18 January 2022

Once again, the excitement was in bond markets with US government bond yields making new pandemic-era highs. The action was most intense at shorter-term maturities, which are now pricing in four rate rises in the next 12 months. Coming alongside hawkish comments from US Federal Reserve governors, the moves anticipate that containing inflation will require more concerted action on rates, and sooner. The narrative that inflation would be temporary spun by central bankers for much of the last year, now lies trampled in the dust.

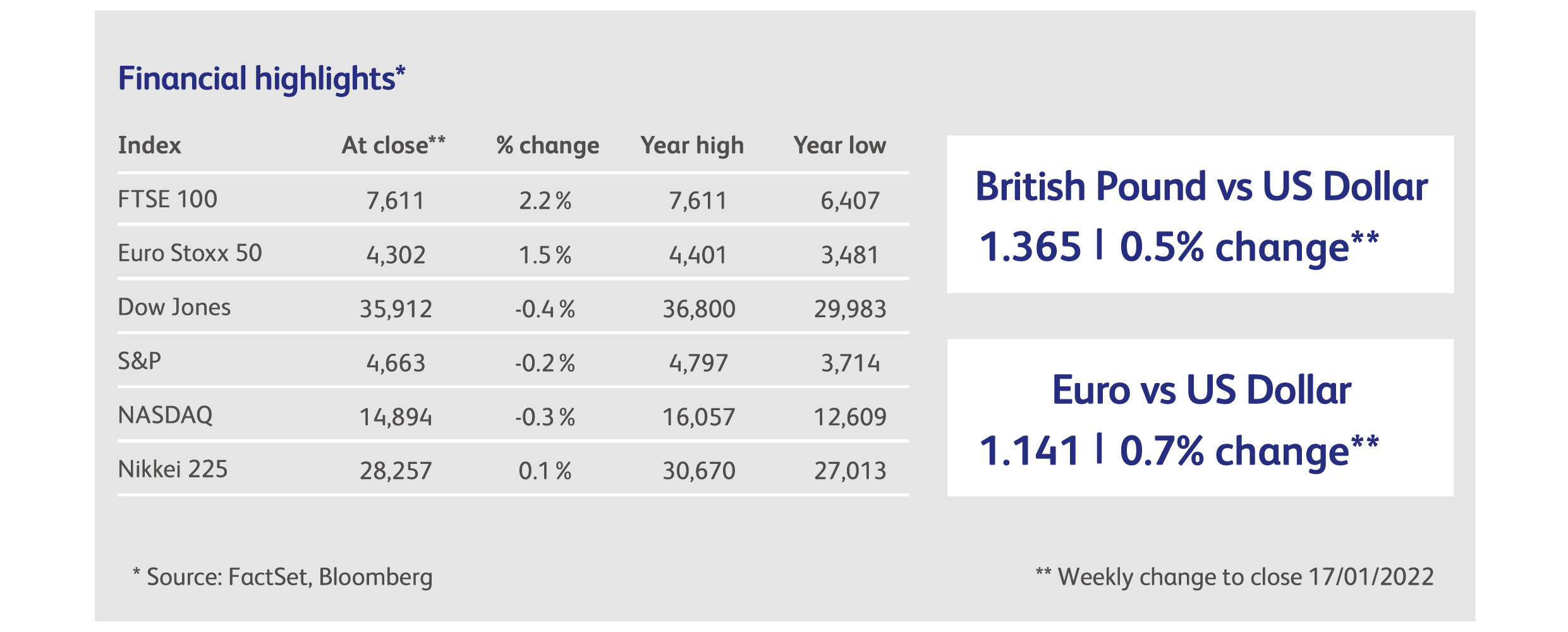

Normally one would expect the US dollar to benefit from rising US Treasury yields but dollar strength has been strangely absent. This has both perplexed analysts and supported markets, which view the dollar as a safe haven and, therefore, a weaker dollar as a sign that investors are keen to take more risk. The weakening dollar has been good news for commodities and gold, which are denominated in dollars, and also for Emerging Market assets, which mostly benefit from having strong local currencies relative to the US dollar. Excitement is gathering around Emerging Market bonds, which had a terrible year last year due to a procession of rate increases by local central banks plus a period of exceptional dollar strength, but which now offer higher yields at a low-point in valuation. Emerging Market equities have bounced recently, but only after a year in which they fell by 5% while developed world equities posted handsome, double-digit gains.

More caution than usual is required in Emerging Market equities, however, as the higher weighting to China in benchmark indices has made it difficult to invest without a positive outlook for Chinese companies and the Chinese economy. That is still missing. Quite apart from the ructions in the Chinese property market, where several enormous property developers are in meltdown, China’s strict Covid-zero approach is about to face off against the highly-infectious Omicron variant. This most likely means more obstructions in supply chains and more persistent inflation for developed-world consumers, who have reacted to the pandemic by switching their spending from local services to goods - which are often manufactured in China.

In developed world markets, the FTSE 100 index continued to assert its long-awaited pre-eminence, and is now up 6% in the last month. Remarkably, this was achieved despite a 3.3% rally in the pound against the US dollar. This strength has not carried over to smaller UK companies, however, with the FTSE 250 and FTSE AIM stock market indices having lost steam since their peak in early September. British investors are in good company here, however, as smaller company stocks have also sold off in Europe and the US. And they have been joined in this by the biggest US technology stocks, which are now close to their September levels. Some argue that this is due to rising bond yields, and a tendency among investors to treat tech stocks as if they were the government bonds of the equity markets. But a simpler explanation is that the more speculative, ultra-high valuation parts of the equity markets are selling off after a phenomenal run.

Facebook (now Meta Platforms) faces a new antitrust lawsuit on behalf of 44 million users in the UK, seeking at least £2.3 billion on the basis that the company’s exploitation of user data infringed competition rules. The suit joins a long list of existing actions, including a US Federal Trade Commission claim that seeks to force the company to unwind its acquisitions of Instagram and Whatsapp. Meanwhile, the Metaverse that Meta Platforms seeks to exploit is already looking like a scene from Stephen Spielberg’s “Ready Player One”: prices for real estate in the Metaverse have soared 4-500% over the last few months, with virtual space near heavily-trafficked areas selling for millions of dollars at a time.

In the latest move by the French government to offset energy-price inflation, electricity generator EDF will be required to sell more power at a deep discount to current market values. The new rules will enable the government to meet its commitment to cap increases in electricity bills for households and small businesses at 4% this year. Separately, EDF cut its expectations for output from its nuclear reactors due to repairs over-running. EDF shares were down 16% on the week. In the UK, the Financial Times reported that the government is considering making payments to energy suppliers to offset rising energy prices.

European banks are among the biggest winners of the global melt-up in bank stocks so far this year, though only after having fallen by 45% collectively in the decade leading up to the pandemic. However, the German banking watchdog drained some of the punchbowl when it ordered the country’s lenders to set aside an additional EUR22 billion due to an overheating property market. The German central bank estimates that property prices are 37% above fair value. In the US, meanwhile, JP Morgan shocked analysts by reporting a 7% rise in employee-related costs for last year. JP Morgan shares were down 6% on the news.

Both Toyota and Volkswagen had to close factories in the city of Tianjin last week, after the city’s 14 million residents were summoned for Covid testing. The aggregate production capacity of the factories is reckoned to be 800,000 cars a year. One third of all cars globally are manufactured in China, and automotive industry analysts are forecasting that the squeeze on supply will last into 2023.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.