5 August 2025

The Bank of England (“BoE”) is reportedly considering slowing the pace of quantitative tightening amid rising gilt yields, with Deutsche Bank suggesting this could save the Treasury up to £5 billion next year. Meanwhile, economic signals remain mixed. EY upgraded its UK 2025 growth forecast to 1%, though momentum is expected to remain subdued. Retail sales remain weak, and business distress is rising, with nearly 50,000 firms in critical condition. The International Monetary Fund (“IMF”) expects two more BoE rate cuts this year, supporting growth prospects, while Lloyds’ business confidence hit a 10-year-high. However, consumer caution persists, with savings surging and food inflation posing risks ahead of Christmas.

UK fiscal concerns came into focus as Chancellor Rachel Reeves faced growing pressure to avoid tax hikes while preserving her £9.9 billion fiscal headroom. JP Morgan suggested reducing this buffer could prevent broad tax rises. Meanwhile, American hedge fund manager, Ray Dalio, warned of a UK “debt doom loop”, with rising debt and tax burdens fuelling capital flight concerns. Uncertainty over wealth tax proposals has prompted advisers to report rising client interest in relocating. Public sector pensions also drew scrutiny after taxpayer contributions surged by a record £47 billion. Amid these strains, calls mounted for higher gambling taxes, though banks like Barclays cautioned against further sector-specific levies. On trade, UK steel won a boost from expanded EU quotas, while Prime Minister Keir Starmer sought zero tariffs from the US.

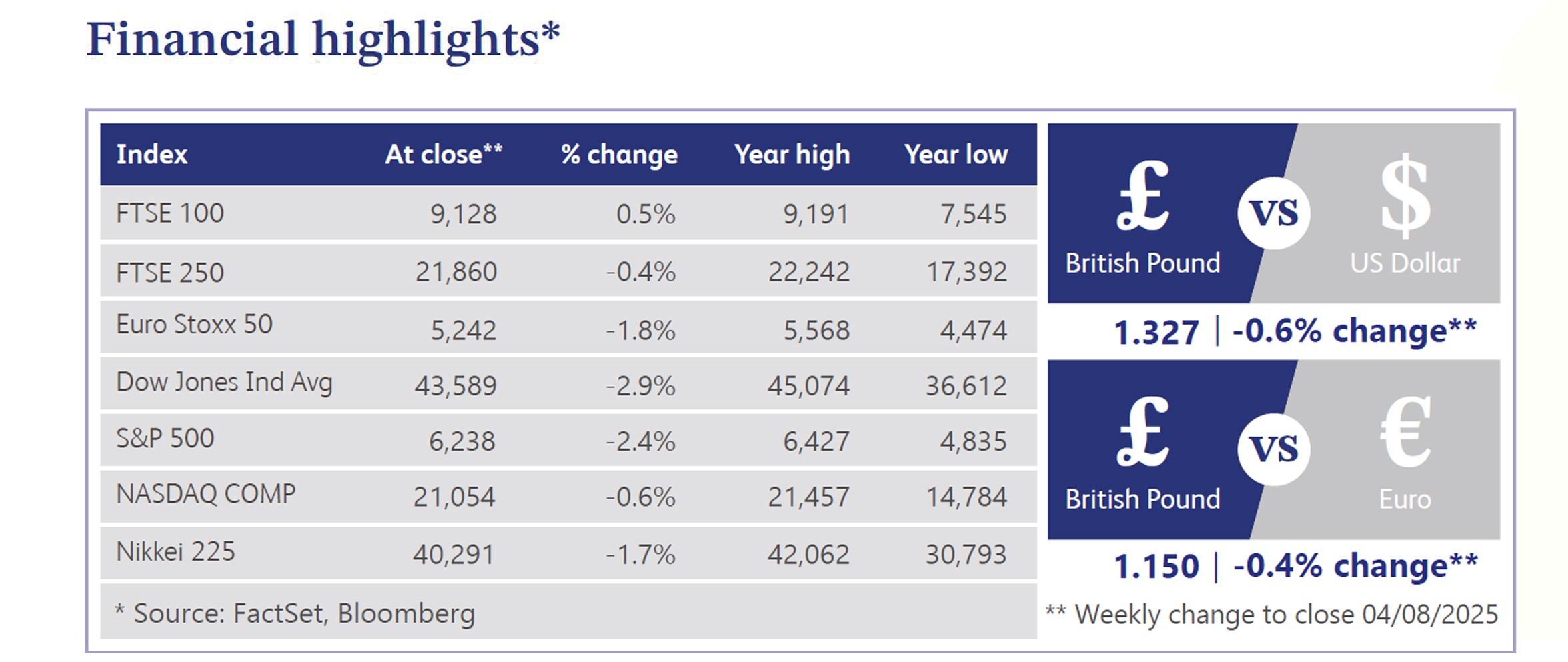

A popular trade on the UK 2061 gilt backfired as its value plunged over 50% since 2022 amid long-duration bond selloffs and fiscal concerns. Sterling edged higher ahead of the US Federal Reserve (“Fed”) decision, though investor sentiment remains divided on the BoE’s rate path, with sticky inflation and weak data complicating the outlook. Meanwhile, Rachel Reeves’ initiative to boost domestic investment risks was met with criticism, with concerns that a campaign featuring a major US platform could drive capital abroad. In gilts, the UK introduced an “associate” tier of market makers, with BMO and TD Bank taking up lighter-duty roles under the Debt Management Office’s (“DMO”) updated structure.

US equities declined, reversing recent gains as weak July nonfarm payrolls and downward revisions reignited growth concerns. Big Tech earnings were mixed, with Microsoft and Meta outperforming while Apple and Amazon fell. Broader market breadth was negative, with small-caps, materials and airlines underperforming. Utilities and mortgages led gainers. Hawkish Fed commentary tempered rate cut hopes despite soft labour data. Trade tensions resurfaced as President Trump imposed new tariffs on India, Brazil and copper, denting sentiment. Treasuries rallied, the dollar strengthened and gold rose 1.9%. WTI crude gained 3.3%. Market focus remains on the Fed’s next move and escalating global trade frictions.

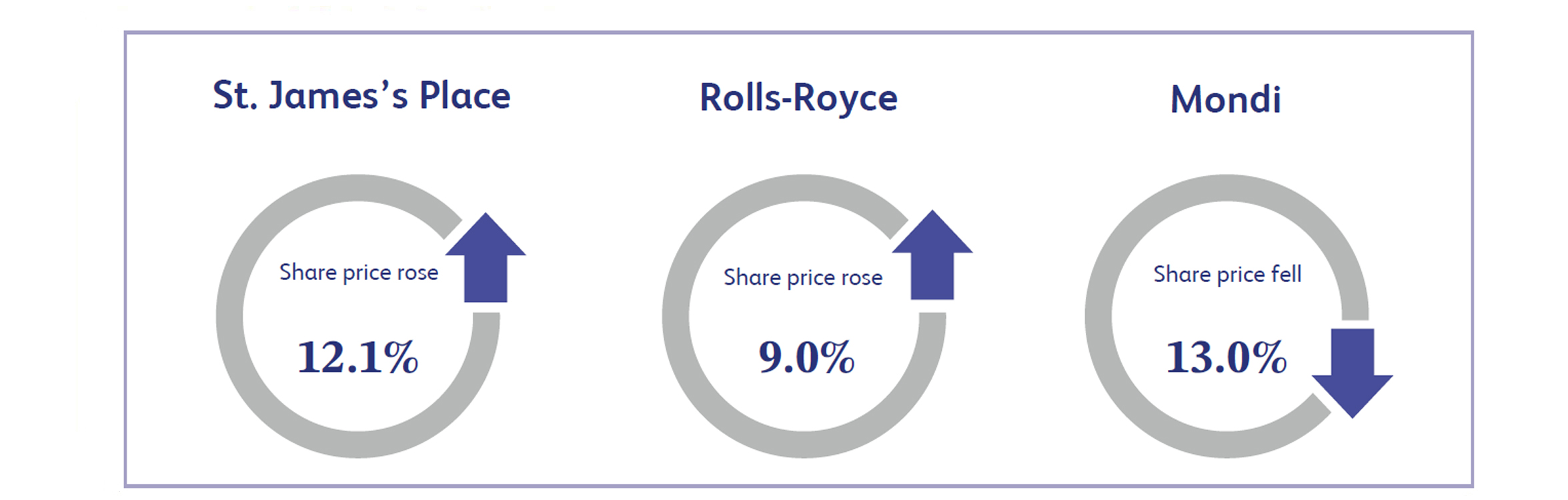

St. James’s Place (“SJP”), the UK-based wealth manager offering financial advice and investment management, surged 12.1% after better-than-expected first half (“H1”) results. New inflows, funds under management, and cash profits exceeded expectations, easing concerns around pricing changes. The firm’s resilience highlighted that client loyalty and advice quality outweigh fee sensitivity. Analysts at Panmure Liberum noted the strong business volumes affirmed SJP’s position as a leader in relationship-driven wealth management. Shares jumped to their highest level since March 2023, reflecting renewed investor confidence that the company’s pricing overhaul won’t undermine long-term growth or client retention.

Rolls-Royce, the UK engineering group best known for its aircraft engines and power systems, rallied 9% after raising full-year guidance on the back of strong H1 results. Civil aerospace led gains thanks to robust aftermarket demand, while power systems also performed well, buoyed by data centres and government contracts. Chief Executive Officer (“CEO”) Tufan Erginbilgic’s turnaround strategy continued to deliver, with cost efficiencies offsetting inflation. Upbeat margin guidance and a resumed dividend further boosted sentiment. The shares hit a new all-time high, underpinned by a sharp rebound in air travel, strategic execution and improving supply chain conditions, despite persistent inflationary pressures.

Mondi, a British packaging and paper producer focused on sustainable solutions, fell 13% after reporting a sharp drop (17%) in H1 pretax profit. The company blamed a challenging macroeconomic backdrop, sticky input costs and weak consumer sentiment. Though it has raised prices to protect margins, cautious customer behaviour and global trade uncertainties have hurt demand. Mondi also warned of continued headwinds into the next half, despite limited direct tariff exposure. Weaker margins and geopolitical uncertainty rattled investors, dragging shares down last week. Analysts remain wary about a near-term recovery amid muted growth prospects and inflationary supply chain pressures.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.