24 June 2025

The UK economy continues to show mixed signals. The Bank of England ("BoE") held rates steady last week, with Governor Andrew Bailey noting that while inflation eased to 3.4% in May from 3.5%, sticky services inflation (4.7%) and global risks mean no firm commitment to a rate cut in August. Retail sales slumped 2.7% month-on-month in May - the sharpest drop since December 2023 - driven by weaker food, clothing and fuel demand. The labour market softened, with job postings rising just 0.3% while active listings fell 1.8%. Meanwhile, consumer confidence rose, led by Generation Z, following a rise in the minimum wage. However, 33% of UK firms plan to reduce staff and 46% intend to raise prices after a £25 billion payroll tax hike. Uncertainty around trade, inflation data reliability and digital currency plans add to the cautious outlook.

UK fiscal dynamics remain challenging despite a new political backdrop. Public borrowing in May hit £17.7 billion - its second-highest May level since 1993 - reflecting the enduring strain on public finances. Chancellor Rachel Reeves defended recent tax hikes, notably the employers’ national insurance (“NI”) rise, while warning of a potential £20 billion shortfall due to over-optimistic productivity assumptions. Reeves has signalled possible tax changes on dividends and bank profits but remains firm on not raising income tax, employee NI or VAT. Meanwhile, a proposed £725 billion infrastructure plan aims to boost investment, yet business concerns grow over rising tax burdens and global trade tensions, particularly with the US. Trump’s “revenge taxes” and ongoing tariff threats are prompting UK firms to reconsider US exposure, with 60% of manufacturers expecting negative impacts. Despite these headwinds, Reeves continues to court investors, branding Britain an “oasis of stability” - a message aimed at bolstering confidence ahead of potentially painful fiscal decisions later this year.

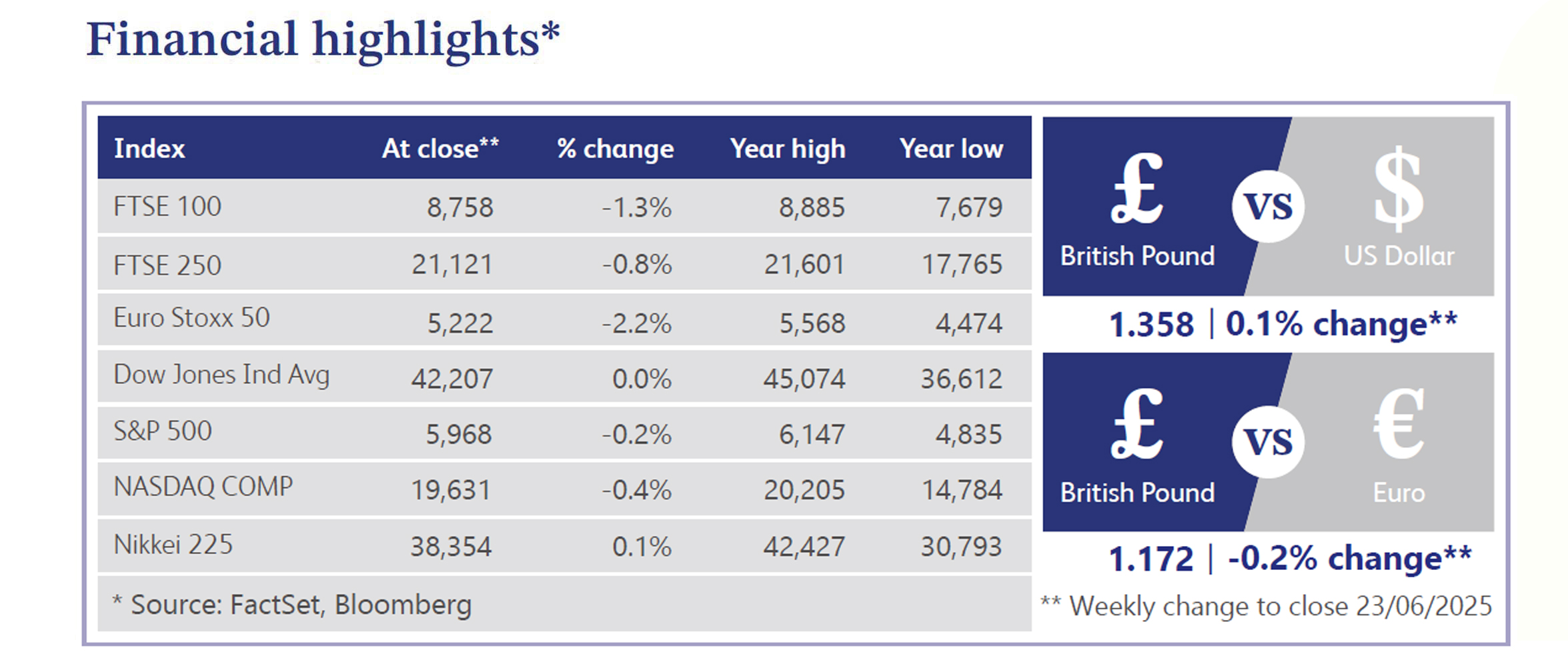

UK equity markets remain under pressure amid weak listings, prompting officials to seek closer ties with China to revive initial public offering (“IPO”) activity. London’s pitch to Chinese firms to list in the UK or Shanghai signals an urgency to attract capital and fend off US competition. In the US, equity markets were mixed as geopolitical tensions around Iran weighed on sentiment. Big tech delivered a split performance with Nvidia up 1.3% and Alphabet down 4.6%. Treasuries firmed, the dollar strengthened (+0.6%) and oil edged higher (+1.1%), reflecting market jitters over potential Middle East disruption. Meanwhile, the Federal Reserve (“Fed”) held rates steady and flagged persistent inflation risks, though some members hinted at possible cuts as early as July.

UK house prices dipped unexpectedly in June, with Rightmove reporting a 0.3% monthly decline, reversing May’s 0.6% rise. The annual gain slowed to 0.8% from 1.2%, as the market adjusts following the stamp duty holiday. Rightmove noted it’s rare for prices to fall in June, though affordability and supply are creating mixed dynamics across regions. In the prime London market, nom-doms exiting the UK are struggling to sell luxury homes, with listings of £5 million+ properties at record highs while deals dropped 15% year-on-year. Meanwhile, London retained its global appeal for commercial real estate, attracting $87 billion in private capital since 2013 and topping JLL’s investor rankings - highlighting a split between residential softness and resilient institutional interest in UK property.

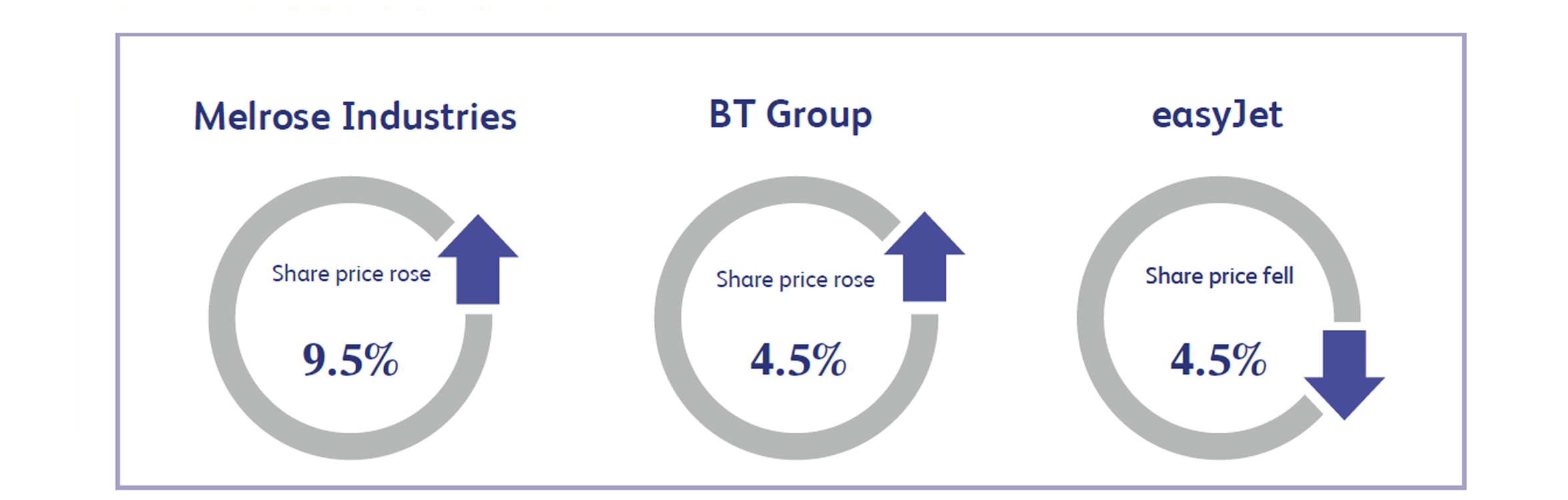

Melrose Industries, a global aerospace manufacturer, saw its shares rise 9.5% amid continued strength in its defence segment. The company specialises in airframe and engine structures, serving both civil and military platforms. RBC analysts noted a 74% surge in Melrose’s Swedish defence business in 2024, though they expect a modest decline in 2025. Still, demand remains strong, driven by Sweden and clients like Czechia. Importantly, Melrose’s involvement in next-generation military aircraft programmes - such as the US Next Generation Air Dominance and Europe’s Future Combat Air System - positions it well for long-term growth in the global aerospace defence market.

BT Group rose 4.5%, buoyed by broader market gains following Chancellor Rachel Reeves’ fiscal announcements. The telecom giant is reportedly in early talks to acquire TalkTalk, aiming to strengthen its broadband footprint. Separately, BT is enhancing customer engagement through AI-powered Verint bots in sales contact centres. However, Chief Executive Officer (“CEO”) Allison Kirkby warned of over 40,000 job cuts by 2030 as part of cost-saving efforts, driven by automation. BT continues to streamline operations, eyeing up to £3 million in cost reductions. The company remains central to the UK’s digital infrastructure and policy discussions, especially amid growing interest in AI-driven efficiency.

easyJet shares fell 4.5% as heightened geopolitical tensions in the Middle East weighed on the broader airline sector. Israel’s recent strikes on Iran raised fears of a prolonged conflict, pushing oil prices higher and stoking concerns over travel disruption. JPMorgan analysts noted that rising fuel costs and potential declines in passenger confidence could challenge airline profitability in the near term. Despite these headwinds, easyJet retains solid fundamentals, with demand for European travel expected to hold up during the summer season. Nevertheless, investor sentiment remains sensitive to macro risks, particularly those affecting fuel costs and international travel stability.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.