirmed it is evaluating recent US overtures, while negotiations with Mexico progressed constructively. The S&P 500 recovered to levels above the early April decline following Donald Trump’s “Liberation Day” tariff announcement.

With 72% of S&P 500 companies having reported their results, blended earnings per share (“EPS”) growth now stands at 12.8%, a significant improvement from 7.2% estimated at the end of the previous quarter. While many companies cited limited visibility on future guidance, corporate commentary remained broadly constructive. Investor sentiment was positive, with growing confidence that businesses are well positioned to navigate slowing global growth and potential trade-related disruptions.

US gross domestic product (“GDP”) declined by 0.3% in the first quarter. However, this headline figure was largely dismissed by markets as it reflected a sharp rise in imports ahead of anticipated tariffs. More encouragingly, real household consumption, the primary driver of US growth, rose by an annualised 1.8%. Equipment investment and inventory rebuilding also contributed further support to growth. Job openings remained stable but softened slightly, partly due to a federal hiring freeze. The April non-farm payrolls report surprised to the upside, showing 177,000 jobs added compared with expectations of 138,000. The unemployment rate remained unchanged at 4.2%. However, the consumer confidence index weakened further, falling to a five-year low amid deteriorating expectations and increasing labour market pessimism.

Headline and core Personal Consumption Expenditures (“PCE”), the Federal Reserve’s (“Fed”) preferred measure of inflation, came in slightly above expectations for March. With inflation moderating and the labour market holding steady, the Fed is expected to keep rates unchanged at 4.5% during this week’s meeting. Markets now anticipate three Fed rate cuts this year rather than four. The US Dollar Index rose slightly, gold declined by 1.7%, and West Texas Intermediate (“WTI”) crude oil fell by 7.5%, ending the week below $60 per barrel.

In the UK, local elections reshaped the political landscape. Reform UK gained 677 council seats, while Labour and the Conservatives lost 186 and 676 seats respectively. These results challenged the dominance of the two main parties and signalled a shift in public sentiment. The Bank of England (“BoE”) is expected to reduce interest rates this week from 4.5% to 4.25%. The market currently anticipates an additional three rate cuts this year as growth risks come into sharper focus.

In Europe, equities extended their gains for a third consecutive week. This was supported by easing trade tensions and corporate earnings that outperformed subdued expectations. Eurozone GDP grew by 0.4% in the first quarter, marking five consecutive quarters of expansion. Eurozone inflation was unchanged in April at 2.2%, slightly below expectations. Nonetheless, core and services inflation accelerated, highlighting continued pricing pressure in areas that have proven more resistant to disinflation. The European Central Bank (“ECB”) is expected to respond by implementing a 0.25% rate cut in June, focusing on economic stability rather than short-term inflation data.

Smith & Nephew, the British medical technology firm, saw shares rise 8.3% following a better-than-expected first quarter update. The company reported underlying revenue growth of 3.1%, reaching $1.41 billion. Notably, the orthopaedics division, which includes hip and knee implants, experienced a 3.2% increase, driven by continued improvements in the US market, which helped to offset ongoing challenges in China. Smith & Nephew also highlighted strategies aimed at mitigating tariff impacts through its global manufacturing network. The company reaffirmed its full-year guidance, targeting approximately 5% revenue growth and a margin target of 20%, providing positive sentiment among investors.

Associated British Foods, the British multinational food processing and retailing company, saw its shares fall 8.4% after reporting a 10% decline in first-half profits. The company’s performance was primarily affected by weaker results from its sugar business, which led to a downward revision of its full-year outlook. However, the company remains optimistic about its retail division, Primark, which contributes about half of its revenue. New Primark stores are planned for both Europe and the US, which are expected to help offset weaker sales in the UK and Ireland. Despite the challenges, Associated British Foods maintained its guidance for Primark, forecasting low single-digit sales growth and adjusted operating profit margins in line with the previous year, indicating some resilience within the retail segment.

Glencore, the Anglo-Swiss miner, saw its shares drop by 7% after reporting a 30% decline in first-quarter copper production. This decline was attributed to ongoing global trade tensions, which have weighed on industrial metal prices. Despite this setback, the company has maintained its full-year production guidance for 2025, with expectations of higher output in the coming months. Analysts remain optimistic about growing demand for copper, cobalt, and other minerals critical to the transition to electric vehicles and renewable energy infrastructure.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.