23 February 2021

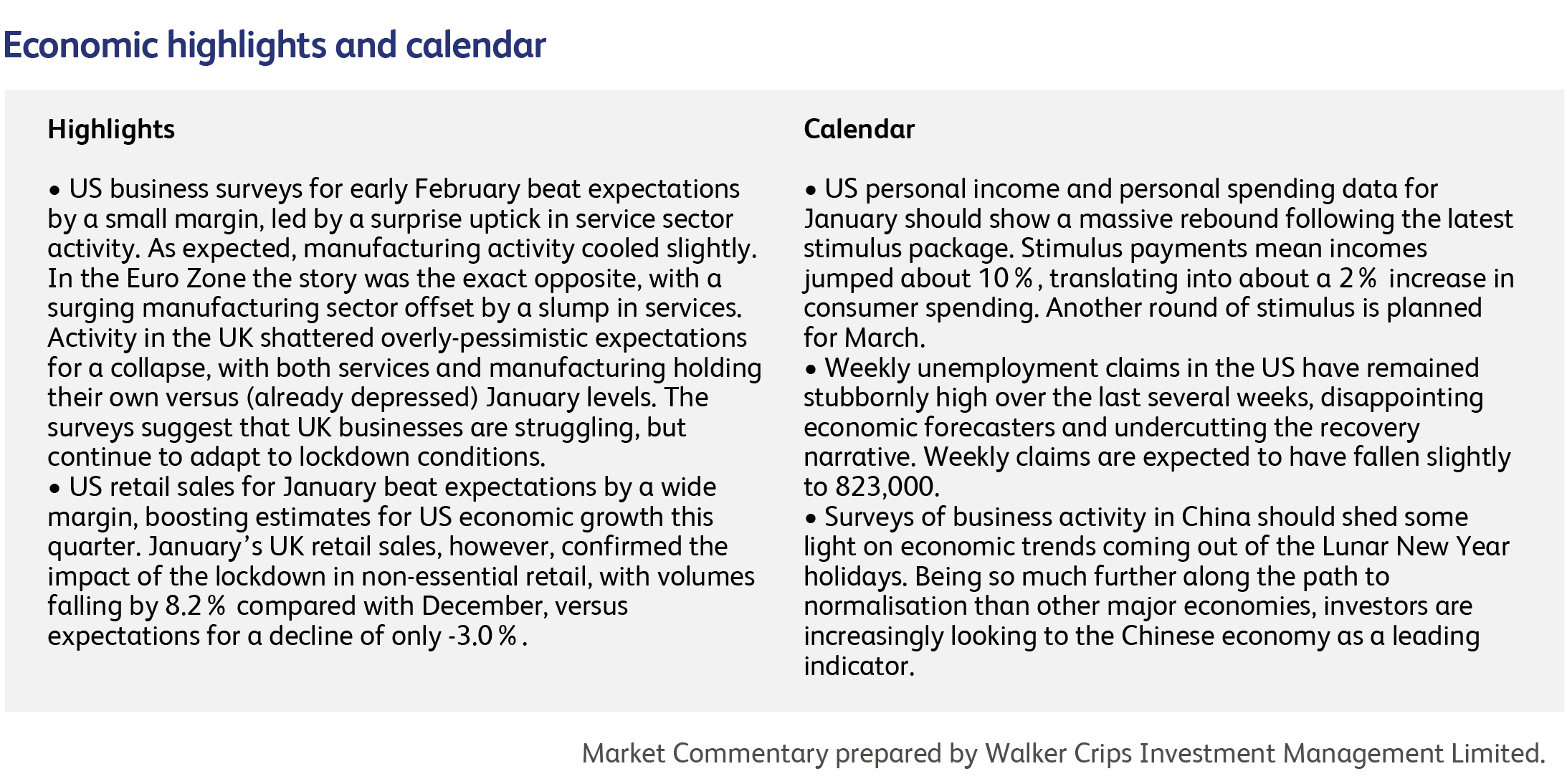

With every vaccination the world returns a little bit more to “normal”, and the moment at which central bankers have to confront the success of their monetary policies draws nearer. Until now, central bankers have been able to keep a straight face when questioned about the implications of zero interest rates and massive bond-buying programmes on roaring stockmarkets and surging asset prices, disclaiming any responsibility. Recently, however, even government bond markets have begun to buy into the recovery story. Yields on benchmark US government bonds, for example, have risen 50% since the start of the year, suggesting that investors are dumping safer-than-houses bonds in favour of riskier investments better able to protect against growth and inflation.

The problem is that, if economies are now on a more certain path to recovery, less monetary stimulus is needed. That means less need for bond-buying programmes (the US Federal Reserve is still spending $80 billion a month), the prospect of higher interest rates at some point in the not-too-distant future and, perhaps most importantly, a significant change in tone from central bankers who have become used to emphasising downside risks. Central bankers have spent the last decade turning themselves into the biggest players in capital markets – what will be the reaction when they announce their withdrawal?

The last time the US central bank tried this, in 2013, it prompted the now-famous “taper tantrum”, in which government bonds slumped and equities wobbled. This was followed by a swift U-turn in policy and more bond-buying; one of a number of such reactions by central bankers since the Credit Crunch that suggest they will spend any amount of money to prevent capital markets selling off. This behaviour has, in turn, contributed to the extraordinary confidence of investors across all asset classes – a phenomenon encapsulated in the motto, “Don’t fight the Fed”. The problem for investors is how to disentangle genuine expectations for economic growth and profits in current asset prices from artificially-inflated confidence. Or, to put it simply, when will the free ride come to an end?

A couple of months ago, it looked America might descend into civil war. Civil war has now arrived, but it is confined to the Republican Party. The strife pits traditionally conservative, pro-establishment Republicans, who were often reluctant supporters of Trump, against Trump-infatuated “culture warriors” and avid consumers of on-line conspiracy theories. One of the strangest discoveries of the past few years has been just how many of the latter category there are – enough to be a formidable political force in a first-past-the-post political system. Even in defeat, Trump won 74 million votes, the second highest total of any presidential candidate in US history.

Conventional Republicans believe that a return to establishment-friendly candidates represents the best chance of beating Democrats in the 2022 mid-term elections. Trump and his supporters, meanwhile, support candidates who distinguish themselves mainly by their loyalty to Trump and commitment to continuous culture war combat. Trump holds the trump card: he could threaten to form a third party. In a poll conducted last month, 64 percent of registered Republican voters said they would "likely" follow Trump if he does, and 32 percent said they would be "very likely”.

Since banning its highest-profile user (Donald Trump) in January, Twitter’s share price is up nearly 60% and has reached an all-time high. Instead of losing a big chunk of the 88 million Twitter accounts that followed Trump, the company projects it will benefit from over 20% growth in daily active users in the current calendar quarter. In another sign that it’s back in favour after years in the wilderness, on Thursday Twitter will host its first “analyst day” since 2014.

The semiconductor manufacturing industry is threatening to become the focus of a new trade war, with China having already targeted the industry as a requirement for national security, and the US government currently proposing tax credits to encourage investment in domestic manufacturing capacity. This comes as the latest silicon chip shortage is expected to wipe out $61 billion of sales for car manufacturers, and with the fallout now threatening to hit the much larger electronics industry. As of now, industry leaders such as Taiwan Semiconductor Manufacturing, Samsung and SK Hynix maintain a years-long advantage in technical know-how.

Shares in HSBC Holdings rose by as much as 5% in Hong Kong overnight as the bank announced profits that beat expectations for the fourth calendar quarter of last year and will resume paying a dividend. Profits of $2.2 billion beat estimates by 22% despite falling by half from the previous year due to losses on loans. Several of the bank’s most senior executives will be moving from London to Hong Kong, reinforcing Asia’s importance to the bank’s growth.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.