23 August 2022

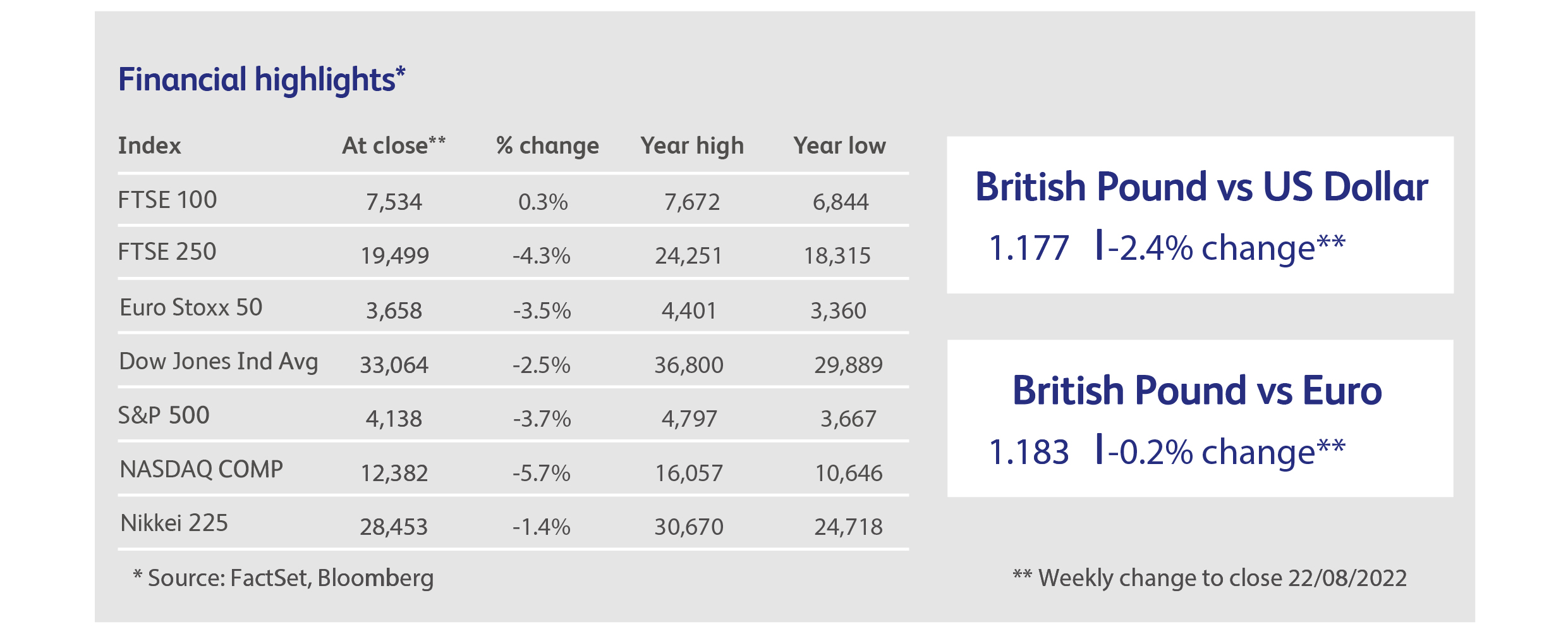

Markets hit the buffers this week following two months in which they had mounted an improbable rally in the face of deteriorating economic data. It took only a few trading days for continental European stock markets to give back a third of the gains accumulated during the rally. American markets followed Europe down, with the technology-heavy Nasdaq Composite Index leading the way, albeit after an impressive 23% rise from trough to peak. Once again, the FTSE 100 was the best performer, sustained by its unique mix of global pharmaceutical, mining, banking and energy companies. Unfortunately, the same did not apply to the more UK-focused FTSE 250, which suffered a 4.3% decline on the week. Bond markets resumed their downward spiral with US 10-year government bond yields back above 3% and 10-year gilt yields surging back towards their highs of the year. The US dollar resumed its safe-haven status, with the pound and euro dropping to new lows for the year. As you were, then.

Just as a clear catalyst had been missing from the rally in the first place, there was no apparent explanation for why the rally came to an end. So-called “earnings season”, as mostly American companies reported their financial performance for the second calendar quarter, passed without too many shocks. Overall, however, profit expectations have been trimmed for most companies in most stock market indexes, suggesting that the rally was built upon a willingness to accept higher valuations rather than upon expectations for higher profits. The minutes to the US Federal Reserve’s last meeting had the potential to move markets but largely confirmed what had already been said: while the primary need is for the Fed to contain inflation, there is also a suggestion of smaller rate hikes going forward. Poor inflation data from the UK may have dampened investors’ enthusiasm for stocks but, more likely, its announcement just coincided with the beginning of the downdraft.

It was a rally in which just about everything had blasted off: from mega-sized technology companies all the way down to micro-cap stocks, across nearly every industry sector, and even into the most speculative parts of the market. It had been the same story in bond markets which saw medium and longer-term government bond markets rise, accompanied by corporate credits all the way from investment grade down to junk bonds. In fact, it was bond markets that pivoted first after a torrid six months to start the year, as fears of interest-rate rises were replaced by fear of a coming recession and the desire for safe havens. This had seemed to change the analysis in stock markets as well, somewhat counterintuitively as recessions are rarely good for company profits. Nevertheless, the rally achieved a level of self-sufficiency, blowing through dreadful business activity surveys, mostly terrible inflation data, increasingly hawkish actions and rhetoric from central bankers, the return of the Chinese economy to lockdowns and the worsening energy shortage in Europe. That the rally continued for so long and with such breadth is testament to the enormous piles of cash accumulated during the pandemic and now sitting on the side-lines. That cash is increasingly being eaten away at by inflation and wants to go somewhere, but it seems that financial assets don’t yet fit the bill.

BHP Group, the world’s biggest mining company, reported its highest-ever full-year profit of $24 billion and surprised investors with a rare, bullish outlook on China, which accounts for more than 60% of the company’s revenues. Production costs rose by 13% due to higher energy prices, and personnel issues related to Covid.

Walmart, the world’s biggest retailer, rallied early in the week after profits for the company’s second quarter beat expectations. However, those expectations had been much diminished after two profit warnings, the first of which, three months ago, prompted a general decline in global equity markets. The company’s latest estimate is that earnings per share will fall by no more than 11% this year. The shares came within 5% of their pre-profit warning level as the rally climaxed during the week, but subsequently fell back as markets weakened.

The American housing market is in dire shape after rate rises doubled the cost of mortgages inside a year, but DIY giant Home Depot was nevertheless able to report organic revenue growth of nearly 6% for its latest quarter. Profits also beat expectations. These results were achieved despite a 3% decline in the number of customers during the quarter, as the company successfully raised prices, increasing the average value of a transaction by 9%. Despite this relative success, Home Depot shares are down 24% year-to-date.

Meme-stocks enjoyed a speculative renaissance during the recent rally, and none more-so than American retailer Bed, Bath & Beyond. American retail investors jumped on the bandwagon again in early August, sending the stock up nearly 500% and the firm’s market value up to $2 billion. At one point the stock rose 75% between its overnight close and morning open. It could not hold onto all its gains, however, after the Bloomberg financial news service reported that the company had fallen behind on payments to suppliers.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.