16 September 2025

The UK economy continues to show mixed signals, with labour market weakness increasingly evident. Data from the Recruitment and Employment Confederation and KPMG revealed starting salaries growing at their slowest pace since the Covid pandemic, while staff availability surged, reflecting cooling demand. Consumer trends remained fragile with Barclaycard reporting spending up just 0.5% year-on-year, well below inflation, and the British Retail Consortium’s shopper confidence index fell further as food price pressures persisted. Retail sales saw modest support from warm weather, but underlying volumes remained soft. July gross domestic product (“GDP”) was flat, dragged down by production, although services activity remained resilient. Infrastructure financing is surging, and fintech investment continues to perform strongly, providing pockets of growth even as inflation expectations rise and fiscal pressures mount.

Political dynamics remain fluid. Prime Minister Keir Starmer reshuffled his cabinet, signalling a more centrist, growth-focused agenda. Angela Rayner’s resignation triggered a deputy leadership contest, with Bridget Phillipson and Lucy Powell emerging as frontrunners. Starmer appointed Steve Reed to housing and Pat McFadden to pensions, while outlining potential reforms to planning, welfare and employment rights. Chancellor Rachel Reeves faces the challenge of anchoring inflation while defending her pro-growth, deregulatory stance amid warnings from businesses about rising costs. Fiscal headwinds remain pronounced, with some commentators warning of a potential International Monetary Fund-style crisis, although such concerns may be overstated.

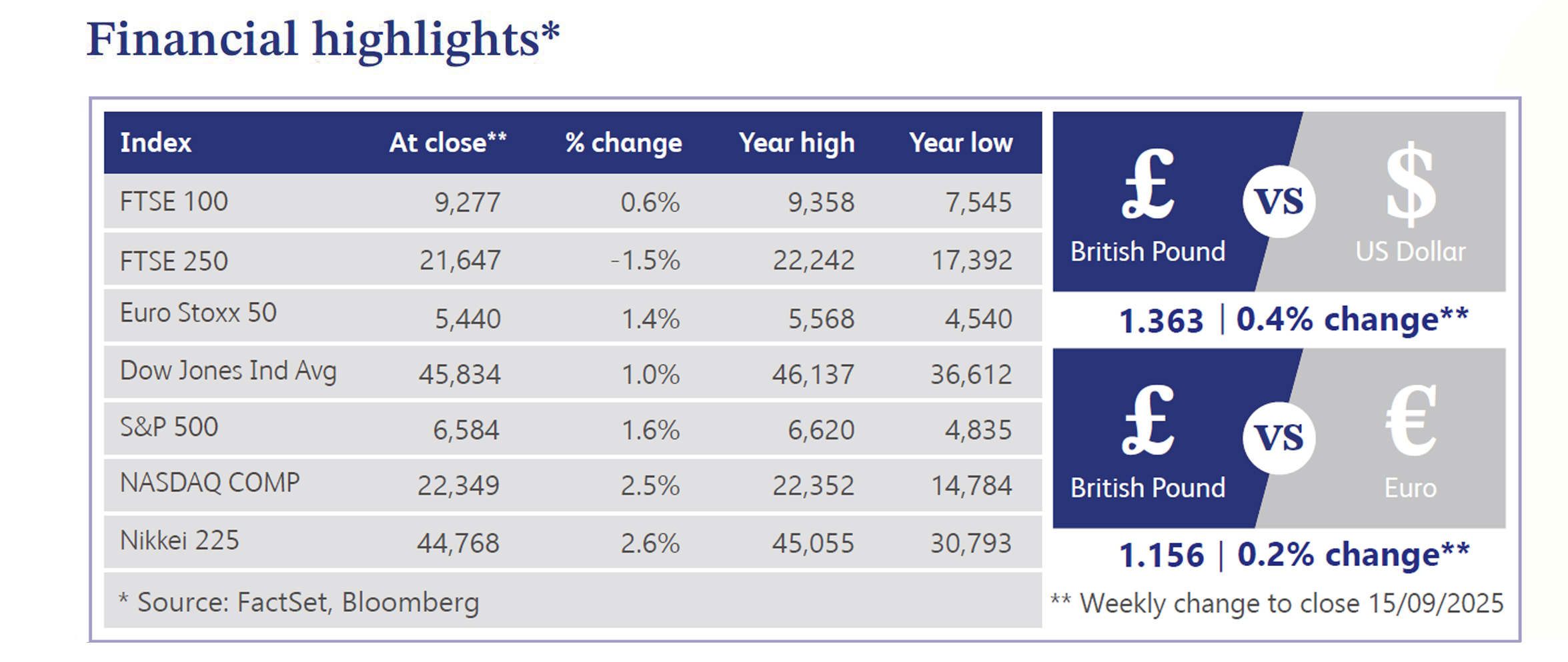

London markets are showing tentative signs of revival. Nearly a dozen private firms plan initial public offerings over the next year, raising hopes after the London Stock Exchange endured its weakest listing cycle in 28 years. Rachel Reeves is expected to meet private equity leaders to promote reforms to make London more attractive. Sentiment is improving, with 40% of investors viewing the UK favourably according to British Private Equity and Venture Capital Association data. However, structural challenges remain with UK equities and debt continuing to lag behind global peers. Additionally, Morgan Stanley has highlighted sterling’s vulnerability to volatility as it trades more like a thinly traded currency.

US equities ended the week higher, driven by technology stocks, with Oracle Corporation surging 25.5% on artificial intelligence-related bookings. The Nasdaq outperformed, while the Russell 2000 lagged. Treasuries strengthened, flattening the yield curve, as markets priced in a 0.25% Federal Reserve (“Fed”) rate cut and further easing by year-end. Payroll revisions showed nearly one million fewer jobs and jobless claims rose, supporting expectations of policy easing. The August headline Consumer Price Index (“CPI”) came in hotter than expected, while core CPI remained steady and core Producer Price Index eased. Gold climbed 0.9% and crude oil gained 1.3%, against a backdrop of ongoing US-China trade tensions.

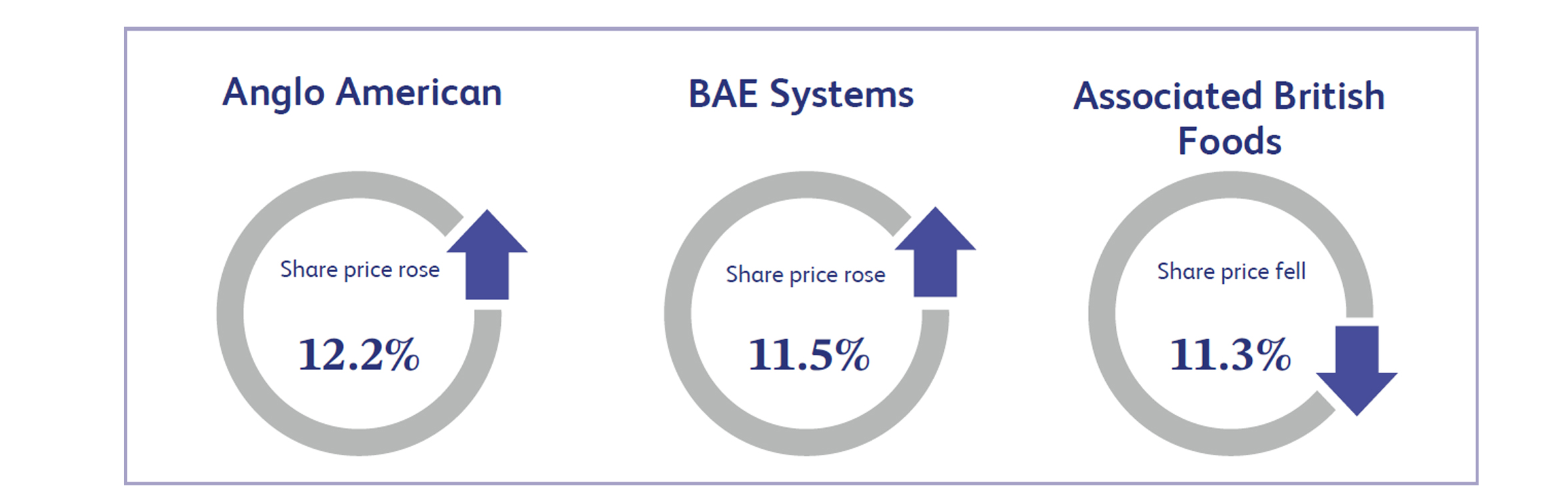

Anglo American, the British multinational mining company, rose 12.2% after announcing a merger with Teck Resources to form a $53 billion copper heavyweight with roughly 1.2 million tonnes of annual output. Investors factored in the strategic pivot towards copper, a key component for electric vehicles and renewable infrastructure, as well as the potential to unlock value from Teck’s project pipeline by leveraging Anglo’s delivery expertise. The deal also rekindled sector merger and acquisition hopes, prompting peers to rally. Analysts flagged operational synergies and upside from re-rating underappreciated assets. In short, the market is betting the tie-up accelerates growth exposure to the energy transition and materially improves Anglo’s medium-term earnings outlook.

BAE Systems, the multinational aerospace, arms and information security company, gained 11.5% after announcing strategic collaborations with Lockheed Martin to develop an uncrewed air system and fast track its Herne autonomous submarine programme. The partnership, combining BAE’s Falcon Works with Lockheed’s Skunk Works and a ten-year undersea autonomy tie up with Cellula Robotics, signals faster research and development cycles and near-term contract opportunities. Geopolitical jitters and recent drone incursions have pushed defence procurement higher, benefiting peers and enhancing order visibility. Investors rewarded BAE’s strengthened technology pipeline and contract prospects, pricing in tangible upside from growing demand for autonomous defence platforms and related export opportunities.

Associated British Foods, the food processing and retailing company, fell 11.3% after a softer update and cautious outlook. The group indicated 1% sales growth at Primark for the second half, with like-for-like sales down roughly 2%, as softer growth in Europe offset strength in the US. Management cautioned of a £40 million adjusted loss in its sugar division following the closure of the Vivergo bioethanol plant and reported an impairment of around £200 million linked to its Spanish restructuring. The combination of margin pressure, one-off charges and limited detail on recovery plans dented near-term earnings visibility. Investors sold off the stock amid growing concerns over execution and cash flow, leading to a sharp contraction in valuation multiples.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.